Peloton has been on a cost-cutting mission and it looks to be working—sort of.

The connected fitness company reported revenue for fiscal first-quarter 2025 of $586 million Thursday, lower than the previous quarter ($643.6 million) and the year-ago period ($595.5 million). Still, revenue came in slightly ahead of consensus estimates of $573 million.

But the company, which sells stationary bikes and treadmills with subscriptions to classes, said its operating expenses this quarter decreased $126 million or 30% year over year, and it reached $11 million of free cash flow. Margins were more impressive, with gross margin rising to 51.8%, which beat the consensus estimate “entirely driven by better hardware margins than expected,” Bernstein analysts noted.

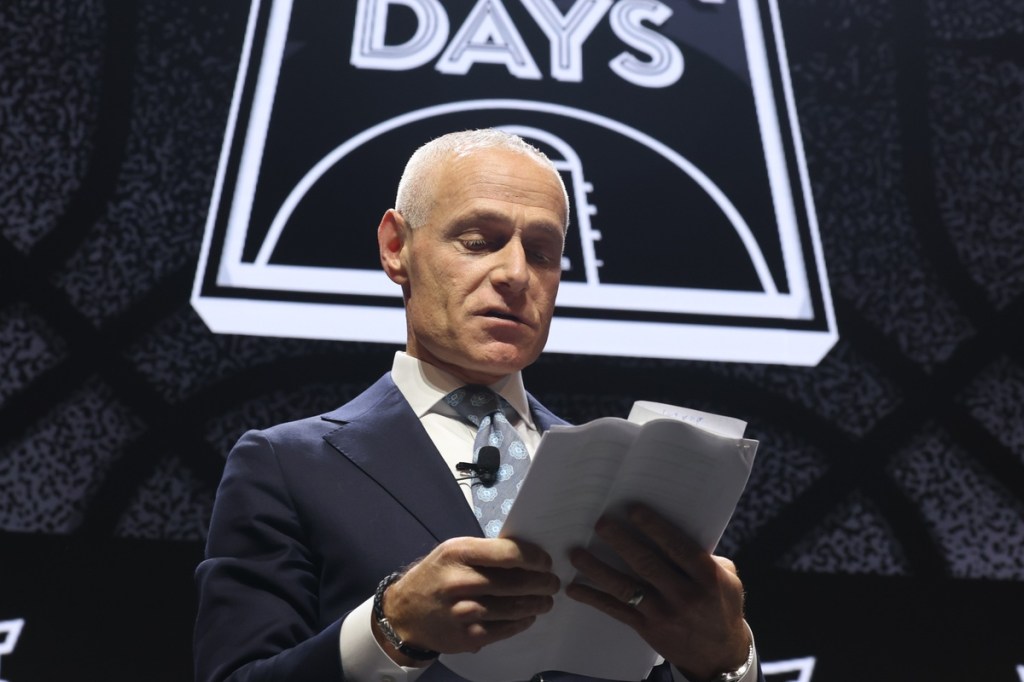

Peloton also announced it hired Peter Stern, former Ford executive and cofounder of Apple Fitness+, to be its next CEO, effective Jan. 1, 2025. The company said Stern, who is the son of a fitness instructor, has “grown over a dozen different subscription businesses,” including Apple iCloud and Ford’s hands-free highway-driving technology.

“We had a strong Q1 FY25 and performed above our guidance on all of our key metrics,” the company said in a statement. “We are focused on optimizing costs across our business and it shows in our [profit and loss] and cash flow.” Peloton (PTON) shares were up nearly 20% in premarket trading Thursday.

Membership churn is still a challenge. It reported it has more than 6.2 million members—a 3% drop from the previous quarter and the year-ago period. Average monthly paid-app subscription churn was at 7% for Q1, a lower churn rate than Q4 2024.

“Growth remains elusive with the subscriber base continuing to shrink,” Bernstein analyst Aneesha Sherman wrote in a note following the earnings release. Peloton said it expects to continue to lose paid-app subscribers, lowering its outlook for the fiscal second quarter down by 20,000 subscribers.

The company pointed to its efforts to expand its third-party retail channels ahead of the holiday season, including selling $2,000 bikes at Costco. (The bikes typically cost around $2,500.)

In its fiscal Q4 earnings reported in August, Peloton managed a slight sales increase (0.2%) for the first time in nine quarters as it slashed its overall losses. CEO Barry McCarthy resigned in May, and the company laid off 15% of staff as part of a broader cost-cutting effort amid a period of rising costs and waning demand.

Peloton saw a big boost in sales and subscribers during the 2020 pandemic as home-bound consumers bought its bikes, while gyms and fitness studios shut down along with the broader economy. The convenience and quality of the fitness platform kept demand high. But subscription numbers plunged in 2023 as consumers pulled back and a bike recall dented demand.

Despite its recent challenges, some on Wall Street are optimistic about Peloton’s future success.

A recent note by Morgan Stanley expressed optimism about Peloton’s outlook, noting improved sentiment around the brand—“the highest we have seen since early 2022”—as the company implemented cost-cutting measures “with clear upside to subscriber and revenue guidance.”