Rush Street Interactive started trading on the New York Stock Exchange last week after going public through a SPAC merger that values the company at $1.8 billion.

The move signals the continued growth in publicly traded gambling companies and the future promise of sports betting and online casinos. RSI closed its first two days of trading at $21.65 per share, down about 6% from the company’s debut.

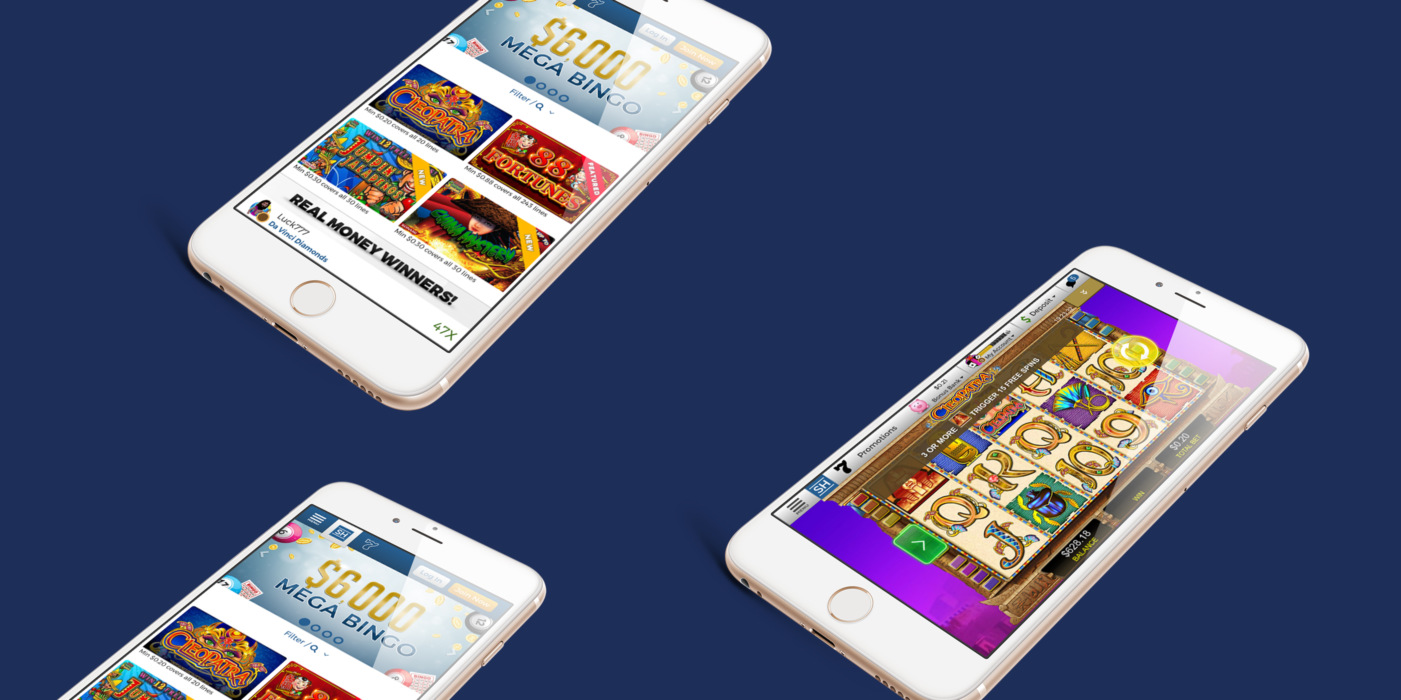

RSI operates online casinos and mobile sportsbooks in New Jersey and Pennsylvania, as well as mobile sportsbooks in Colorado, Illinois, Indiana and Iowa.

Publicly Traded Gaming Boom

- DraftKings went public in April through a SPAC merger.

- Golden Nugget Online Gaming — owned by Houston Rockets owner Tilman Fertitta — went public on Dec. 30 through a SPAC merger.

- Mobile gaming company Skillz went public in December through a SPAC merger.

- Sports betting data provider Genius Sports is going public through a SPAC merger early this year as well.

With a stake in both online casinos and sports betting, Rush Street CEO Greg Carlin believes a mature U.S. iGaming market could be worth $20 billion, while sports betting could hit $15 billion.

U.S. bettors legally wagered $3 billion on sports for the first time in October 2020.

At the end of 2020, there were 20 legal U.S. sports betting markets, but just five states with legal iGaming or online poker. Both will increase in 2021 as multiple states have passed legislation to legalize them.

A look at the potential: In an established online betting market like Pennsylvania, sports wagering grew 153.7% year-over-year in November.

Comparatively, online casino slot and table games exploded in the state, jumping 673.4% and 592.2%, respectively.