Warren Buffet has been wildly successful when it comes to investing, making money with Apple, Coca-Cola, SirusXM, and more. Now, Buffet can add “team owner” to his portfolio.

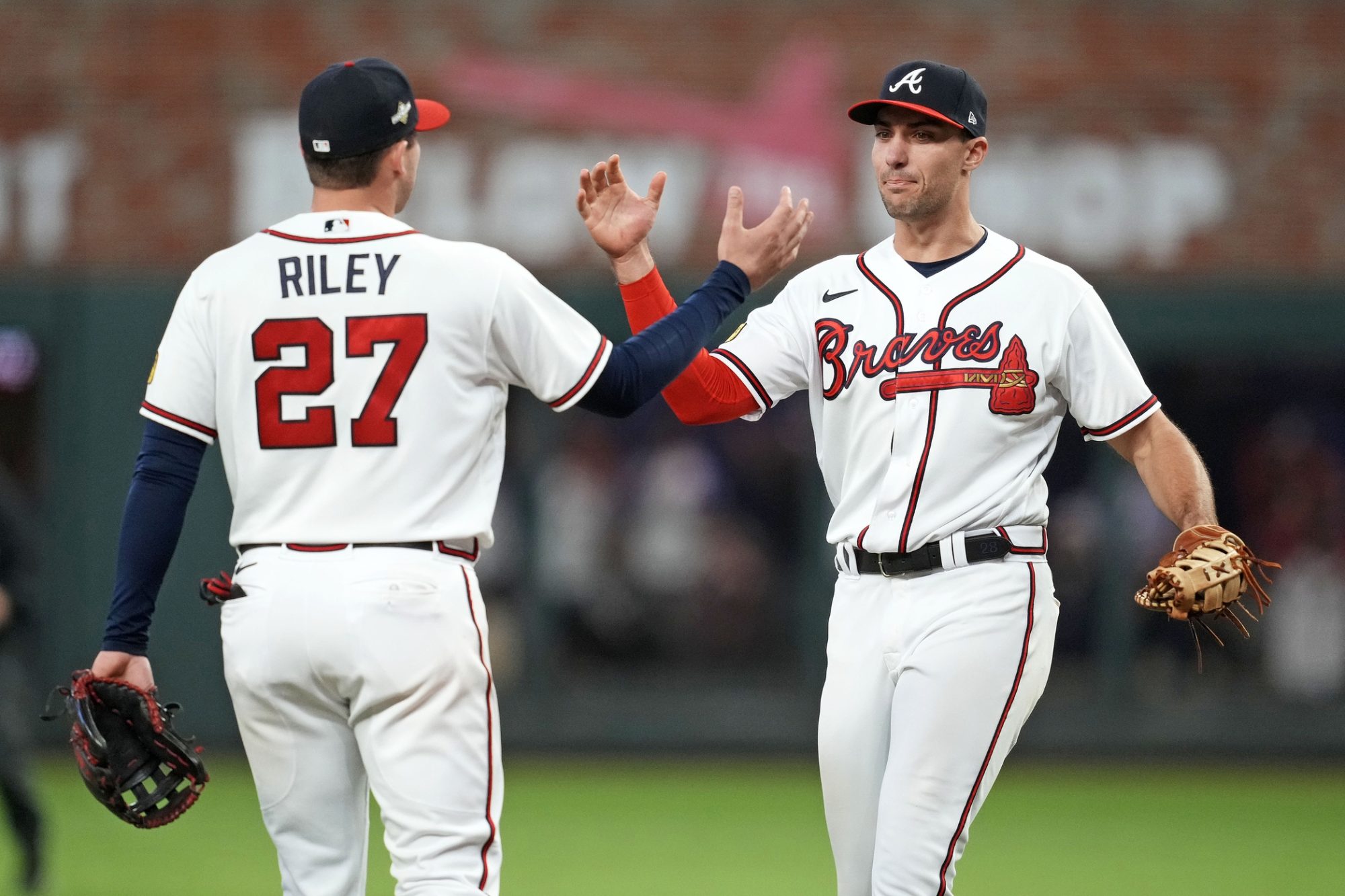

Berkshire Hathaway — Buffet’s mega-fund with a market cap of more than $700 billion — has invested in Atlanta Braves Holdings, the new parent company of the MLB team that was spun off from Liberty Media earlier this year. Berkshire Hathaway recently bought nearly $8 million worth of Braves shares, according to an SEC filing.

Known for his shrewd investment strategies, Buffett’s stock choices have been lauded for their high success rates, and the Braves have posted consecutive quarters of revenue growth since the spinoff.

In their third fiscal quarter, the team reported an 11% jump in revenue to $272 million. Operating income swung from a loss of $4.7 million in the comparable period a year ago to a gain of $15.7 million. In the second quarter, Braves revenue grew to $270 million — an increase of 8% over last year.

The Braves had a disappointing early playoff exit after winning more regular-season games than any other team in MLB, but appear set to continue their momentum in 2024. Atlanta has a stable flow of local TV money, as Bally Sports South plans to continue showing games while its bankrupt parent company Diamond Sports Groups forgoes other MLB team contracts.

Next season is expected to bring a payroll increase from this campaign’s $208 million price tag.

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)