On Oct. 28, theScore reported its fourth quarter earnings, showing the impact the pandemic and shutdown of live games had on the sports media company.

Overall, theScore reported quarterly revenue of $2.5 million, down from $6.4 million in the same quarter last year. Its entire fiscal year generated $20.7 million, a decrease from $31.1 million in 2019 — showcasing the dramatic effect the two quarters of no live sports had.

“We were seeing great early momentum when, along with the rest of the industry, we had to adjust to the global disruption to sports brought on by the COVID-19 pandemic,” theScore founder and Chief Executive Officer John Levy said. “Notwithstanding these challenges, we successfully navigated this period by keeping our team at full strength, preserving the vast majority of our user base, and diligently preparing for the return of sports.”

There was a bright spot in the company’s fiscal 2020: esports. In the latest quarter, theScore’s esports video content generated 292 million views, a year-over-year growth of 243%.

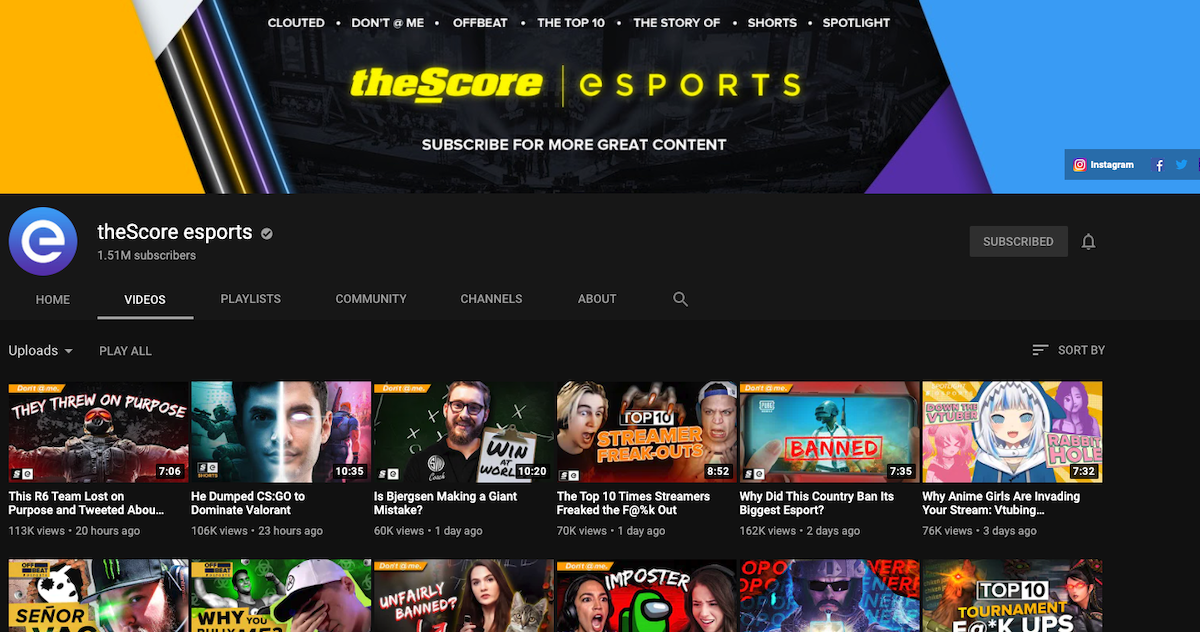

Its YouTube channel added 112,000 subscribers to reach 1.5 million total, and its TikTok account surpassed 1 million followers after adding 641,000 during the period.

Esports is one of the three pillars of the business, along with its sports media and sports betting segments, according to Aubrey Levy, theScore’s vice president of content and marketing. Its other pillars performed decently, with its media app having 3.0 million average monthly users, 83% of the monthly users the same period last year when there was live sports.

As sports media and betting dried up without live sports, esports took off across the globe. Aubrey Levy said theScore’s esports content strategy didn’t change, because it didn’t have to.

“Esports has been on this upward trajectory in audience development for two, three years,” he said. “From a focus perspective, it didn’t change anything because we had built up a competency and we were able to to adapt smoothly, pivoting workflow and maintain a quality and output so we could continue the momentum.”

In the quarter, theScore worked with Riot Games and MasterCard, among other partners, monetizing the esports sector more than it ever has.

“Over the past six months, we’ve added some marquee names, some endemic, others sophisticated non-endemics across the spectrum,” Aubrey Levy said. “Because of this momentum, there’s an increased focus ramping up the sales pipeline.”

Esports media hasn’t been an easy equation to crack for traditional sports media companies. For example, ESPN’s YouTube esports channel has 61,700 subscribers.

Aubrey Levy added theScore did try to enter the esports space with the same mobile-first strategy it approaches traditional sports. It didn’t work. Instead, he said the company kept trying and eventually cracked the code and started to experience the growth trajectory it’s on.

“It tends to not parallel directly,” he said. “It requires its own focus and you need to put some time and energy in how to talk to that audience and what coverage they’re looking for. It’s a heavy video consuming, on desktop, tech savvy audience.”

Finding the right way to connect with an esports audience has led to working with clients, including Riot — developer of League of Legends, one of the world’s most popular esports — that are looking to connect with fans.

Aubrey Levy said he’s proud theScore has positioned itself to be a producer that can help brands enter the esports space.

“It’s not just that brands can leverage us, but can lean on us to be a production partner and knowledge-based consultancy to approach the market effectively,” he said. “We can defang a lot of the risks to entering esports and mitigates the concern of how to talk to the audience effectively.”

With sports back, theScore is starting to see rebounds in its other two pillars.

The new quarter is starting strong for theScore, with wagers up 500% year-over-year in September as theScore Bet app went live in Colorado and Indiana. Iowa is set to be the next launch state early next year.

Media ad sales also set a single-month record in September, according to the company.

Those growth notes came as sports returned at the end of the last quarter, helping boost the new quarter — and fiscal year.

“We are in a strong position to build on this momentum … further leveraging the power of media and gaming, bringing theScore Bet to more states, and exploring opportunities to add to our existing market access footprint,” John Levy said.