In the News

The electric vehicle (“EV”) industry saw two considerable pieces of news emerge this week. Tesla CEO Elon Musk publicly opposed the US government’s federal spending plan which included $7.5 billion of capital to expand the nation’s charging stations for EVs. Also in the news, Toyota announced that it would build a $1.29 billion battery plant for EVs in North Carolina.

Musk’s dismissal of the capital expenditure on charging infrastructure was due, in large part, to the CEO’s disagreement on the actual capital allocation – citing that the industry didn’t need support for charging stations. The bill also contained up to a $12,500 subsidy for US EV’s produced and manufactured by union labor with american-made components.

While Musk cast aspersions on the government’s plan – private and public capital is pouring into the space.

Just take Toyota as an example. The company has allocated billions of dollars to developing EV related technologies over the coming decade. Due to immense supply chain issues faced around the economy, the company is looking to bring some of the EV supply chain infrastructure stateside. This comes just shortly after the firm announced that it would be investing $13.6 billion in battery technology by 2030.

According to research done by Pitchbook as of late 2020, the aggregate value of publicly traded pureplay electric car companies was $492.3 billion compared to the $589.0 billion value of the traditional automotive market.

There are multiple factors which are driving the continued shift toward electric vehicles. Regulatory tailwinds, capital inflow, and rapid improvements in technology all play significant roles in recent growth. These factors have not only propelled pureplay electric vehicle companies to hit the public markets but also have caused legacy automakers to invest in pick-and-shovel infrastructure around the battery supply chain while also committing to zero carbon emission sales.

From states and cities to large corporations, the EV market is set to play a significant and immediate role in global decarbonization efforts.

Why does this matter?

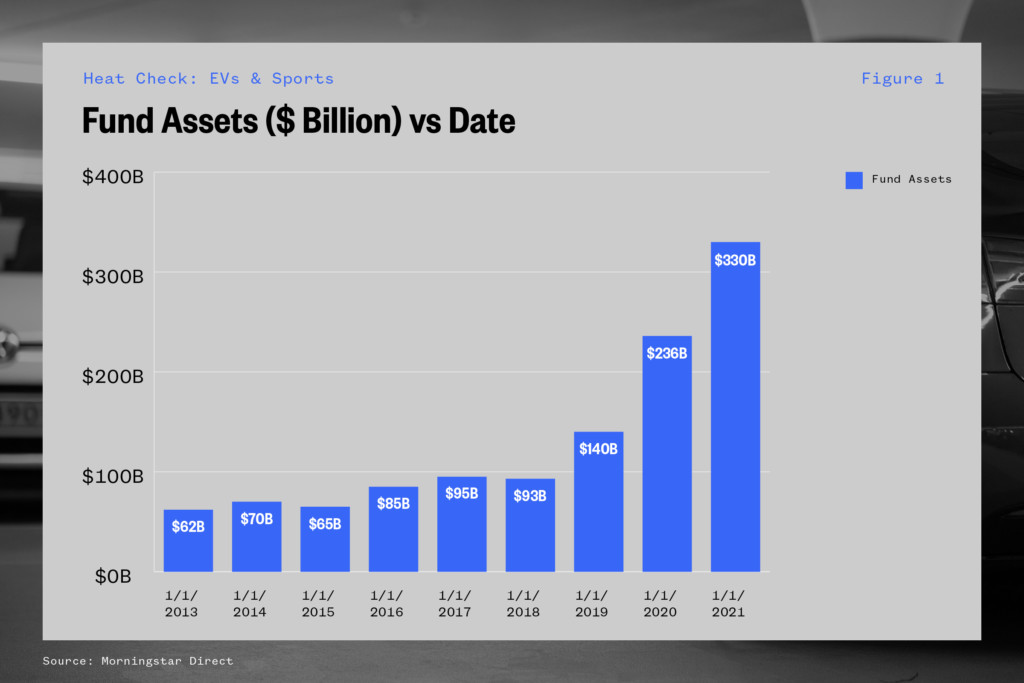

The ESG movement is real and it’s here. From year end 2020 through September 2021, U.S. sustainable fund assets grew nearly $100 billion to $330 billion according to research from Morningstar. Additionally, according to NAVEX Global, the Quoted Companies Alliance and FactSet, the amount of large scale public and private companies with ESG mandates is staggering.

- As of 2020 year end, 80% of publicly traded companies, 79% of venture and private equity backed companies, and 67% of privately-owned companies had ESG initiatives in place.

- More than three out of four (77%) of small and mid-cap companies have a formal mandate for ESG.

- More than one in four S&P 500 companies that conducted earnings calls for Q4 2020 cited “ESG targets”. This represents a 63% increase in ESG mentions from the previous quarter, and the highest number of ESG mentions in the last ten years.

