Goodbye bikes and treadmills. Hello…rowing machines?

Over the past few months, there’s been blood in the streets as connected fitness hype dwindles in the public markets. Peloton, the market leader, has seen its stock price tank 78% since July.

The private markets, however, are still flush with cash and connected fitness companies remain plentiful as founders look to build their way to the next…well, maybe not Peloton anymore, but certainly to the next big consumer fitness product.

That’s where our story begins today as we unpack the rise of Ergatta, a connected rowing company focused on becoming the next fitness tech brand to dominate the market.

The Product

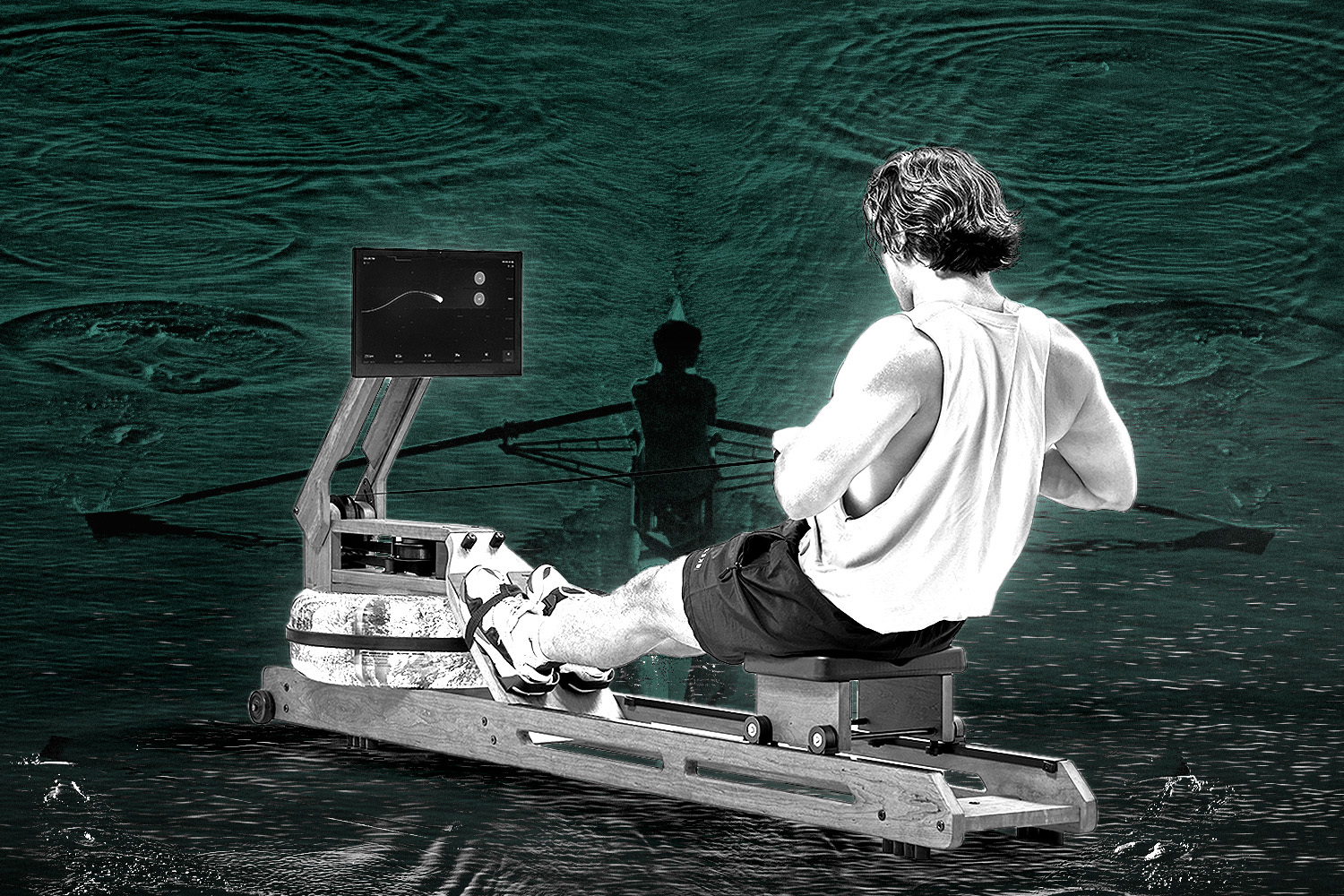

“Our hardware is intentionally designed for the home. It’s elegant, it’s made out of wood, it looks like a piece of furniture, it stores compactly, and it’s meant to elevate the aesthetic of any room it’s in,” CEO Tom Aulet told me about his company’s flagship product.

Ergatta products were never intended for commercial gyms.

Beyond sleek design, there’s been a general revitalization of the rowing industry over the past decade. Aulet, grinning from the comfort of his New York home, credited Crossfit and an episode of “House of Cards” that fixated on the protagonist’s use of a rowing machine with spiking interest.

Then, of course, you have the explosion of connected fitness at large. Valuations for private companies have skyrocketed, public companies like Peloton saw their market caps reach all-time highs, and brick-and-mortar gyms seemed all but dead as the pandemic loomed large.

While the narrative has since changed in recent months, the groundwork was laid for incumbents in the connected fitness space to battle it out.

The Technology

So, why rowing? What is it about sitting down on a faux boat without water that’s getting the fitness community all riled up? The answer is two-fold.

First is the idea that rowing provides a superior workout. From a physiological standpoint, it’s hard to beat the workout you get on a rowing machine — it’s low impact and covers basically all muscle groups. But rowers might also provide for a superior business model.

- Storage: Rowers store compactly, and according to Aulet, storage space is the No. 2 reason (behind price) that prohibits a customer from making a fitness equipment purchase.

- Customer profile: Rowing appeals to individuals who care about fitness, are willing to spend, but are introverted and not interested in public classes.

