The success has turned the franchise into a sports icon.

Note: the NBA 2K franchise is one that I am wholly partial to. While I had enjoyed many installations of EA’s NBA Live¹, NBA 2K11 felt like the first great basketball simulation that I had ever played.

With that said, I will attempt to provide an unbiased analysis on what Take Two got right with NBA 2K.

The Gameplan for Sports

Sports video games differ from most traditional genres because they specifically target a niche audience. In fact, the most useful comparison can be made between NBA 2K and another Take-Two franchise: Grand Theft Auto.

GTA V has made 80 million sales since its launch in 2013. It’s one of the greatest-selling video games of all time, and continues to make money to this day — which, in Take Two’s words, has surpassed even their own expectations.

In a comparable timeframe, the entire NBA 2K franchise has sold 29 million copies.

Historically, the issue for sports games was that the size of the addressable market was dependent on how popular the league was. For example, for basketball simulation games, their target were individuals who were NBA fans AND gamers — in other words, P(Gamer∩NBA Fan).

To see the exact magnitude of this, consider this:

U.S. population = 323.1M

Number of NBA fans in the U.S. = 24.5M² (probability = 7.6%)

Number of console gamers in the U.S. = 89.8M (probability = 27.8%)

Probability NBA fan AND console gamer = 2.1%

Estimated number of people in the U.S. who are NBA fans AND gamers = 6.1M

Meaning that in the U.S., the NBA video game market was tiny compared to mass market games, which were designed for the entire market.

And yet — Take Two continues to laud NBA 2K as one of its flagship franchises.

This is because, while the number of individuals who were both NBA fans and console gamers was relatively low, Take Two realized the value of going deep into a specific niche. Since they would stand to gain the most from a game catered to their interests, users would, at its peak, have a much higher willingness to pay than for a mass-market game at its peak.³

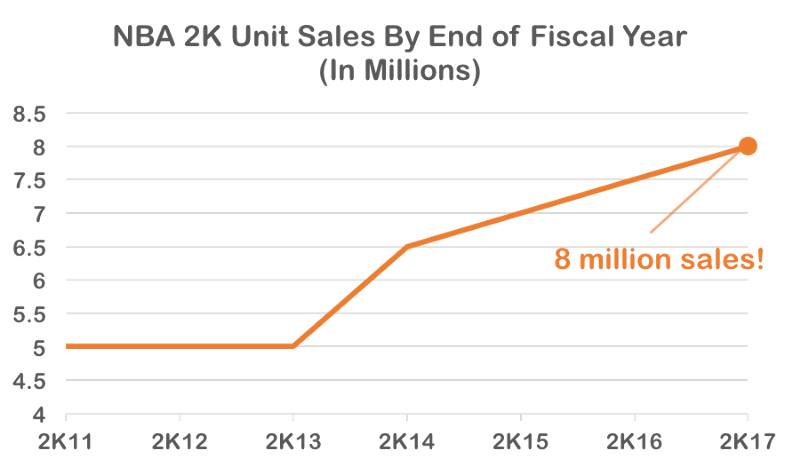

Since 2K11, sales have looked like this:

And yet, while their unit sales increased at a linear rate from 2K14, their revenues grew at an increasing rate. In fact, in 2017, NBA 2K17 accounted for an additional $265 million in revenue — or 72.6% of their growth.

This indicates two things:

1. The importance of repeat customers

2. The power of microtransactions

Repeat Customers

Given the cyclical nature of sports (which games are simulating), major sports game franchises have become distinguished by the frequency of releases.

This has made repeat purchases an important factor for video game developers. While these numbers are not public, it would be a fairly safe bet to assume that 2K has market leading rates.

When deciding to purchase the successive version of a sports game, consumers implicitly calculate whether the incremental benefit of purchasing the new version of the game is worth the price.

Previous game developers’ additional features would focus on details⁴ and roster updates. In this scenario, developers would rely on the depreciation of value from older games — where users would purchase new versions once the benefit of the old game would run out. Alternatively, they could truly value the additional features sufficiently.

Where 2K differentiated themselves was via its My Career mode — which was, historically, its most-played feature. By introducing a storyline for 2K16, 2K created another reason for users to continue purchasing their product: meaning that the utility gained from the new game was far beyond simple details or roster changes. In other words, 2K increased the average willingness to pay for each successive release, leading to a greater probability of purchase.

And by maintaining their customers, 2K could also introduce new sources of revenue:

Microtransactions

Microtransactions are effective in sports games because sports fans are, by nature, much more likely to be willing to pay for them, all at no marginal cost.

2K was the first sports game that really took advantage of this concept — and opened up a whole new reason for companies to develop the genre. In a world where digital downloads are a part of gaming, niche games are tremendously more valuable, since their users are more willing to pay for that extra content.

So, while repeat customers maintained the base, microtransactions would grow the pot of revenue gained from each user.

This means that the acceptable number of microtransactions, and the amount at which users would pay for them, was much greater for NBA 2K.

A Word on China

The big risk for games like 2K is the incoming disruption from mobile gaming — whose goal will be to win casual gamers. However, if sports games maintain their hold in console gaming, they may become a reason for users to purchase consoles — with the result looking a lot like the cable industry today.

But here’s why I still love NBA 2K: for the first time, sports games were given the treatment that they deserved. Sports games are not like mass market games, and their fans will not exhibit the those same behaviours.

Now, it’s likely that the 2K franchise has reached its saturation point in America, at least in terms of units sold. For them to grow their revenues further, they will need to target two avenues: international growth, or further increase their revenue per user.

Microtransactions will not be the ideal strategy for growth: we’ve already seen complaints from users, and we will certainly see (and indeed, may already be seeing) real negative returns from flooding the game with too many.⁵

Rather, the easier path to revenue growth would be through international expansion. Take Two has already made its way into the Chinese market — through its free-to-play NBA 2K Online, which acts as lead generation for their console games.

Still, the Chinese market is one that will continue to frustrate. Since the ban lift in 2015, China has been slow to adopt consoles — instead preferring PC gaming.

It’s quite possible that 2K will need to create a compelling offering catering to this — which may mean developing a paid PC game.

¹ RIP NBA Live. ^

² Highest viewership for any one game during the 2017 NBA Finals. ^

³ This argument would actually also hold for games like Call of Duty, which target people who love both war and video games. ^

⁴ i.e.: more realistic movement, historic teams, new skills, etc. ^

⁵ Another avenue for increasing revenue per user is by creating special editions, which of course they’ve already done: with their Legend Edition ($100) and Legend Edition Gold ($150). ^

This piece has been presented to you by SMU’s Master of Science in Sport Management.

Front Office Sports is a leading multi-platform publication and industry resource that covers the intersection of business and sports.

Want to learn more, or have a story featured about you or your organization? Contact us today.

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)