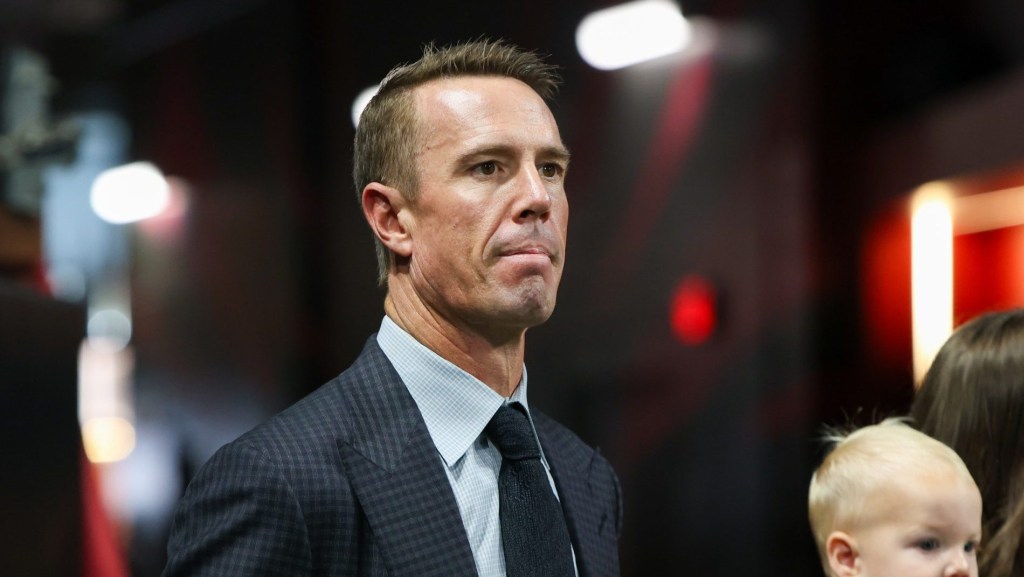

Former Jaguars quarterback Blake Bortles never thought much about investing while he was playing. “I told my financial adviser, ‘Just make sure my credit card doesn’t get declined when I swipe it,’” he tells Front Office Sports.

That changed after he retired in 2022, as Bortles began looking for ways to get involved in business. Now, he’s part of Momentous Sports, a new Orlando-based investment fund aiming to raise $100 million to invest in pro sports teams and nearby real estate, including residential housing, retail space, and public areas. Bortles declined to disclose the amount he invested, saying he made a “sizable investment that felt right for our family.”

Momentous, backed by Magnolia Hill Partners, also counts former NFL quarterbacks John Elway and Tim Tebow among its investors. It has already invested in USL Super League soccer team Sporting Jax.

Magnolia CEO Marley Hughes tells FOS the quarterbacks are not just “faces on a placard or a piece of collateral.”

“They’re actually invested with us; they believe in what we’re doing,” he says.

The launch of Momentous comes amid an unprecedented surge in private-equity interest in sports. PE investment in sports has been a trend for the past few years, but it has gone into overdrive lately. In September alone, Momentous announced its plans to raise $100 million; Arctos Partners unveiled a new business that will connect investors with pro sports opportunities; Apollo Global Management launched a dedicated sports division; CVC Capital Partners formed a new sports-specific arm; Chiron Sports Group rolled out Legacy 25, a fund backed by athletes like Rob Gronkowski and Brian Hoyer that will invest in and around the U.S. college sports landscape; and Avenue Sports Fund closed with more than $1 billion in capital commitments.

Momentous

In addition to everyone named above, Momentous is backed by Andrew Cathy, CEO of Chick-fil-A and grandson of the company’s founder.

Its first project is a mixed-use real estate development in Jacksonville, Fla., near a planned future stadium for both the men’s and women’s Sporting Jax soccer teams (the men’s team plays in the USL Championship and the women’s team plays in the Gainbridge Super League).

Hughes wouldn’t share specifics of other deals in the works, but did tell FOS “our pipeline and diligence list is very long. We’ll be sharing more later this year.”

Arctos

Dallas-headquartered Arctos boasts a portfolio that features investments in more than 25 franchises, including 10% stakes in the Bills and Chargers, as well as investments in the NBA’s Warriors and Kings, MLB’s Giants, Dodgers, and Astros, the NHL’s Penguins, Devils, and Lightning, and more.

On Tuesday, the firm announced the formation of Arctos Capital Markets, which will identify sports investment opportunities and connect them to high-net-worth individuals.

“Our goal is simple: be the first call,” Arctos cofounder Doc O’Connor said in the press release, adding that for individual investors, the new business “offers an efficient path to minority or control ownership.”

Apollo

On Monday, Apollo revealed its new sports division, Apollo Sports Capital, which will be led by Al Tylis—former chairman of Mexican soccer team Club Necaxa. It will invest in everything from franchises, leagues, and venues to media and events.

Apollo isn’t necessarily known as a major player in sports, although it has made some inroads—for instance, it provided a $107 million (£80 million) loan to U.K. soccer team Nottingham Forest. And in September, The Athletic reported Apollo is looking to buy a significant stake in Atletico Madrid, which plays in Spanish soccer league LaLiga and is currently backed by another PE firm, Ares Management.

CVC

The portfolio of Luxembourg-based CVC includes holdings in LaLiga, the Women’s Tennis Association, and French soccer governing body Ligue de Football Professionnel, which oversees leagues including Ligue 1.

CVC’s sports assets have a combined value of about $13.6 billion. On Sept. 11, the firm revealed it will house those assets in a new entity called Global Sport Group, which is led by chair Marc Allera, whose experience includes serving as chair of Jagex, a British video game maker backed by CVC.

Chiron

The Swedish private-equity firm intends to invest $150 million across college programs through Legacy 25. In addition to Gronkowski and Hoyer, it counts as investors former NFL players Matthew Slater, Devin and Jason McCourty; former MLB player Kevin Youkilis; and Maya Brady, who plays professional softball and is Tom Brady’s niece.

Chiron says on its website it believes the college sports industry is “on the brink of an unprecedented gold-rush,” and there is room to capitalize, including through investments in institutions and conferences themselves, as well as adjacent businesses.

It has already done some of the latter, with one example being its investment in Jump, a software platform for sports teams cofounded by Alex Rodriguez that recently raised $23 million.

Avenue Sports

This fund, managed by former Milwaukee Bucks owner Marc Lasry, announced Monday that it closed its first investment vehicle with more than $1 billion in tow.

Launched in November 2023, it has already invested in The Bay Golf Club—a team in TGL, the indoor golf league from Tiger Woods and Rory McIlroy—as well as MLB’s Orioles and the U.S. SailGP team.

It sits under the umbrella of Lasry’s New York–based Avenue Capital. Lasry, whose firm unsuccessfully tried to buy Angel City before Disney CEO Bob Iger and his wife, Willow Bay, swooped in and purchased the club at an enterprise value of $250 million, still has dreams of buying an NWSL team, he told FOS during an episode of Portfolio Players earlier this year.