The NBA office has been tasked with providing an “in-depth analysis of expansion” to the league’s Board of Governors as it debates whether to add beyond its current 30 teams.

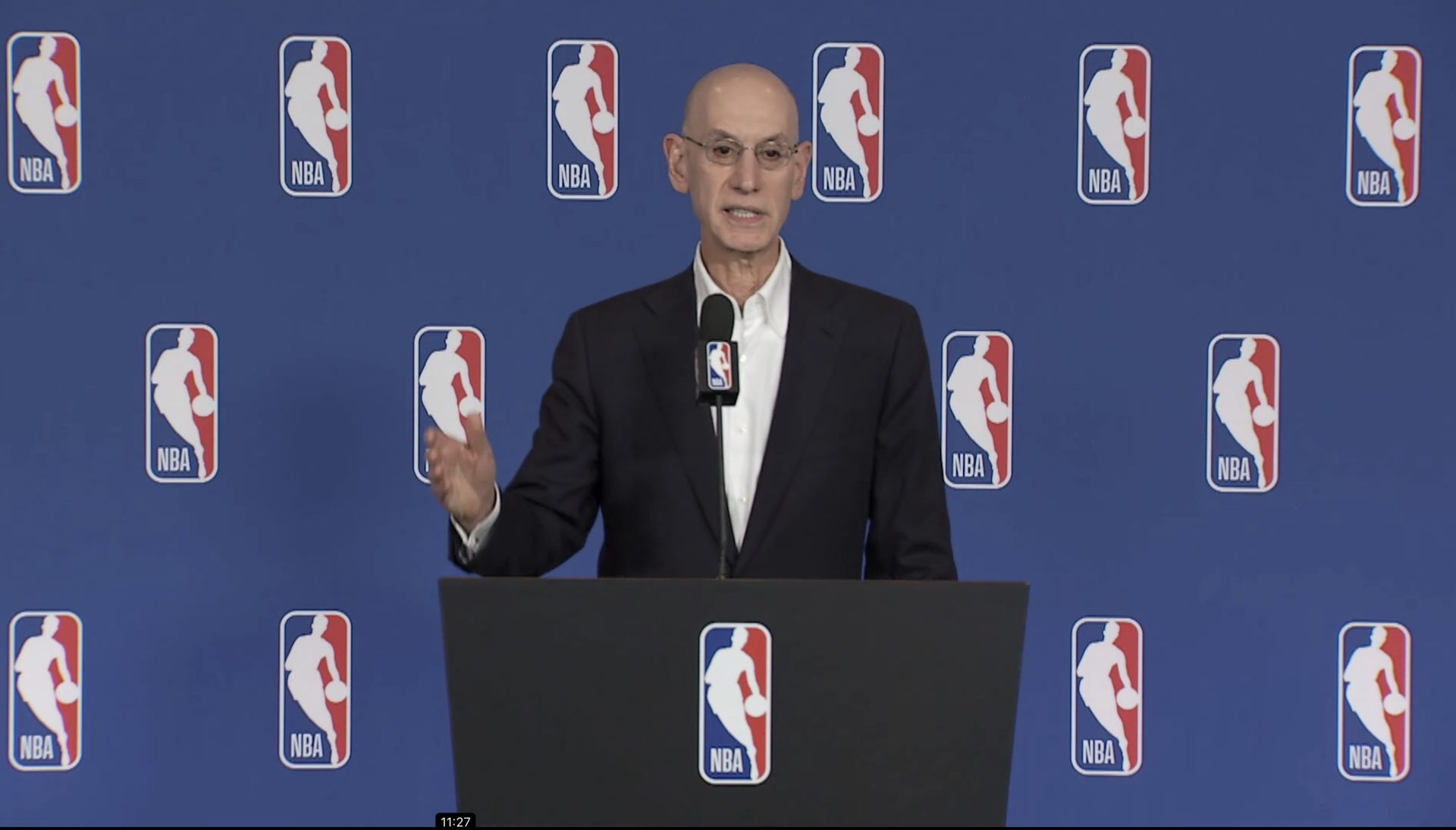

League commissioner Adam Silver met with reporters Tuesday night in Las Vegas after the NBA’s latest Board of Governors meeting, and he said the consensus among owners was to continue studying the issue.

“A lot of analysis needs to be done, and nothing has been predetermined,” Silver told reporters. “We’re going to be as thorough as possible and look at all the potential issues.”

Silver’s comments on expansion have varied over the years. He talked about it as a near-certainty five years ago during the COVID-19 pandemic when the league needed money, but he backed off as the NBA sought to complete a new collective bargaining agreement (in 2023) and new media-rights deals (last year). Since those have been completed, he has talked about expansion with much more ambiguity.

The analysis will be led by two existing subcommittees of the league’s owners, the advisory finance committee and the audit strategy committee.

In June, Silver said that Tuesday’s meeting would be used to “take the temperature” on expansion. When asked what the attitude toward it was, he said “curiosity.”

“A consensus quickly formed that the league office should do the work,” Silver said. “And work with these particular committees and the board and present that analysis.”

Silver provided no details on timelines, expansion bid prices, or possible markets because that would be an assumption that the analysis will go in favor of expansion. Despite the lack of resolution, the commissioner called Tuesday “a significant step.”

The next steps, according to Silver, are to examine specific markets and what facilities and “appetite” each has, and the long-term impacts of sharing league revenue with two additional teams. Non-economic factors include the talent dilution that would come from an expansion draft. Las Vegas and Seattle have long been rumored to be the NBA’s two preferred markets.

One economic issue is the future of the regional sports networks, which Silver called “a broken model” in September amid widespread cord-cutting.

“We would be malpracticing if we didn’t figure out how local regional television is going to work before expanding,” Silver said. “The notion that we would hand over a team into a city where we’re not currently operating and say, ‘You’re going to have to figure out how you’re going to distribute your games to your local fans’ doesn’t make sense.”

This past season, the NBA’s regional partners received “significantly lower fees,” Silver said in September. Though more games will be on national TV and streaming the new media deal, lessening the reliance on RSNs, it’s still a major issue for the league. At the start of last season, 18 local networks were either defunct or bankrupt. Several teams have taken steps to launch their own streaming services or make their games available for free over the air.

Trail Blazers Sale

Tuesday’s meeting did not include a vote on either the Celtics or Lakers sales, but Silver did speak about the Trail Blazers after the estate of former owner Paul Allen put the team up for sale in May.

The team isn’t expected to command the $6.1 billion valuation the Celtics netted, nor the $10 billion figure from the Lakers sale. “It is our preference that that team remains in Portland,” Silver said when asked whether the team could move. “We’ve had great success in Portland over the years.”

“[Portland] likely needs a new arena, so that will be part of the challenge for any new ownership group coming in,” Silver said. The team has played in the Moda Center since 1995, which has never undergone significant renovations in its 30-year history. It was supposed to be upgraded ahead of hosting the 2030 Women’s Final Four, but those plans are reportedly on hold until the team is sold.