While ESG has been broadly adopted, the sports industry still lags behind the broader market. There are currently some direct sponsorships with teams and arenas, demonstrating that action is being taken to increase ESG related activations.

- Seattle Kraken: Climate Pledge Arena (Amazon chose to name the arena Climate Pledge Arena, in honor of The Climate Pledge, a commitment co-founded by Amazon and Global Optimism in 2019).

- Denver Broncos and Colorado Avalanche: Ball.com Arena (recyclable aluminum).

- PAC-12: Unifi REPREVE partnership to show recycled jerseys.

- Atlanta Hawks: Partnership with Novelis and State Farm Arena to be the official sustainability partner.

- Milwaukee Bucks: SC Johnson partnership with Fiserv Arena to improve sustainability practices.

- Arsenal: First EPL team to sign the UN Sports for Climate Action Framework.

- Formula E: Only motorsport series to receive ISO 20121 certification (best practices for event planners related to sustainability).

Despite the fact that there are examples of teams and leagues moving towards more definitive ESG style mandates, there is massive room for growth.

In March of 2021, a paper published by the New Weather Institute highlighted various areas where sports sponsorship relies heavily on high-carbon polluters

“Today the world faces a climate emergency and sport is floating on a sea of high carbon sponsorship. In our sample survey we found over 250 prominent deals across multiple sports.”

-New Weather Institute

The report specifically highlighted the automotive industry which has an approximate $1.29 billion spend on sports with an estimated 64% of car companies’ sponsorship budget dedicated to sports specifically. Existing automotive companies in the sponsorship space skew towards internal combustion and not electric – this should change in the near future.

Supporting Research

As previously stated, funding for anything related to ESG has exploded in the last 18 months. According to data from Morningstar research, the total number of sustainable fund assets in the United States grew from $236 billion in December of 2020 to $330 billion in September of this year.

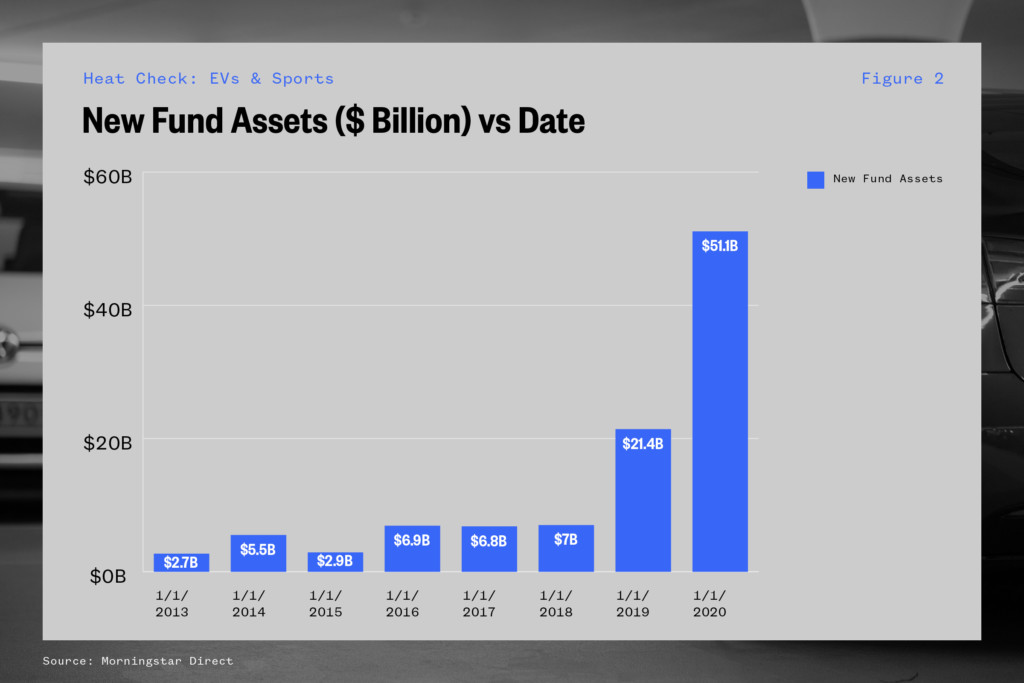

Overall fund sizes have been bolstered by significant recent investment in new sustainable assets. $51 billion of new assets flowed into ESG funds in 2020 compared to $21.4 billion in 2019.

