Under Armour has announced a new marketing push heading into 2020 that will showcase its roster full of prominent athletes, and attempt to grow brand appeal with consumers.

The shift in strategy comes in the midst of an SEC investigation into the company’s accounting practices, and another quarter of revenue declines.

On its 2019 third-quarter earnings call on November 4, Under Armour said newly allocated advertising dollars are a direct byproduct of better than anticipated margins achieved during the period. A slew of new merchandise sold to customers by the company and its wholesale partners at varying price points lowered inventory available for discount retailers, thereby maximizing sales profits, it said.

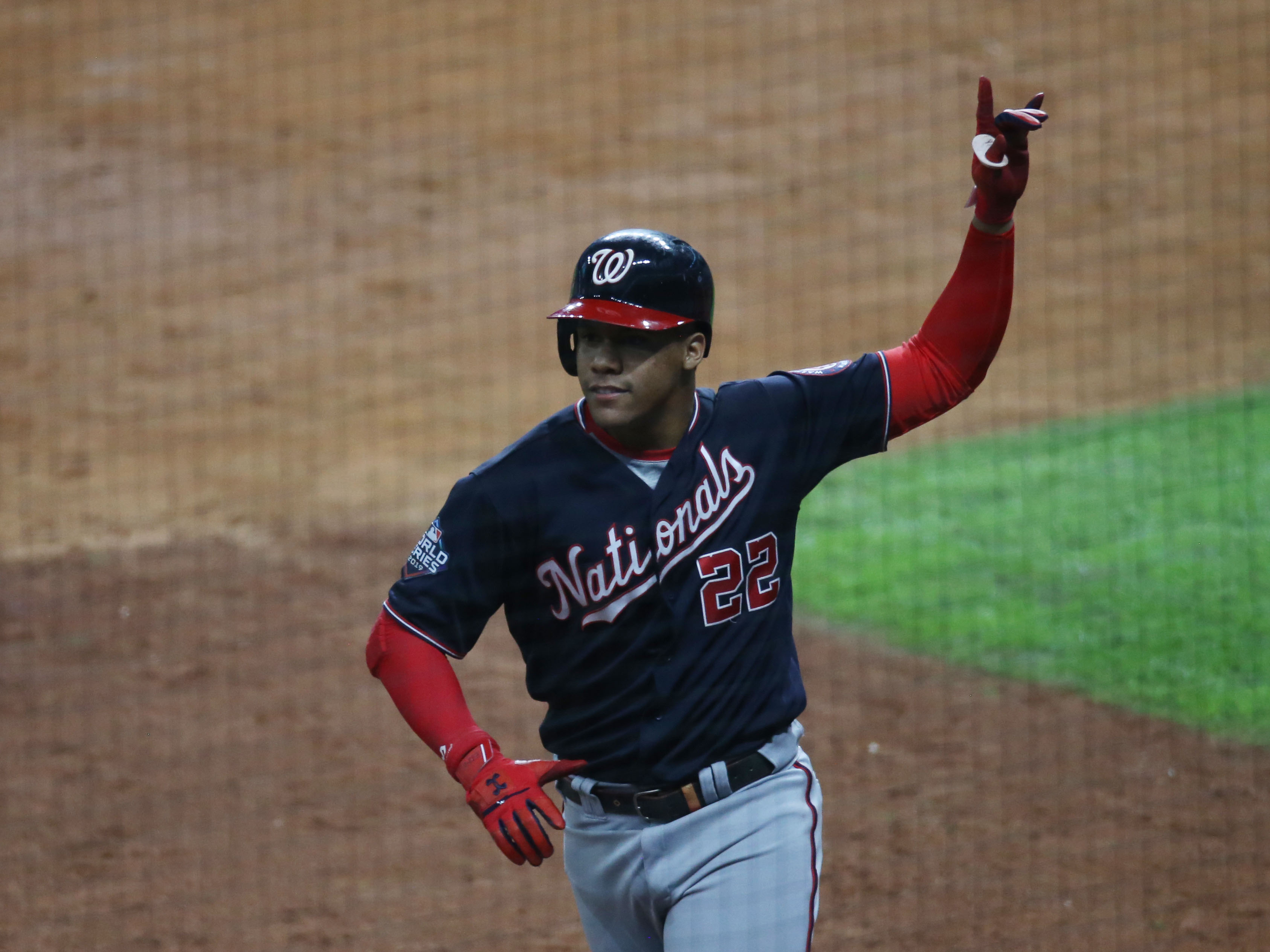

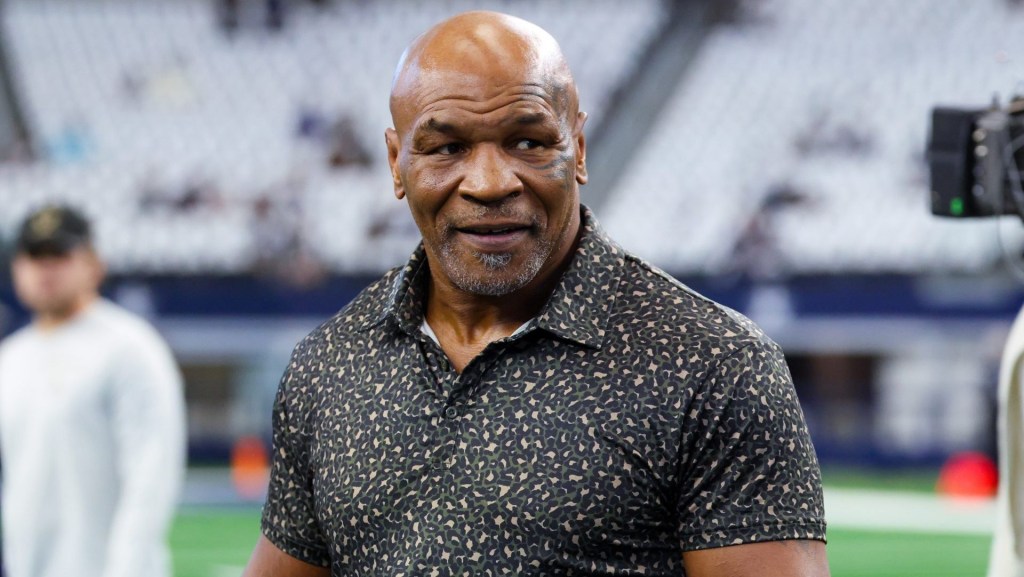

“We are taking this opportunity to proactively invest back into the brand through increased marketing spend in a deliberate shift from defense to offense,” CEO Kevin Plank told investors. He also touted potential marketing opportunities with New England Patriots Quarterback Tom Brady and Washington Nationals star Juan Soto as part of the strategy.

Under Armour announced on October 22 that Plank will be transitioning to his new role as executive chairman and brand chief beginning in January, making room for Patrick Frisk, current President and COO, to lead day-to-day facets of the company.

Since 2017, Under Armour has built up data analytics capabilities to better compete with market rivals Nike and Adidas and leverage its digital and social media channels to grow market share. The company is now ready to unleash developed tools in a type of “top-funnel storytelling” approach it has not executed in several years, according to Plank.

“You are going to hear about this brand, and you are going to hear us tell our story. That’s for sure,” he said.

Both Plank and Frisk will attempt to transition Under Armour into a more premium brand going forward, while catering to the same active core customer. A large part of that strategy is fixated on new product development. The company hinted that an abundance of midsole running shoes are in the pipeline, similar to its Infinite HOVR running shoe released in February currently priced at $120.

