The pandemic shuttered gyms and boutique studios, leading fitness enthusiasts to find creative ways to stay in shape. That has been to the benefit of companies already investing in the space.

Virtual workouts have gained more popularity as they provide convenience and personalization, which is difficult to find through in-person classes or even the gym.

And at the same time, since many digital services come at a lower price point than traditional gym memberships, people are finding it more suitable. Gym closures have only furthered the trend.

Subsequently, fitness apps, streaming services, wearables and connected devices have become the new normal for the fitness industry as it tries to navigate the pandemic.

Connected fitness devices saw an increase in popularity once lockdown measures were put in place. The category accounted for only 2.9% of overall revenue in the fitness equipment industry in 2015, but that figure is expected to exceed 7.5% by the end of this year, according to CB Insights. The home fitness equipment market is expected to hit $4.3 billion in value by 2021.

Part of the popularity for connected fitness devices like Peloton is the data that comes with consistently using the platform. The personalized, competitive program only pushes users to workout more, said Gaby Diaz, a law student at the Florida International University College of Law, about her Peloton bike.

“When the pandemic began, I realized that I missed the feeling of in-person classes. I am a competitive person by nature and working out alone wasn’t satisfying me, so I bought the bike because I could ride against other people in the class and my friends,” Diaz said. “Plus, the fact that it is virtual makes me want to work harder because I am able to see everyone’s stats.”

Diaz, a first-time user of the stationary bike, had frequented the gym twice a week before the pandemic hit. She bought the bike for its convenience and the different arrays of live and pre-recorded workouts that it provided her at home.

“The Peloton gives me so many workouts to pick from that I never get bored. The live classes are super motivating, plus, there is no additional time wasted driving to and from the gym,” said Diaz. “I think that this is one of the best purchases that I’ve made for my health.”

Diaz bought the bike primarily for the Peloton app as it provides on-demand workouts, after her friend bought the bike in July. She intends to use the bike every day now.

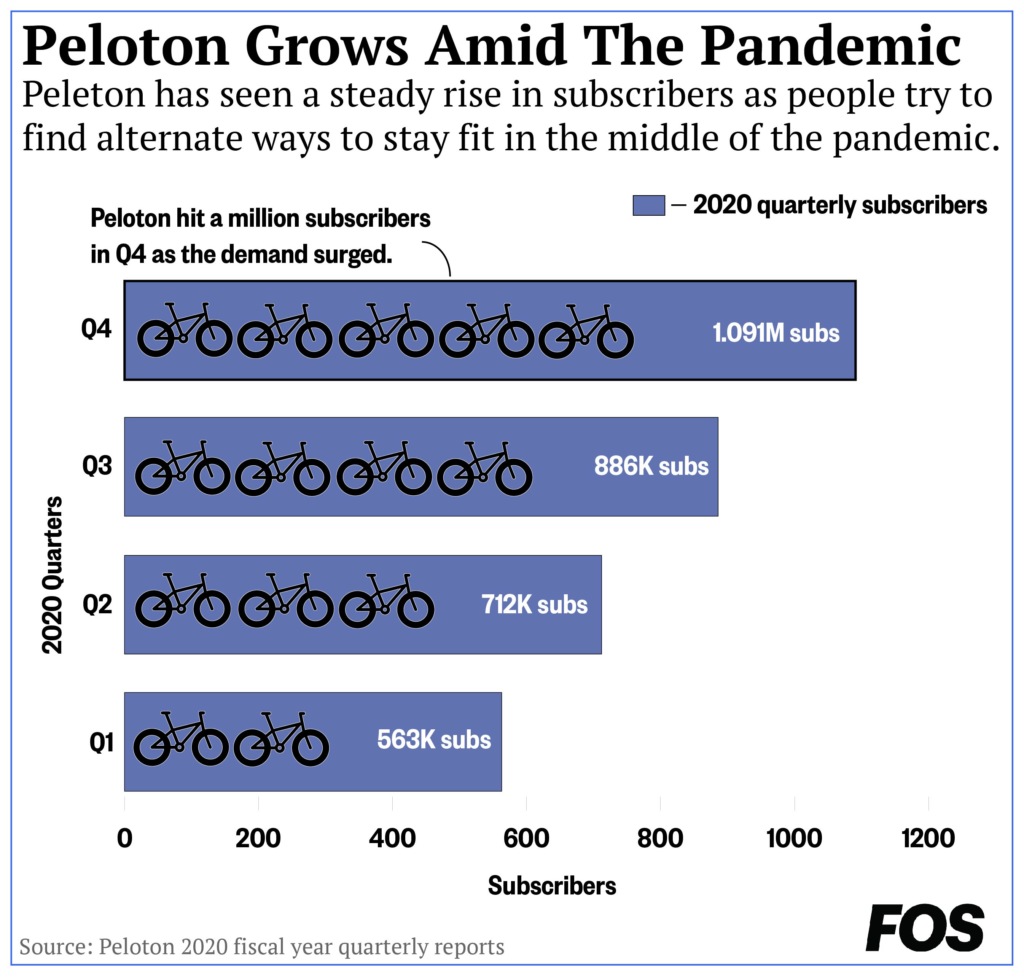

Peloton has had a breakout year as consumers have embraced the at-home fitness boom with the company’s sales skyrocketing to $607.1 million in its first quarter of its 2021 fiscal year, a 172% jump from a year earlier. The company ended the quarter with more than 1.09 million connected fitness subscribers, up 113% year-over-year.

The company has roughly 3.1 million members in total, including those who only pay for a digital subscription. Connected fitness subscribers pay $39 per month to sync their workout classes to their Peloton equipment.

“100 million subscribers, we believe is a reasonable goal,” said Peloton CEO John Foley in an interview with CNBC. “There’s close to 200 million gym-goers in the world. That’s 200 million people paying hard money, month after month, to access what we believe to be inferior fitness equipment in an inferior location.”

The wave of connected fitness equipment has led to many innovative products being launched during the pandemic, like the AI-powered gym equipment offered by Tonal.

The equipment has an LED touchscreen, and two arms that allow lifts up to 200 pounds in one-pound increments. Magnets and electrical currents help mimic the weightlifting experience.

The startup raised about $110 million in its recent investment round. Marketing efforts, scaling its supply chain and new workout content will be the company’s primary goals for the new funding. Tonal hardware costs $2,995 and the company has increased its sales by 12 times since last year.

Lululemon has also jumped into the connected fitness race with the company acquiring Mirror for $500 million in June. Mirror describes itself as “the nearly invisible home gym,” and it provides virtual trainers that offer personalized sessions, a wide range of workouts and performance tracker — which will come with a nearly $1,500 price tag.

Along with startups, mainstream companies are also entering the connected fitness space. Apple announced Apple Fitness+, a dedicated fitness and workout app in September. The tech giant is positioning itself to carve out a piece of Peloton’s subscriber base and gain market share. Apple Fitness+, which will be $9.99 a month or $79.99 for a year, is expected to launch by the end of the year.

With the connected fitness space growing during the pandemic, health and fitness equipment sales reached $2.2 billion between January and August, up 73% year-over-year.

“The sports industry is experiencing unprecedented growth and high demand for a distinct mix of products during this adjustment to an extended stay at home,” said Matt Powell, senior industry advisor for NPD’s sports practice. “I anticipate we’ll see a renewed emphasis on health and fitness for the long term.”

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)