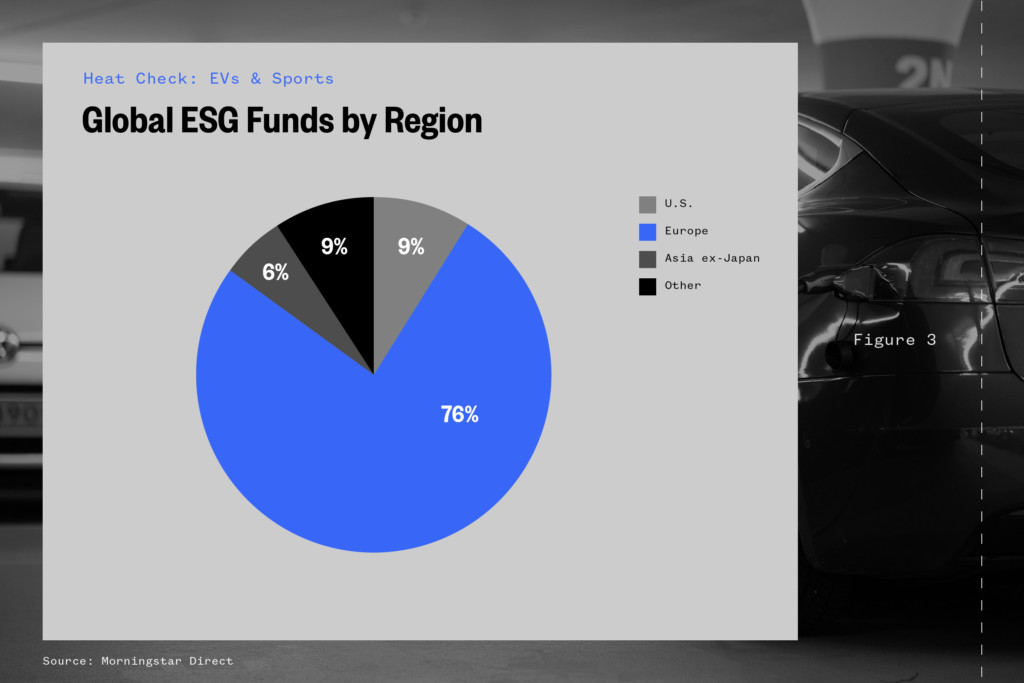

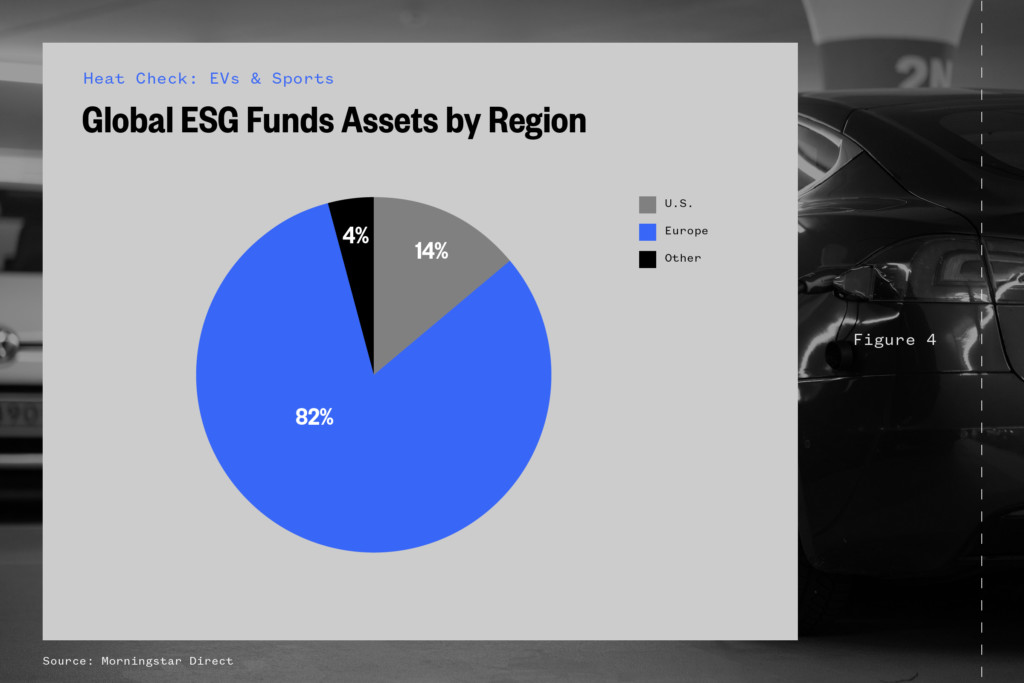

While the capital inflows are an indicator of increased adoption, the current distribution of total sustainable assets (i.e. EV companies) and funds themselves are still heavily skewed towards Europe. Over 80% of ESG fund assets and 76% of ESG funds are located in Europe.

