A minority investor in AC Milan has decided to end an attempt in an Italian court to freeze the $1.2 billion sale of the top-flight soccer club to New York-based private investment firm RedBird Capital Partners.

In June, Blue Skye Financial Partners claimed American investment firm Elliott Management — Milan’s majority shareholder since 2018 — held talks “behind closed doors” about the sale.

In July, U.S. District Judge Katherine Polk Failla authorized Blue Skye — which owns a 4.3% stake in the Italian soccer champions — to obtain a “limited” number of documents to use in a Luxembourg court.

- Earlier this month, RedBird announced it closed its deal to purchase Milan.

- Before the sale, Blue Skye had filed a petition in an Italian court to halt the deal.

- On Tuesday, a hearing was held where the request was dropped.

Milan — the 14th-most valuable soccer team in the world at $1.2 billion, per Forbes — had garnered takeover interest from several private equity firms, including Investcorp.

The Bahrain-based company, which has $42.7 billion in assets under management, was once in exclusive talks to buy Milan but failed to reach a deal before the end of an exclusivity period in April.

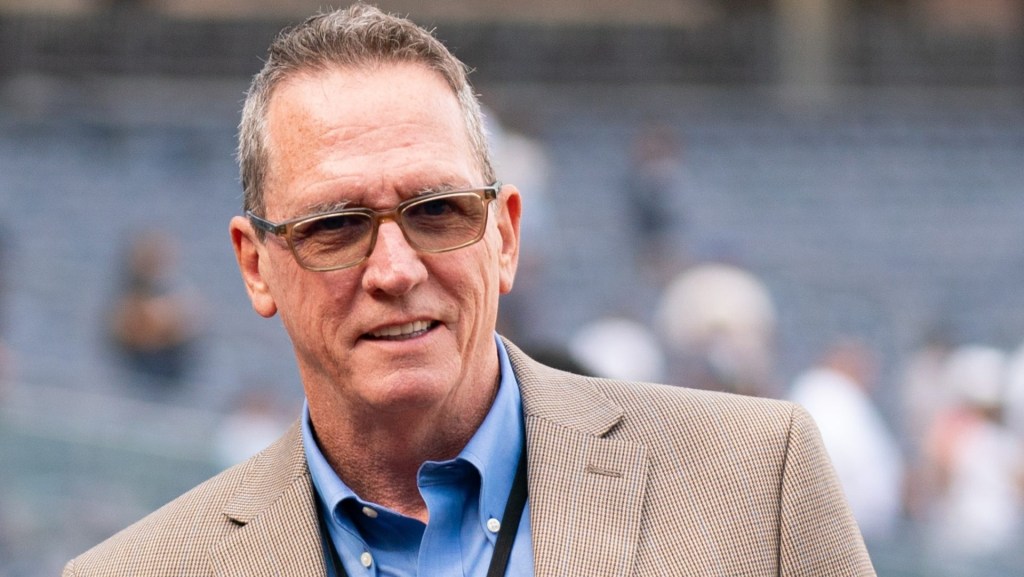

Big-Name Investors

In August, MLB’s New York Yankees and investment firm Main Street Advisors — backed by NBA superstar LeBron James — became stakeholders in Milan. The deal marked the Yankees’ second soccer investment, which includes a 20% stake in MLS’ New York City FC.

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)