- Trends: Aulet says rowing is increasingly becoming accepted as a preferred modality of training. The change has been driven in large part by the likes of Crossfit and Orange Theory.

But you don’t need a $2,199 machine to try rowing. What makes Ergatta different?

Game-based fitness.

The Ergatta Experience

When using an Ergatta, you’re fundamentally playing a game — one that provides users with competition, personalized feedback, and the ability to continuously level up their experience.

This could become a major competitive advantage. While users wouldn’t necessarily be considered “gamers,” the software behind the product certainly gives off the vibe of a video game.

Still, at its core, Ergatta is about fitness. Gaming is just the mechanism to delight and retain users. If the company is able to find the profitable midpoint in the Venn diagram of these markets, they’ll benefit from both market tailwinds and entrenched human behaviors.

According to 2021 research report by Dan Fromer and The New Consumer, the pandemic resulted in several sticky behavioral changes:

- 90% consumers who switched to exercising more at home stated that they have maintained the behavior.

- 65% of consumers indicated that they prefer working out at home.

- 41% of consumers indicated that they would be conducting 100% of the workouts at home over the next 12 months.

- 87% of consumers indicated they would be working out at least 50% at home.

And then there’s gaming. Microsoft’s recent $69 billion acquisition of Activision alone should be an indication of just how powerful that industry is.

Ergatta spends a large amount of its capital on its software and, because of that, Aulet says their financials look more like that of a gaming company than anything else.

Zwift, LiteBoxer, and Supernatural are other companies that have found a home at the nexus of fitness and gaming. While the distinction between “gamification” and actual game construction for fitness companies is one that has yet to be totally defined, more and more companies are seeing the value proposition of marrying the two industries.

Looking Ahead

When asking Aulet about his company’s $30 million Series A, it was clear that he sees defining the company’s addressable market as imperative.

Selling rowing machines might seem niche, but anything related to gaming is not. Aulet believes game-based fitness will ultimately be the leading category in the new digital fitness ecosystem.

So while Ergatta has their work cut out for them, the field they’re playing on should provide for some lucrative opportunities.