Winning is always good for business — and for MSG Sports, it helped generate record revenue in fiscal 2023.

Fueled in part by the New York Knicks’ best season in a decade, the parent company of the NBA team and NHL Rangers posted $887 million in revenue for the fiscal year, up by 8% for a new high, and adjusted operating income of $115 million.

There were eight home playoff games between the Knicks and Rangers this past spring, down from 10 in 2022, which contributed to a 28% decline in fourth-quarter revenue to $127 million. But the overall annual revenue lift was owed in part to the Knicks’ 4% spike in attendance, which led to corresponding gains in sponsorship, premium seating, and merchandise sales as the team advanced to the Eastern Conference semifinals.

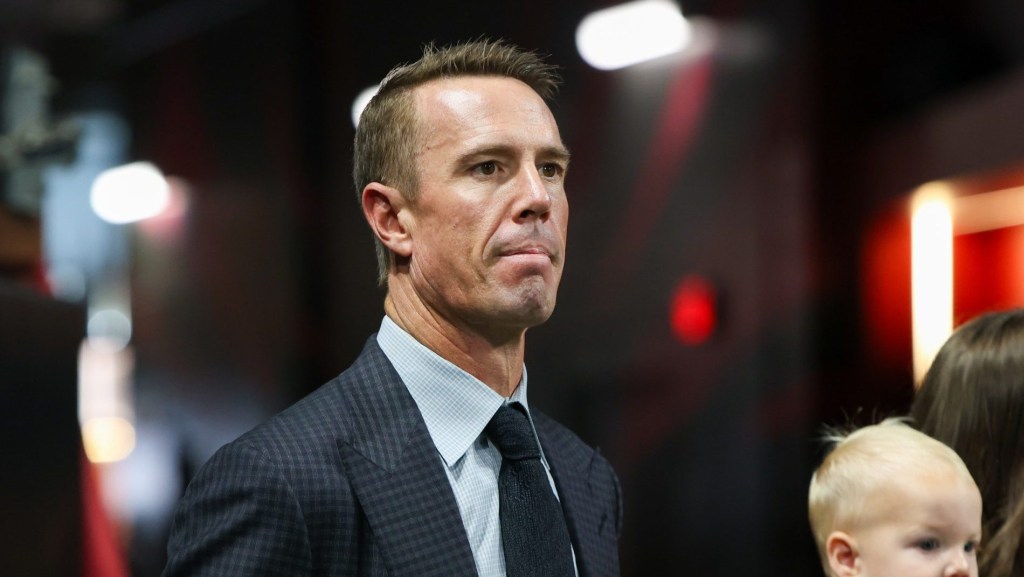

“The momentum was broad-based with every key revenue line up compared to fiscal ’22’s record results,” said David Hopkinson, MSG Sports president and COO. “We really think this is a testament to the strength of our business and the underlying value of the assets.”

Up For Sale?

Hopkinson said that underlying value could also lead to potential minority equity sales in either or both teams.

“We would not rule out the possibility,” Hopkinson said. “We continue to be as confident as ever in the value of our teams. They are incredibly scarce assets … with significant opportunities for long-term growth, which we don’t think is appropriately reflected in our current stock price.”

That stock is essentially flat for the year-to-date at about $180 per share, and a recent slide has erased what had been a double-digit percentage gain.