It’s still early days in the development of private equity in sports, but 2024 was undoubtedly the year that this form of outside investment truly became mainstream in the industry. It’s laid the foundation for a very different future in the business of sports.

The NFL led the way, finally approving in August a structure that allows a preapproved group of private equity investors to invest in teams. But the most dominant of sports leagues wasn’t alone. Each of the other major pro properties expanded their own roles with private equity during the year, while college sports even began to move into this area. Executives from this area also aggressively became a force in global team ownership, particularly the Premier League.

“We have the benefit of having a lot of interest in the investment community,” said NFL EVP of finance Joe Siclare, following the league’s 31–1 vote to create its private equity structure.

That will likely soon prove to be quite the understatement. Already, the NFL has approved private equity investments for the Bills and Dolphins, and more such deals are in development elsewhere in the league. “It’s an access to capital that I think has been of interest to us for a long time,” said NFL commissioner Roger Goodell. “I think it’s a positive development for us.”

No Power, No Problem

On the surface, there would appear to be limited appeal for these firms to invest in teams. Many leagues cap private equity investment at 30% of a particular team, with the NFL coming in much lower at 10%. There are no voting or governance rights, no path to control, strict conduct clauses, and frequently minimum hold periods for equity stakes. Additionally, the NFL has approved a list of only eight firms that are allowed to participate in its private equity program.

The NFL also has added a “carry” requirement in which the league will collect a percentage of all private equity stake sales, adding yet another layer of profit participation for a league that also generated more than $20 billion in annual revenue.

But among the private equity firms, there’s still keen interest to be part of this structure. It still offers one of the closest things to a guaranteed return anywhere in the investment community given the continued escalation of sports team values. There’s also a big halo effect from being formally involved with a major sports league such as the NFL, in turn opening up other potential deals for those firms.

“Steve has been the architect of an impressive ecosystem of sports, entertainment, and real estate assets that underscores the sector’s significant potential for growth and value creation,” said Ares Management’s Mark Affolter and Jim Miller of Dolphins owner Stephen Ross in December. The firm recently became a part-owner of the Dolphins in a deal valuing the team at a reported valuation of $8.1 billion. “We look forward to working with Steve to continue unlocking new and exciting opportunities ahead.”

Opening Up Resources

The rising stature of private equity in sports, and particularly the NFL, has become increasingly necessary as many leagues have almost become victims of their own success. The fast-rising nature of team values has increasingly made ownership available to only the wealthiest of individuals.

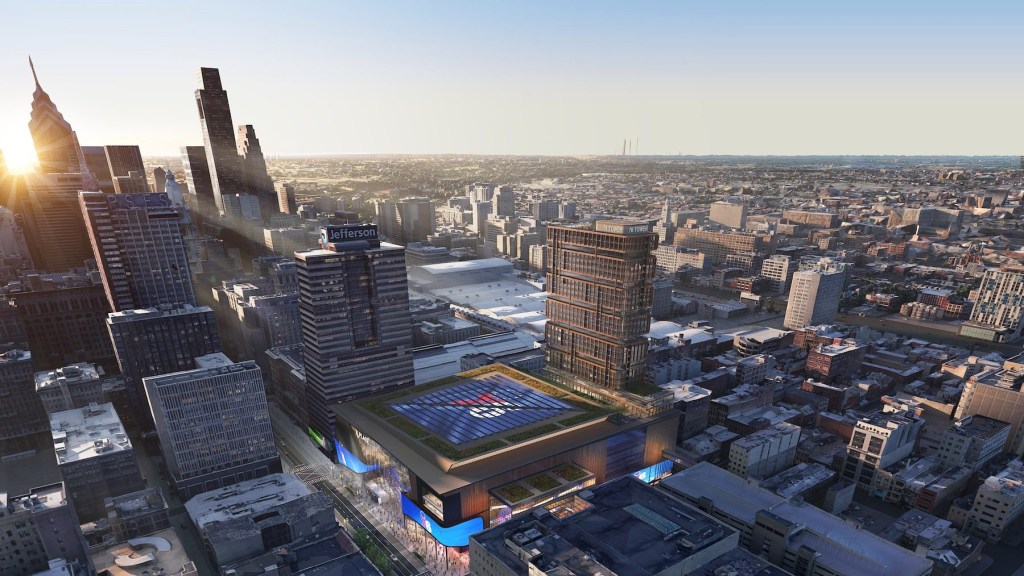

Private equity also helps open up additional resources for a wide range of team projects, including new stadiums and mixed-use developments, and forge new market territories—such as the Bills’ intent to further mine southern Ontario with the aid of a new investment from Arctos Partners that will be joined by several new individual partners with Toronto ties.

“Two heads are better than one,” said Bills owner Terry Pegula. “I was a sole owner, bringing in Arctos with their experience worldwide in multiple sports, I think is a good thing. And I’m willing to listen on the business side to any input they may have.”

The Global Game

The hefty wealth that private equity has created in turn has created an additional class of investors who are rapidly buying teams around the world, particularly in soccer. Roughly a third of the clubs in Europe’s “Big Five” leagues in that sport now have some type of connection to private equity. Executives from private equity have also been at the center of a growing series of recent deals for teams such as Sheffield United and Ipswich Town, and even lower-tier clubs are becoming appealing.

Meanwhile, the private-equity-backed Bruin Capital is now making a big play in soccer player and coach representation, buying up several agencies to form a new entity, As1.

There has been significant fan pushback to the ongoing developments in some corners, including an aborted move by the Bundesliga to sell part of its commercial operations to private equity. But the overall trend line is expected to grow and become an even more established thing in 2025.