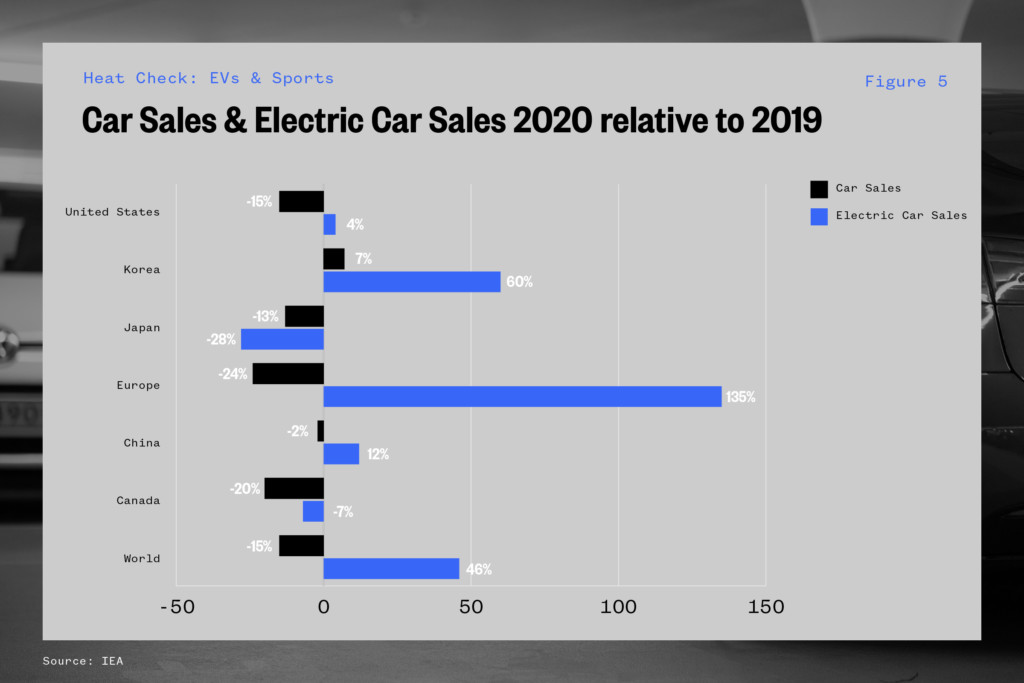

As it pertains to EVs specifically, the International Energy Agency posted results from their 2020 Electric Vehicle Report. While the entire manufacturing world was put on hold as supply chains and production lines were paralyzed by lockdown protocols, the EV market demonstrated surprising resiliency.

“The IEA preliminary estimate is that electric car sales worldwide climbed to over 3 million and reached a market share of over 4%, making 2020 a record-breaking year for electric mobility”

-IEA

According to the report, two main factors drove the increased adoption despite widespread economic issues.

- Policy support was strong – in particular in Europe as 2020 was an important target year for emissions standards. Purchase incentives increased, notably in Germany.

- Continued declines in battery costs, upgraded original equipment manufacturer offers, fleet operators initiating their technology transition, and the enthusiasm of electric car buyers provided a strong environment for continued EV uptake.

The U.S. saw a 4% increase in EV sales compared to a 15% decrease in regular automotive sales.

If the growth in sustainable investing domestically is any indicator, then these U.S. sales numbers should increasingly skew towards Europe, particularly as regulatory frameworks continue to shift towards decarbonization.

Case Study: Rivian

The existing model for large market cap car companies to enter into the sports sponsorship realm has been well established. There is a natural path for EVs to take on the mantle as large scale ESG sponsors for teams as they look to push more sustainability initiatives.

An example of a potential partner is newly public electric truck manufacturer Rivian. Rivian is one of the many EV startups to hit the public markets in the last 12 months. Unlike other EV companies, Rivian focuses almost entirely on light trucks – which so happens to be the best-selling vehicle in the United States. While the company is yet to generate any sales (while it sounds crazy there are already 55,400 pre-orders at the end of October prior to IPO), demand is high and market dynamics favor anyone willing to build in the space. Rivian fits this mold.

Interestingly, SUVs have done more to increase CO2 emissions in the past decade than planes, cargo ships, or heavy industry. The company has found tremendous product market fit and was able to raise $10.5 billion since 2019 from the likes of Amazon, Ford, Cox Automotive, T. Rowe Price, and D1 Capital.

Additionally, every one of the company’s trucks, SUVs, and vans will be manufactured in its 3.3 million square foot Normal, Illinois plant. The company is also rumored to be on the hunt for new manufacturing facilities in Texas which could increase output by 200k vehicles per year in 2024.

Additional Companies in the Space

| Company | Valuation / Market Cap | Link |

| NIO | $54.16B | Here |

| Nikola | $4.04B | Here |

| Lucid Motors | $73.86B | Here |

| Canoo | $2.31B | Here |

| Arrival | $5.01B | Here |

| Karma Automotive | $150.0M | Here |

| Fisker | $5.12B | Here |

| Lordstown Motors | $809.29M | Here |

ESG will play an important role not only for professional sports teams and leagues but corporations across the country. EVs, as a vertical, have a runway for growth particularly in U.S. domestic markets as regulatory and capital tailwinds push the industry forward.