The Cavaliers vs. the Warriors is one of the NBA’s strongest rivalries in recent history as the teams battled in four consecutive Finals in the mid-to-late 2010s.

Golden State has carried its formula to its organization’s inaugural season in the WNBA. The Valkyries enter the All-Star break with a 10–12 record and have sold out all 11 of their home games—setting the precedent for the five expansion teams coming from 2026 to 2030, including a team in Cleveland in 2028.

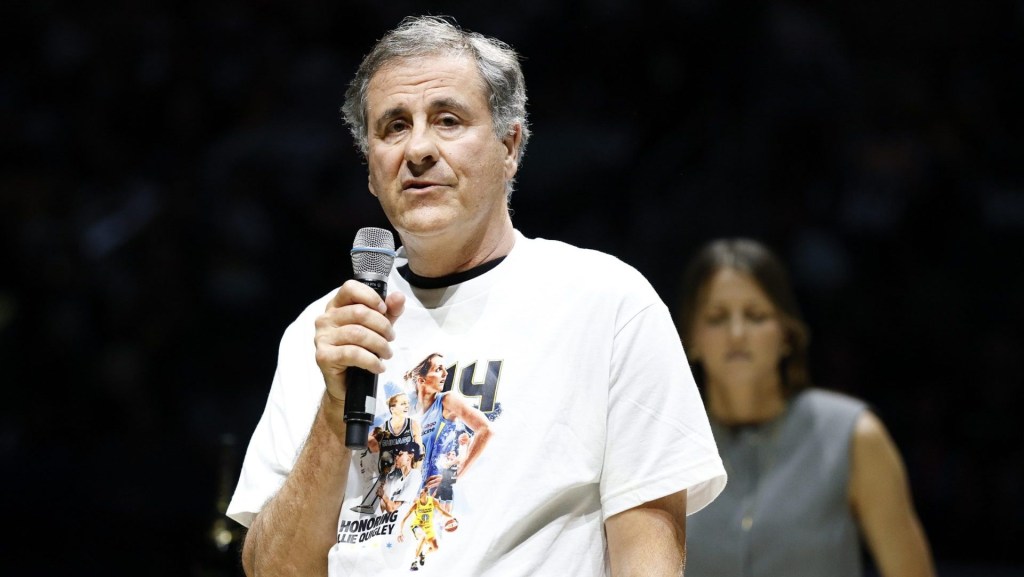

Cleveland’s WNBA team, like Golden State, is led by the ownership group of its NBA counterpart—a recipe the WNBA followed for the three expansion teams announced at the end of June. Cleveland is led by Rock Entertainment Group (REG), which is owned by Dan Gilbert and also runs the NBA G League’s Cleveland Charge and AHL’s Cleveland Monsters.

A large part of the Valkyries’ early success stems from the basketball infrastructure it had already established with its NBA team. They share Chase Center with the Warriors, and their practice facility in Oakland is the renovated version of the Warriors’ previous facility.

Cleveland is following a similar formula. Its WNBA franchise will share Rocket Arena with the Cavaliers and will practice at the Cleveland Clinic Courts, the Cavs’ current practice facility, when the NBA team moves into the Clinic Global Peak Performance Center.

“This is going to be a unified group,” Rock Entertainment Group CEO Nic Barlage tells Front Office Sports. “We’re really going to have a shared services model. Everything from training to modality to working out and nutrition.”

Barlage said the organization’s already established basketball infrastructure was a key selling point in its 114-page pitch deck to the WNBA. On top of the reported $250 million expansion fee, he says REG promises a nine-figure investment for the WNBA franchise, including renovation and new office spaces in downtown Cleveland.

Another point of emphasis in the pitch was capturing a wider audience, one that went beyond northeast Ohio, considering the franchise will be the first major women’s professional team in the region.

“We want this to be Cleveland’s team, Columbus’s team, Cincinnati’s team, Pittsburgh’s team, Buffalo’s team,” Barlage says.

The franchise is off to a promising start in capturing an audience, selling 4,400 season-ticket deposits in less than three weeks since the franchise was announced. The deposit, which does not guarantee a season ticket, but places fans on a priority wait-list for membership. At $28 apiece, the team has earned more than $120,000.

The team tells Front Office Sports it aims to hit 5,000 by the end of the month. The Valkyries sold 15,000 season-ticket deposits by the end of July 2024, nine months after the team was officially announced. Golden State announced in March that it became the first franchise in WNBA history to sell 10,000 season tickets.

CBA Watchers

As WNBA All-Star weekend begins Friday, the off-court focus is on the first in-person CBA negotiations. The league and its players’ union are looking to secure a new deal starting the 2026 season.

Barlage says Cleveland is “absolutely monitoring” the news around the CBA, but he says the organization is “staying completely out of it.”

“We feel fortunate. By the time we start in 2028, a lot of those things should be ironed out,” Barlage says.