For many people—including some athletes—the beginning of the year means Dry January.

The alcohol-free month has roots in sports. As a term, “Dry January” took off in 2011 when actress Emily Robinson announced on Instagram she was giving up alcohol for the month to train for a half-marathon. What began as a personal fitness challenge for an individual has since become a global ritual, which for many people has also turned into a year-round lifestyle reset.

The problem with eschewing alcohol was that, until recently, the category was limited. Products were too cloying, watery, or tasted gassy and vegetal, and were more expensive compared to their alcoholic counterparts.

Fast forward: The market for non-alcoholic (NA) drinks has soared. NA beer, wine, spirits, and mocktails have become big business with the U.S. no-alcohol market estimated to hit $5 billion by 2028 as part of a global surge, according to IWSR, which provides insight for the beverage industry.

Now, products made for alcohol-free lifestyles deliver real taste and include options from sweet and fruity to dry and herbaceous, including craft-beer alternatives. Newer spirit alternatives for gin, tequila, mezcal, rum, herbal aperitifs, etc., are satisfying enough to be sipped neat or mixed into cocktails. NA products are also meticulously designed to sell with high-end packaging, not begrudgingly shelved as afterthoughts.

They can still be pricey. NA beer costs about as much as traditional craft beer, averaging $14 or more a six-pack. And 750-ml bottles of spirit alternatives average well upward of $35 a bottle. However, better ingredients and refined de-alcoholization techniques have significantly improved quality to make the spend worth it. The more successful NA products cost just as much to produce as top-shelf alcoholic wine, beer, and spirits.

While legacy brands like Budweiser (Bud Zero) and Heineken (0.0) have helped bring the category mainstream, the fastest growth is happening at the premium end—driven in large part by celebrity and athlete investors who are using sporting occasions for prominent placement. Today’s sports figures and franchises aren’t just endorsing these products; across nearly every sport, they’re investing in them as well as launching their own.

The NA leader is Athletic Brewing, which was founded in 2017 by Bill Shufelt and John Walker. Since it hit shelves in 2018, investors include athletes J.J. Watt, Naomi Osaka, and Lance Armstrong. The Connecticut-based company currently holds nearly 18% of the category market share with a significant margin over other competitors.

Its products, with a wide range of styles on par with alcoholic craft beer, have helped to completely change the stadium concession landscape, with fans now expecting access to those options. Athletic NA beers are even featured on Michelin-starred restaurant menus.

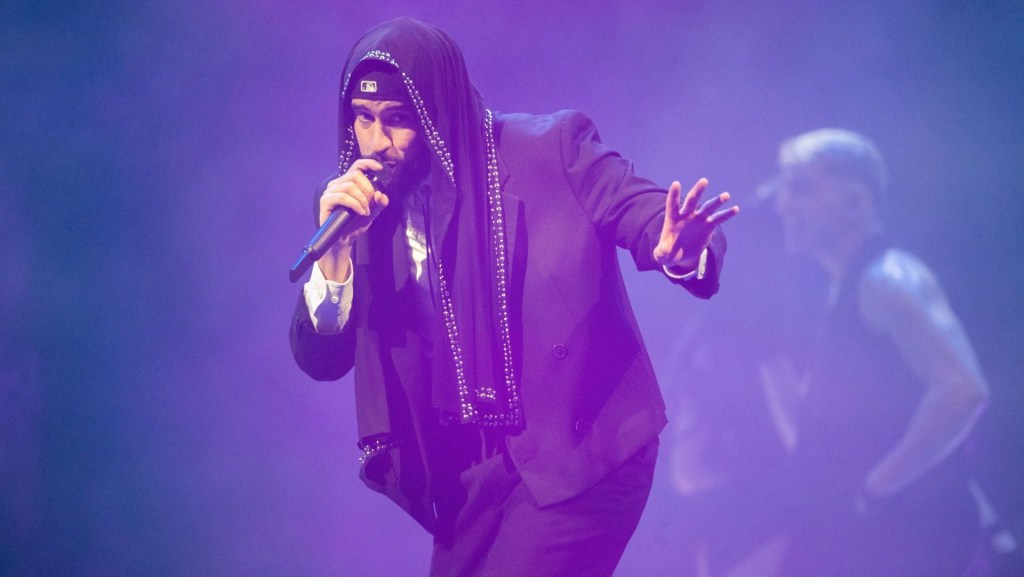

Athletic’s global success—selling 399,500 barrels in 2024, reaching more than 75,000 locations and a 2025 facility expansion—has inspired other athlete-owned launches. Now among the “NoLo” category of no- and lower-alcohol drinks (less than 4% ABV) are DrinkSip (DeMarcus Lawrence) and Fun Brands mocktails (Neymar Jr.).

For athletes, the move into the space makes sense: The market is big as fans rethink how they drink—swapping alcohol for NA, or rotating between the two. But athletes can also double-down on the investments as ambassadors for their products as they increasingly limit or avoid alcohol to protect performance, recovery, and longevity.

