Over the last 15 years, FloSports has almost quietly taken over niche sports streaming rights.

Founded to elevate “underserved” sports properties, the Austin-based company initially received little funding or notoriety.

It has now raised more than $70 million from flashy investors, created a subscription-based model — and continues to aggressively pursue more sports properties. It brings in more than $100 million in annual revenue, according to one estimate.

FloSports boasts more than 20 verticals (Division II football and competitive marching are two examples). It’s begun moving in on more mainstream properties, too, like Big East women’s basketball — for which it just signed a multi-year extension.

And yet, the company certainly has its share of issues. Amid lucrative funding rounds, it had a major executive shakeup. The streamer has long been criticized for subpar broadcast quality and streams that cut out. The company’s automatic subscription renewals are the subject of a recent class action lawsuit.

Still, FloSports has quickly become one of the main underdogs acquiring sports media rights today.

Ascension and Attention

Brothers Martin and Mark Floreani, along with Madhu Venkatesan, founded FloSports in 2006. Martin, a college wrestler, and Mark, a track athlete, “bootstrapped” the company in the first eight years, according to Kevin Boller, FloSports’ SVP of Strategy and Corporate Development.

“I don’t believe they get enough credit for how forward-thinking this was. Because of the ubiquity today of social media, the proliferation of streaming video on demand — definitely, they were well ahead of their time,” he told Front Office Sports.

In 2012, the company converted to its subscription-based model. Two years later, it landed its first funding round.

- A 2014 Series A round raised $8 million — perhaps an impressive number for a small startup but the most modest fundraise to date.

- In 2016, investors took notice during a Series B funding round that raked in $20 million. “The investors saw that things were really going to go to streaming,” Boller said, adding investors thought the company could also succeed with more scale.

- In 2019, Discovery led a near-$50 million Series C round. “I think they viewed [FloSports] as something that was in line with where they believed their business was going,” Boller said.

This period wasn’t always smooth sailing. Martin Floreani abruptly left FloSports in 2018. He was later embroiled in a lawsuit with the company.

Despite the internal disputes, FloSports entered the pandemic armed with millions of dollars — and was able to come out swinging as sports re-emerged, acquiring multiple sports and building out verticals.

The Vision

In the last year, FloSports has put significant focus and investment into “six priority sports,” Boller said. In total, it has 20-25 verticals separated by sport — FloTrack, FloHoops, and FloWrestling, for example.

One of its latest moves: acquiring the exclusive U.S. rights for three international Rugby Leagues. In a statement, FloSports’ director of Global Rights Acquisition Ryan Fenton said the leagues “fit perfectly into our vision to elevate rugby in the U.S.”

The press release pointed to Nielsen data suggesting Rugby is growing more quickly than any other sport in the nation; and referenced that the 2031 and 2033 Men’s and Women’s Rugby World Cups will be held in the U.S.

The company has also invested heavily into NCAA sports — but while legacy broadcasters have gone after Tier I, Division I media rights, FloSports has gone in the opposite direction. They’re interested specifically in lower-division sports, and in some cases offerings that have never previously had a major media rights deal.

“The NCAA is really interesting to us because … a tremendous amount of things are changing,” Boller said. “We’ve seen success in our model of taking these very captive audiences for these NCAA sports …and figuring out a way to really grow that offering.”

That explains its college sports spending spree this past summer:

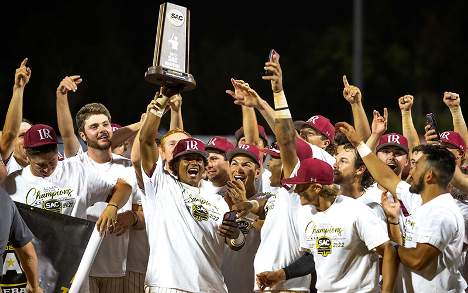

- In mid-July, the streamer inked a five-year deal for all sports in the South Atlantic Conference.

- It invested seven figures total, making it the largest conference-wide D-II media deal in history.

- Just a few weeks later, FloSports broke its own D-II record — signing a seven-figure, four-year deal with the Great Lakes Intercollegiate Athletic Conference.

FloSports has also dabbled in D-I rights, and in mid-August announced a renewed partnership for Big East women’s basketball and Olympic sports coverage. The price was not disclosed.

To access these verticals, the company FloSports is betting that those fans will be willing to pay — with multiple subscription plans.

The bet, of course, is one that multiple media companies are making. Virtually every major network from NBC to ESPN has created a subscription-based streaming service — and conferences from the SEC to the Big Ten have agreed to distribute their content that way.

Whether that model has longevity remains to be seen. Investors, at least, believe it will.

The Plan

At an off-site meeting with executives just days before FOS interviewed Boller, the company solidified a three-year plan where it will experiment with different subscription plans, explore content innovation, and, yes, improve broadcast quality.

For years, fans have lambasted the feeds’ inconsistencies and low quality. Boller said FloSports doesn’t want to shy away from the criticism, promising to improve everything from the graphics to the announcers.

“We know that we can do better. We know that we’ve had issues with production quality and stream quality,” Boller said. “We’re really going to invest heavily in customer experience.”

- Boller noted that quality control is an issue many first-time streamers encounter.

- There have been plenty of issues from the space’s biggest players, like NFL RedZone and Sunday Ticket.

As for the future of the business model, the company is focused on scaling verticals efficiently and building “communities” of fans — from documentaries to sports data, Boller said.

FloSports is also considering multiple distribution options. “Should all of [the content] be in front of the paywall? Should some of that be behind?” Boller said. “I think we can be potentially creative about what we charge for. We could have lower-tier plans if we decide that’s the route to go.”

(Given the class-action suit against the company, which was just filed in August, there may be more questions about the subscription model on the horizon.)

Boller even hinted at FloSports entering the linear television market in the future. He said the company has had conversations about “free, ad-supported TV.”

“There’s nothing that limits us from increasing our distribution.”