The NBA 2K League helped set the dominoes in motion. (Photo via Sports Illustrated)

Recently, all the major American sports leagues (save for the MLB) have announced either esports leagues or tournaments: the MLS with eMLS, the NFL with the Madden NFL 18 Club Championship, the NHL with an unnamed NHL 18 league, and most notably, the NBA with the NBA 2K League.

This boom coincides with a phenomenon that I’ve referenced before in relation to esports – we are clearly in the growth stage of the product lifecycle, where there are many entrants, few incumbents, and many variations on the product. We have yet to see the standard streamlining of products – where dominant firms eventually experience continued growth in sales, consolidate, and when a dominant design emerges.

We are still very far from that point – indeed, esports organizations have yet to turn a profit, and it may take years for them to do so.

How Leagues Can Use Esports

What makes the traditional leagues’ esports ventures unique is that they are not standalone businesses. With that said, their future will be wholly driven by their goals: is esports a way to drive the existing business, or can it eventually operate as a standalone business?

In the former case, profit doesn’t matter – as long as the 2K league is driving ticket and jersey sales, the NBA is happy!

In the latter case, profit still should not matter. The optimal long-term growth strategy (and to be clear, esports is a long-term strategy) involves taking a loss in the short-term in favor of long-term profits.

In either case, we should expect the leagues to take a hit with esports – meaning that they are either in great financial condition (true for some), or are simply drinking the esports Kool-Aid. The former strategy is likely to reap greater overall profits in the short term, while the latter strategy could have a greater ceiling.

With that said, because of the nature of the games on which these leagues and tournaments are based on, the ceiling of league-backed esports is fundamentally tapped. If leagues are aware of this, it is probable that the strategy that they are pursuing is the former, in which case esports becomes a way to complement the existing products.

On whether leagues are planning to use esports to augment their existing products, Sam Riber, Senior Vice President of esports at MKTG says much of the intention is to do so:

“While it exists as a standalone property, a league’s esports offering is ultimately intended to support the league while remaining relevant in interest areas that are important to consumers/their fan base… It can also provide the opportunity to cross sell existing league partners or secure new partners to the eSports offering. Depending on the league and partner, the gaming property may even allow brands typically excluded from base league sponsorship investment (due to category exclusivity) the chance to secure an association/connection to the league through the esports platform.”

Riber’s point – that esports can act as a value-add, or as an additional asset for existing sponsors while also attracting new sponsors (acting as a “foot in the door”), is tremendously important. It is likely that sponsorship will be the primary driver of revenue for leagues’ esports ventures in the near future – and using it in conjunction with sponsorships for their existing products is one way to support overall league growth.

The Target Market

As I alluded to earlier, leagues should enter into this with the assumption that their viewership will not match that of games such as League of Legends or Dota. In fact, given the differences between the games and their audiences, the hope should be to draw from the pool of fans who play the respective games, rather than the general pool of esports fans (i.e.: eMLS should expect to draw from FIFA 18 fans, rather than LoL fans). In this sense, these ventures may expand the esports market further. This is great for esports as a whole!

While there may be some overlap between fans of different games, the inherent differences (including less teamwork, more randomness, etc.) between sports games and popular esports games will reduce the likelihood of a fan following both games.

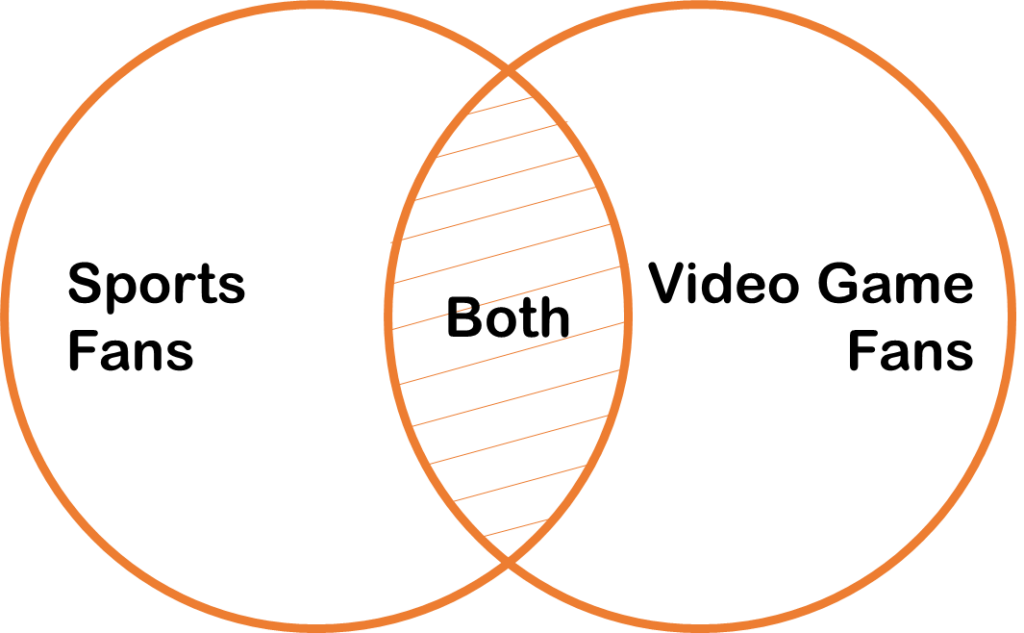

A useful way to visualize this may be through a Venn diagram:

Where leagues would be targeting either “both” or “video game fans”.

For the leagues, it will be important to determine whether or not the popularity of the games itself will be enough to sustain an esports league. NBA 2K, the most popular sports franchise in the world, has a relatively small gamer base, and it’s highly unlikely that a majority of these gamers will follow the league.

That said – if the entire purpose of this is to prop up their existing product (as I suspect), then this might be a moot point, and the league may only need to generate a sufficient following, rather than a consistently high revenue stream.

Cable TV and Esports

While it has yet to happen for most sports, leagues are also aware of the potential of a cable TV doom.

To be fair, leagues are already starting to hedge their bets through streaming: via outlets such as Facebook, Amazon, and Twitter – but the traditional cable bundle has always been profitable to leagues. In linear programming, options are limited, relative to streaming, where options are seemingly limitless. With cable TV, viewers are more likely to watch, and stay, during the entire broadcast.

This means that, with a shift towards streaming, total viewership could increase, while the rate of people watching through to the end of the broadcast could decrease. In doing so, the number of, what would be traditionally thought of as the “hardcore fans”, could also decrease.

However, the internet (and its vast sea of knowledge) has also given rise to a completely different type of hardcore fan – one that does not necessarily watch all their team’s games, but can recite every stat about each player on their team, watches highlights on Instagram, attends games, and buys merchandise. While these fans will not help leagues with their broadcast revenue, they do provide value in other ways.

An esports league precisely targets these fans. In providing another channel for league-related entertainment, fans are provided with an opportunity to “go deeper” into their sport of interest, hence becoming more likely to become the internet-age hardcore fan.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)