“What’s interesting about our transformation is this evolution in how we think about creating a product for a specific consumer mindset that’s really allowed us as an organization to become incredibly consumer-centric,” said Frisk. “It’s not the company wasn’t consumer-centric before, it’s just that we are now able to use data much more purposefully to understand what matters to the consumer.”

READ MORE: Biofreeze Using Sports Marketing To Follow Same Path As Gatorade

Overall, Under Armour reported a 1% decline in revenue to $1.4 billion in the third quarter ending September 30, due largely to a 4% decline in its North America business. International growth of 5% -– fueled by a strong collective performance in Europe, the Middle East, and Africa -– helped to offset some of the losses. North America represents Under Armour’s largest consumer market by a wide margin.

The sports apparel and footwear maker additionally expects both lower excess inventory for off-price partners and challenges in converting higher store traffic into higher direct-to-consumer sales to plague total revenue outputs in 2019. Direct-to-consumer sales by Under Armour declined 1% in the quarter to $463 million, representing roughly one-third of total revenue.

Projected Under Armour revenue for the year is now expected to grow 2%, compared to 3% to 4% forecasts estimated earlier this year.

READ MORE: Borussia Dortmund Sees U.S. Growth Ahead, Even Without Pulisic

Addressing the SEC’s investigation into the company’s accounting practices made public by the Wall Street Journal on Sunday, Chief Financial Officer David Bergman said that Under Armour has been supplying the regulator with financial documents since the summer of 2017.

“We have been fully cooperating with these inquiries for nearly two-and-a-half years,” said Bergman. “We firmly believe that our accounting practices and disclosures were appropriate.”