‘Just As Premium’

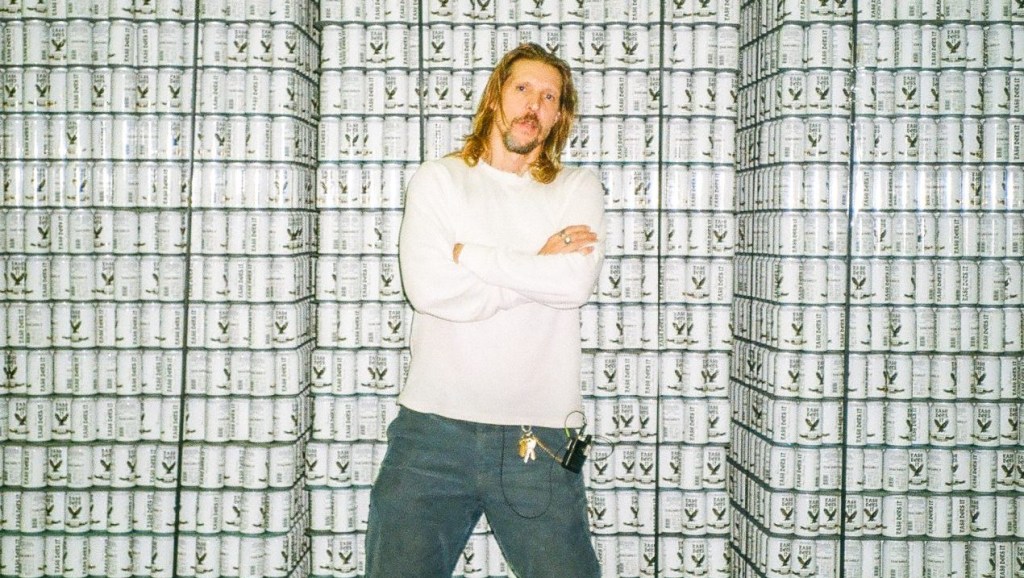

Pro-skateboarder Erik Ellington was sober for 11 years when he got tired of existing NA options, most of which are modeled after hoppy craft beer or European pilsner styles. “My whole life revolved around the somewhat rebellious culture of skateboarding, art, graffiti, and music. I couldn’t find an NA beer that fit the bill to taste the way I remembered from the beers I loved when I drank, which were classic American lagers,” he tells Front Office Sports.

In 2024, he approached Good Group, a studio that launches consumer packaged goods brands, to fill the void with Easy Does It. “I started it because I wanted a fitting brand, and through the process I learned that most of our customers choose NA when they still drink alcohol, but are now more selective of when they do.”

Good Group founder Kellen Roland tells FOS the collaboration with Ellington was a huge opportunity to bridge a gap for some consumers: “When he told me about the idea and his approach to it from the perspective of skating counterculture and its rituals surrounding the tastes of classic American beer, it all just made sense.”

Formula One driver Lewis Hamilton is one of the founders of Almave, an NA tequila alternative produced at Casa Lumbre by Iván Saldaña, who is also the distiller of Montelobos and other venerated spirits brands. It’s made by de-alcoholizing authentic blue Weber agave distillate, and retails for between $29 and $40 per bottle. Hamilton tells FOS that his focus for the brand was to “capture the essence, ritual, and craftsmanship behind traditional Mexican spirits, just without the alcohol.”

In his words, non-alcoholic drinking is about “being present and clear-headed” while still getting the social returns with friends and family. Along with not interfering with performance, the products also needed to have style and substance. “Creating a non-alc tequila alternative wasn’t about preaching or telling people what to do,” he says. “It was about offering an option that feels just as exciting, just as social, and just as premium.”

‘Sleepy’ No More

No- and low-alcohol products have also infiltrated leagues, teams, and stadiums. It spells big revenue.

First, there’s a huge market opportunity for NA alcohol companies that’s unique to their products: Many teams, leagues, and venues won’t spring for sponsorships with alcohol. This leaves a vacuum in the massively lucrative sports industry that NA companies can uniquely slide into. Some venues also specifically ban alcohol in certain sections or across entire stadiums; others have specifically introduced alcohol-free seating zones.

SponsorUnited reported in 2024 that at least 20 non-alcoholic beer brands are engaged in sponsorship deals with sports teams, events, and entire leagues, with an average of 10 deals per brand. They say 30% of deals include a star meant to spark viral social-media engagement. That means NA brands are pouring money into working with athletes as ambassadors, flooding Instagram feeds with sponsored posts, like a recent Estrella Galicia 0.0 ad with Spanish Formula One driver Carlos Sainz Jr.

For its second season in 2024, the Professional Women’s Hockey League signed a multiyear sponsorship with Molson. Then, in December 2025, the league announced additional deals with two Canadian companies: Sober Carpenter for non-alcoholic beer and Clever zero-proof canned cocktails.

The league tells FOS the partnership alongside Molson’s gives it full-spectrum coverage in terms of drink options. “We know that fans want and expect choices, with many opting for non-alcoholic options for a variety of reasons,” says PWHL communication director Madeleine Davidson. “Having both brands on board provides great options for fans depending on their unique interests—a priority for catering to our diverse PWHL audience.”

One of the clearest signs of the beverage category’s impact is Athletic Brewing’s partnership with Premier League side Arsenal. Athletic Brewing CMO Andrew Katz tells FOS that Arsenal recognized fans’ shifting desire for NA drinks early—they were looking for both options. For Katz, it’s a question of finding “balance when they wish to moderate.” The market at Emirates Stadium is helped by the fact that alcohol consumption is restricted in general seating areas.

Katz says sponsorship opportunities like the one with Arsenal—and just this week they also announced they will be the official NA beer for League One Volleyball for a second season—help normalize non-alcoholic choices in sports settings and open up the category as a whole. Athletic has long targeted sports: Katz says that when first building the brand, the founders handed out samples at endurance races after their own participation. Now, one of their partners is Ironman.

He adds that the category has evolved from “niche, penalty-box product into a full-fledged lifestyle category” that reflects modern standards for social settings. Once a “sleepy” corner of the cooler when the brand launched eight years ago, the category now makes up more than 3% of total beer sales. He says some retailers report that it drives as much as 20% of their beer business.

It’s proof that sports fans are embracing alternatives to the traditional “Wassup” culture popularized by Budweiser in the early aughts. Stands at this year’s Super Bowl, for instance, will still be full of beer drinkers—but non-alcoholic beverage consumers now won’t be the odd fans out.