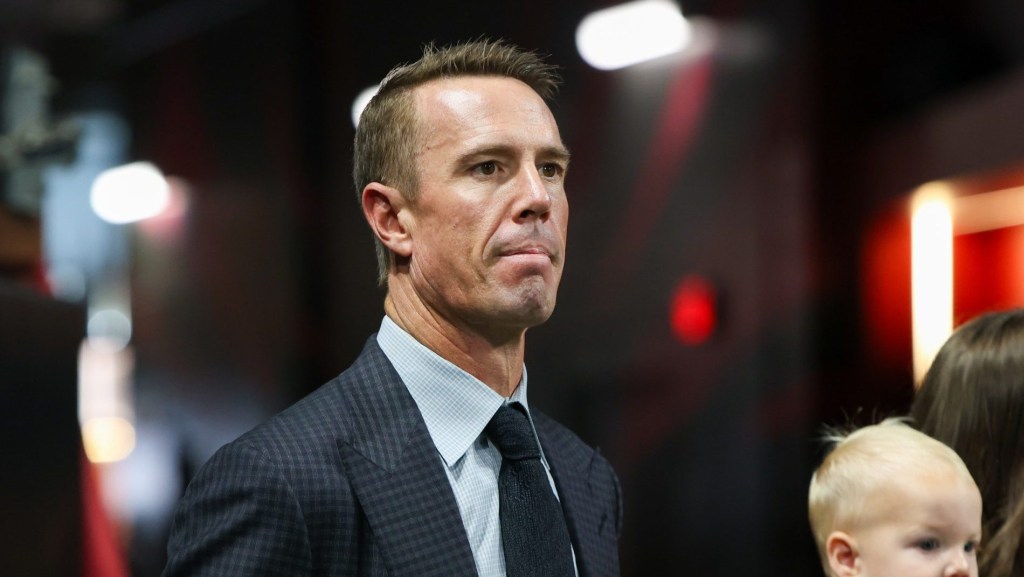

Atlanta Falcons minority owner Rashaun Williams knows about investing.

The venture capitalist, a recurring guest shark on Shark Tank, was an early investor in companies like DraftKings, Robinhood, Coinbase, Lyft, Ring, and Dropbox, and has made more than 170 investments with 50 exits.

So, what’s changed in the years he’s been putting money into early-stage companies? He says pro athletes now get some of the best investment opportunities in the market—before the rest of the field.

“I would argue that there are only two groups of people that get the best access to deals in the United States—I’m talking about tech and consumer products,” Williams said on the first episode of the Front Office Sports series Portfolio Players. “The top 20 VC firms—because all of those founders want money from the guys who backed Spotify, Docusign, Airbnb, and Pinterest… The second group: athletes and entertainers.”

“In the past, [athletes] just didn’t know what to ask. They didn’t know how to vet which opportunity made sense,” Williams said.

Now, early-stage start-ups are more commonly giving access at a funding round to athletes along with VC firms because they’re seeing the benefit for their brand to associate with athletes’ celebrity.

For example, Philadelphia Eagles running back Saquon Barkley brought more awareness to software company Ramp by announcing his investment days before he starred in the company’s first Super Bowl ad. (Barkley has since also invested in defense tech start-up Anduril.)

VC firms are cozying up to athletes more and more. Joe Burrow and Blake Griffin have worked with Patricof Co. to make investments, and the NIL (name, image, and likeness) revolution in college sports has opened doors for even younger stars to get equity deals. Paige Bueckers and Flau’jae Johnson both got ownership stakes in the Unrivaled women’s basketball league through NIL deals.

“The athletes and entertainers have the second-best access, in my opinion, because they can invest with the top 20 VCs,” Williams said, “but the retail investors are largely getting the markup and the leftovers from the ecosystem.”