The battle over the future of TNT Sports parent company Warner Bros. Discovery is now heading toward Capitol Hill and federal regulators.

WBD disclosed in a series of regulatory filings this week that the U.S. Justice Department will review its intended $82.7 million merger agreement with Netflix, as well as a separate $108.4 billion acquisition offer from CBS Sports parent Paramount that it has repeatedly spurned, including again on Wednesday.

Paramount, meanwhile, continues to lob its own regulatory broadsides against WBD, writing to a House Judiciary antitrust subcommittee that the planned deal with Netflix is “presumptively unlawful.”

“Red-herring arguments should be ignored as a distraction from the unavoidable illegality of the current Netflix/Warner Bros. Discovery deal,” wrote Paramount chief legal officer Makan Delrahim in a letter to the antitrust subcommittee. “We are confident that the Justice Department and regulators around the world will conduct a careful review of each deal and reach their respective decision on the merits.”

The congressional submission gives a further clue to Paramount’s next move after it has now been turned down eight times by WBD, spanning the time before and after WBD put itself up for sale. After failing to win over WBD’s board, it is now looking for political and regulatory help from Washington and elsewhere.

“Experts across the ideological spectrum have recognized that [the Netflix-WBD deal] is clearly anticompetitive, and not a close call,” Delharim wrote.

WBD, meanwhile, is also bracing for a potential lawsuit from Paramount.

Upping the Bid?

Despite the repeated rejection of Paramount and the potential for legal headaches, WBD board chair Samuel Di Piazza Jr. still has not ruled out potentially doing a deal with the David Ellison–led company. That, however, would require Paramount improving materially upon the $30 per share, all-cash bid it tendered.

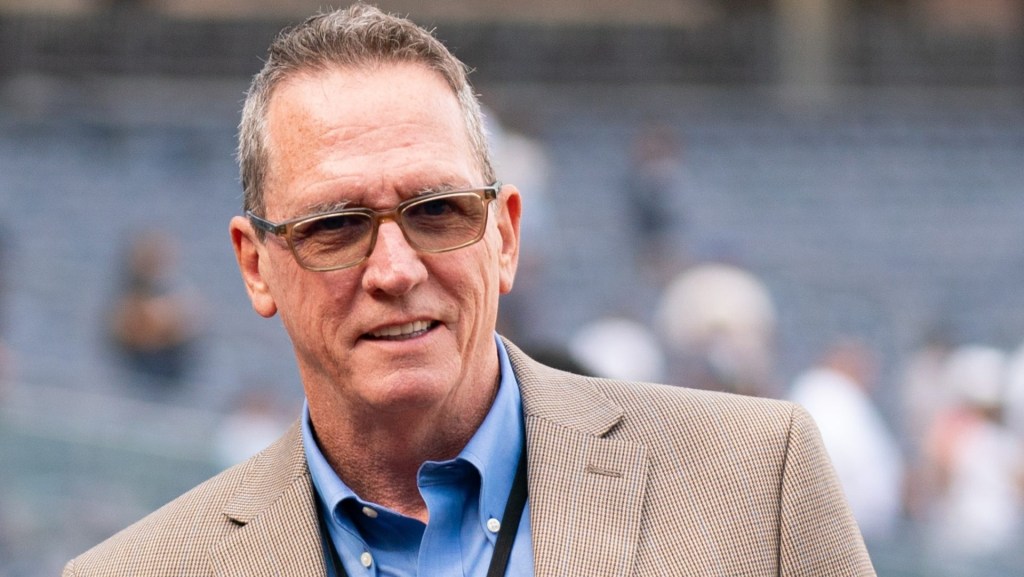

“From our perspective, they’ve got to put something on the table that is compelling and is superior,” Di Piazza told CNBC.

The Netflix deal involves WBD’s studio and streaming business, while Paramount is aiming to acquire the entire company, including TNT Sports and the linear TV assets. If the Netflix deal proceeds, WBD will continue with a planned split of the company that will create Discovery Global, a new holding entity that would house TNT Sports. That split, and the Netflix deal, are slated to close in the second half of 2026, and a new sports-centric streaming service is under development within TNT Sports and Discovery Global.