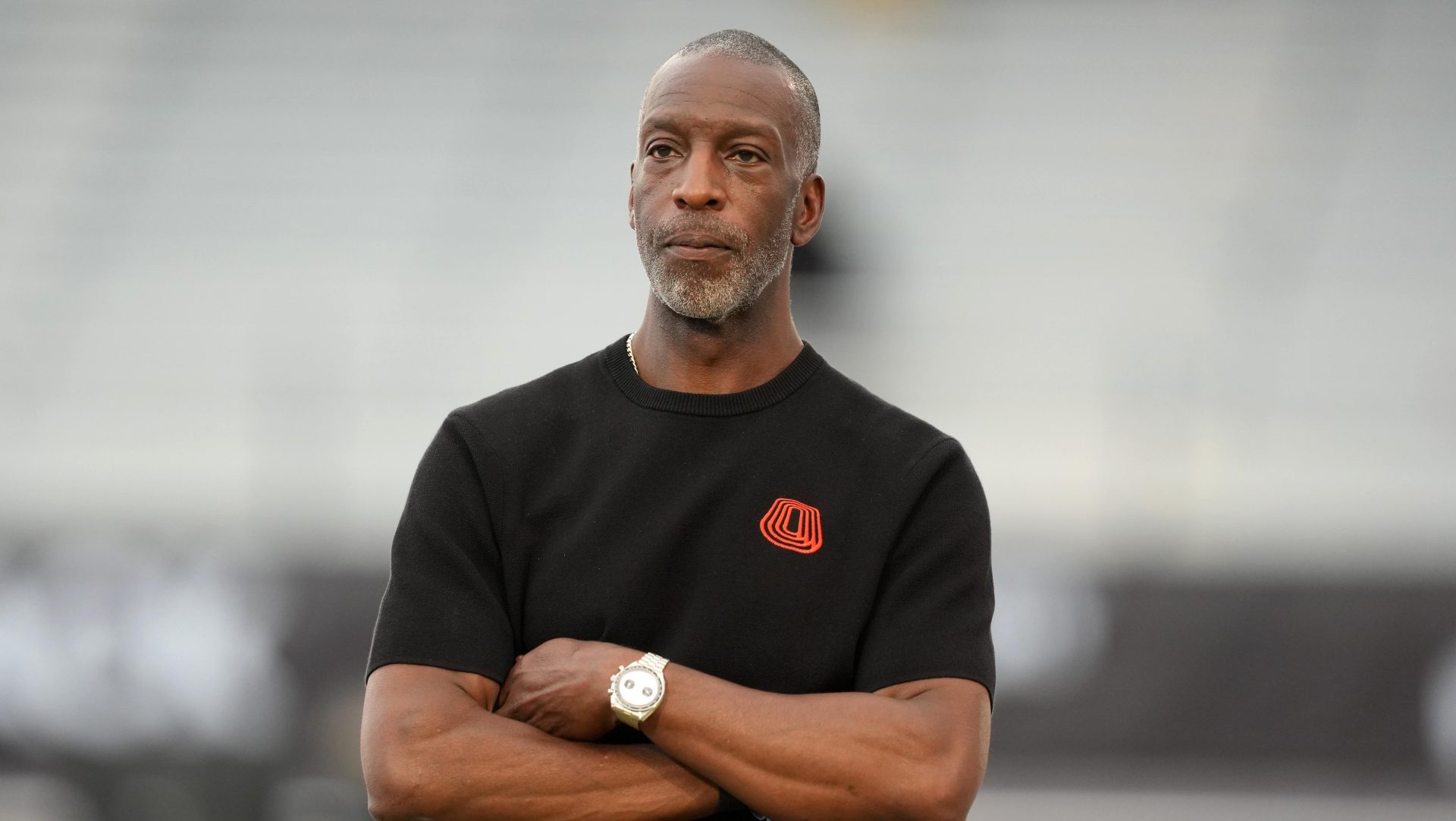

Grand Slam Track has filed for Chapter 11 bankruptcy.

The track start-up founded by Olympic champion Michael Johnson did not have the funds to pay back all of the money it owed athletes and vendors. The league paid athletes half of what they were due in October, then tried to negotiate with vendors.

Several vendors rejected Grand Slam’s offer to bring them up to half of total invoices, equal to 50% of what they’ve ever been owed rather than half of outstanding debts.

Grand Slam said in a press release that it plans to use the Chapter 11 reorganization process to keep the league alive. The league says that Chapter 11 will “stabilize its finances, implement a more efficient cost and operating model, and position GST for long-term success.”

Grand Slam has also laid off a few people, but not its entire staff, a source close to the league tells Front Office Sports. In October, FOS reported that Grand Slam had fewer than 10 employees remaining.

According to its public bankruptcy filing, Grand Slam estimates it has under $50,000 in assets, between $10,000,001 and $50 million in liabilities, and between 200 and 999 creditors. The document was filed Thursday and signed by Johnson, Grand Slam president and COO Steve Gera, and J. Rudy Freeman, who the source says is an “independent board representative” for the league.

The league announced the news on social media in a post saying it’s moving into a “court-supervised reorganization” and undergoing “a necessary reset.” The post emphasized the “opportunity for future seasons” and did not include the word “bankruptcy.”

Johnson continues to say that the league could return.

“Grand Slam Track was founded to create a professional platform that reflects the talent and dedication of this sport’s athletes,” he said in a statement. “While GST has faced significant challenges that have caused frustrations for many – myself included – I refuse to give up on the mission of Grand Slam Track and the future we are building together.”

Johnson launched his start-up league with a $12.6 million prize pot—which would have been revolutionary in track—plus dedicated salaries and appearance fees for athletes. Grand Slam staged three of its four planned meets this spring in Kingston, Miami, and Philadelphia. The league abruptly canceled its L.A. Slam, and in July, Johnson told Front Office Sports Today that an investor had backed out of a deal, which FOS reported at the time was an eight-figure signed term sheet. In August, The Athletic reported that Chelsea owner Todd Boehly was that prospective investor, and the league never actually had the more than $30 million it proclaimed to have in its coffers.

Earlier this fall, existing investors provided Grand Slam with up to eight figures in emergency financing. The league sent about $5.5 million of that directly to athletes, equal to roughly half of what it owed them. Grand Slam then planned to negotiate with vendors and send any remaining funds to athletes. It made an initial settlement offer to vendors on Oct. 31 to pay back half of the total amount it has ever owed them, but not all vendors accepted the deal.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)

![[US, Mexico & Canada customers only] Sep 28, 2025; Bethpage, New York, USA; Team USA's Bryson DeChambeau reacts after hitting his approach on the 15th hole during the singles on the final day of competition for the Ryder Cup at Bethpage Black.](https://frontofficesports.com/wp-content/uploads/2026/03/USATSI_27197957_168416386_lowres-scaled.jpg?quality=100&w=1024)