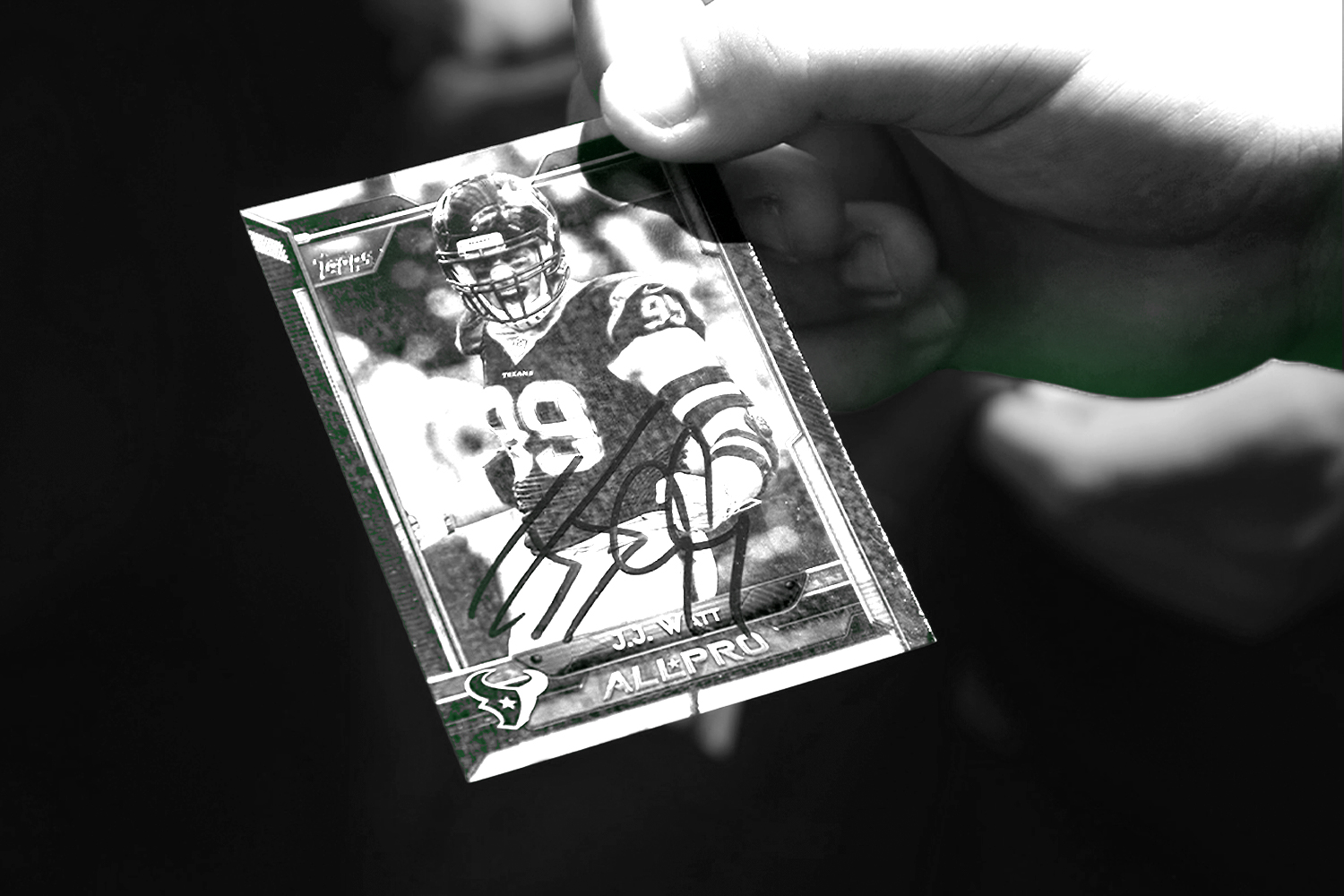

The trading cards industry is hotter than ever with no signs of slowing down.

Topps, a leading producer of sports trading cards, reported $166.6 million in sales for its fiscal quarter ending April 3.

The $59.3 million increase compared to the same period a year prior was driven by the company’s sports and entertainment business, which saw sales reach $103.2 million, a 105.3% uptick compared to fiscal Q1 2020.

Topps expects 2021 sales to range between $740 million and $760 million. Last year’s sales were $567 million.

The growth of Topps is one of many signs of a thriving consumer category.

- eBay’s “State of Trading Cards” report revealed a 142% increase in domestic sales with more than 4 million cards sold on its website in 2020 compared to a year prior.

- A 1952 Topps Mickey Mantle card auctioned through a private sale recently sold for $5.2 million, a record for sports cards.

- Earlier this year, Goldin Auctions, an auction house for collectibles, announced a $40 million fundraise led by The Chernin Group. Goldin grossed over $100 million in 2020.

- Topps is going public via a merger with Mudrick Capital Acquisition Corp II, a blank-check company, valuing the company at $1.3 billion. Milwaukee Bucks co-owner Marc Lasry and former USWNT soccer coach Jill Ellis will be on the company’s board.

However, the frenzy over trading cards comes with downsides.

Last month, Target temporarily removed trading cards from brick-and-mortar locations following an altercation at one of its Wisconsin stores over the highly coveted collectibles.