Arctos Sports Partners is the first private equity fund to buy into the NHL, following a change in bylaws that allowed such investments.

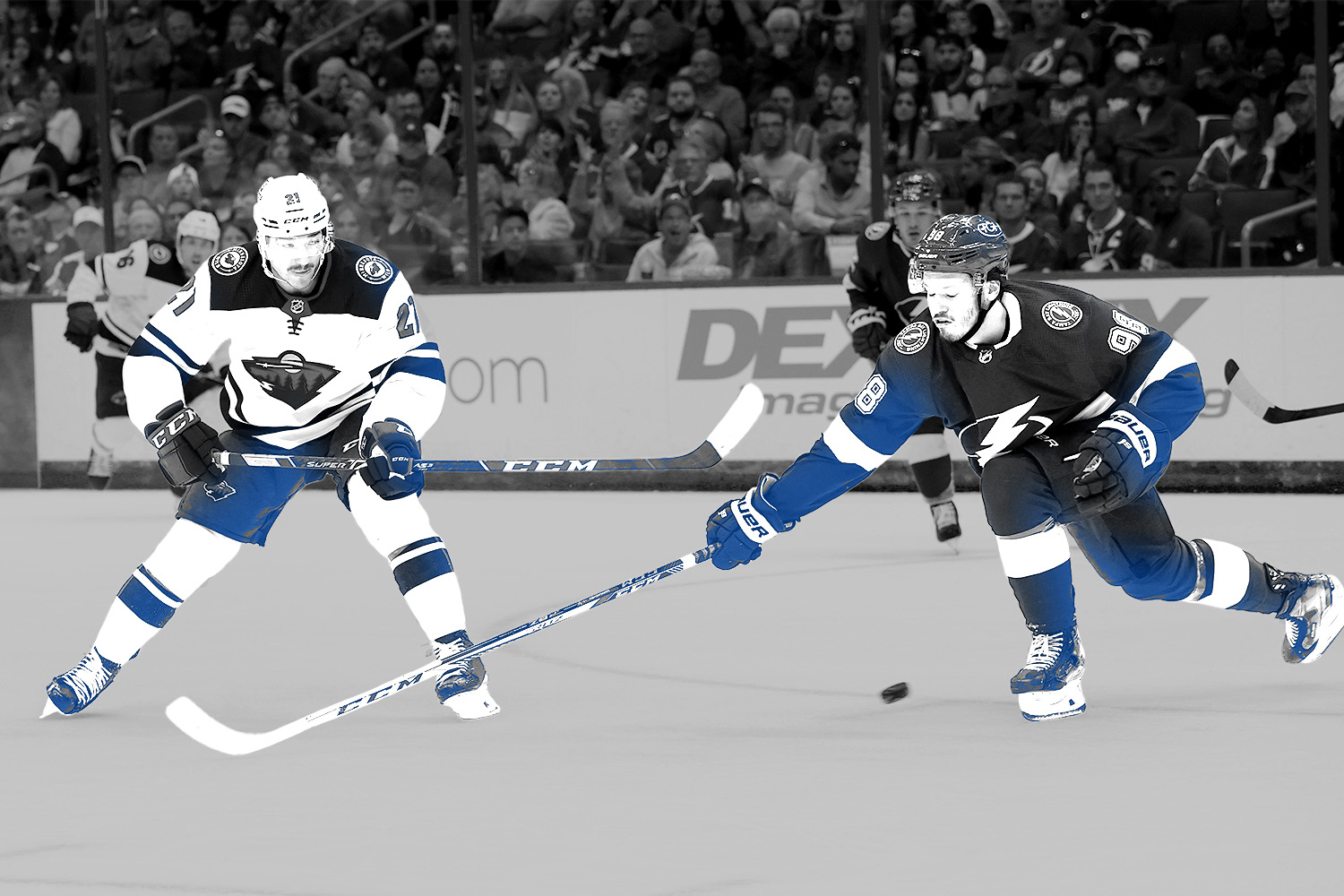

The fund closed investments in the defending Stanley Cup champion Tampa Bay Lightning and Minnesota Wild, now owning 10% of the latter. The league’s board of governors voted in December to allow institutional investors.

The Wild and Lightning were respectively valued at $675 million and $650 million by Forbes last month, making them the 19th- and 20th-most valuable NHL teams. Both figures rose over 30% from a year ago.

Arctos has quickly established itself as one of the most prominent names in sports private equity.

- Its flagship fund rose above $3 billion after a $2.1 billion raise in October.

- It invested in two Northern California NBA teams: the Sacramento Kings (17% stake, $1.8 billion valuation) and the Golden State Warriors (5% stake, $5.5 billion valuation).

- It also has holdings in Fenway Sports Group and the Premier Lacrosse League.

New Ownership Possibilities

The NHL’s new rules allow teams to sell up to 30% stakes to private equity firms.

Individual firms can own part of up to five teams, can hold up to 20% in any team, and must invest at least $20 million each time.