SAN FRANCISCO — Another critical change in how Nielsen tabulates television viewership will be tested during Super Bowl LX, likely resulting in additional audience boosts for the NFL.

The measurement agency has finalized plans for a pilot program during NBC’s broadcast of the Feb. 8 game between the Seahawks and Patriots that will look to better assess group viewing patterns. Nielsen has distributed among its viewership panel smartwatch-type wearable devices that passively captures audio codes from TV broadcasts.

While Nielsen conducted some additional testing of the enhanced co-viewing technology during the NFL’s recent conference championship games, Super Bowl LX will mark the formal start of the pilot program. The game is set to at least challenge, if not surpass, last year’s average audience of 127.7 million for the Super Bowl that established a U.S. television audience record.

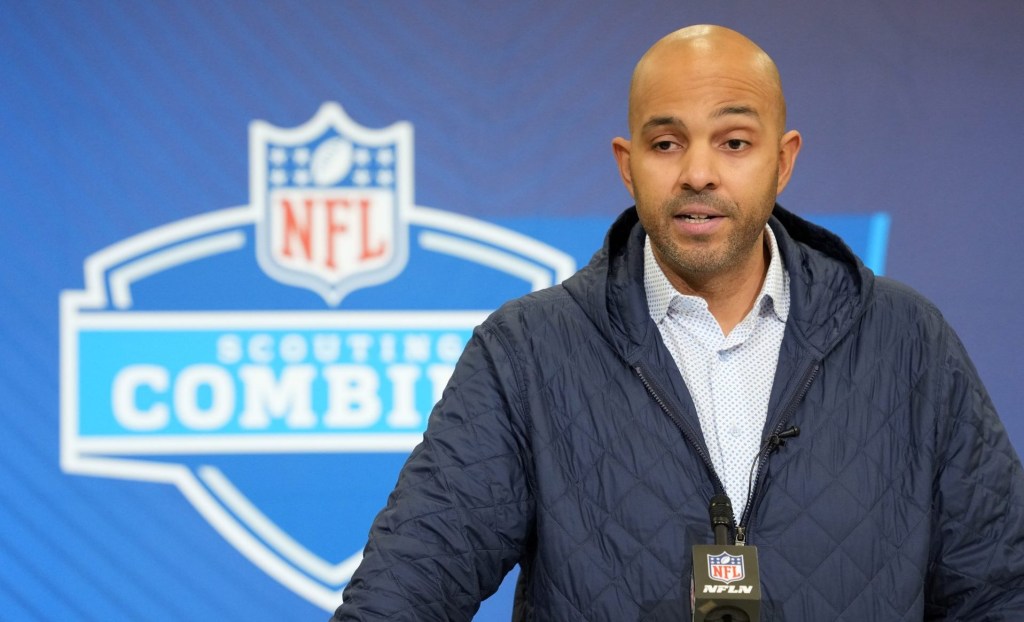

“Nielsen’s mission is to constantly push measurement forward, and deliver the most accurate data ever,” said Nielsen CEO Karthik Rao. “This co-viewing pilot builds on that mission.”

To Rao’s point, this is the third major advancement of Nielsen’s audience measurement in the last year, following an expansion of out-of-home tabulation right before Super Bowl LIX, and the September introduction of Big Data + Panel. That latter rollout has helped produce historic viewership figures across sports, particularly in college football and the NFL, as each of these developments is designed to better capture viewership activity that is already happening.

Making Progress

This latest development around co-viewing, however, specifically addresses what has long been a chief complaint of the NFL. For several years, the league has argued that Nielsen processes have not fully measured group viewing patterns that are fundamental to NFL fan culture.

As a result, the league has claimed that its actual viewership is greater than what’s being reported by Nielsen, still the industry leader in TV audience measurement. The economic implications of the perceived divide are massive, as lower ratings can result in downward shifts in advertising rates, and in turn the value of rights fees, in the billions of dollars.

In September, the NFL said that “there’s more work to be done” with Nielsen, in large part due to deficiencies it saw in how the agency handled co-viewing measurement.

With this pilot program, though, the league lauded Nielsen’s efforts to improve in this particular area.

“We’re optimistic about this, and believe we’re going to learn a lot from what they’re doing,” NFL chief data and analytics officer Paul Ballew tells Front Office Sports. “I have to give Nielsen credit. We’ve pushed them really hard about this. It’s been an issue for us for some time now, and has been frustrating. But they’ve listened and come up with ideas to address the issue.”

Not Yet the Standard

It’s important to note, though, the enhanced co-viewing measurement is not yet part of official Nielsen viewership figures, and is not considered “currency” in the market. In this initial testing phase, it will also take about a week after a game for this part of the data to be tabulated—much longer than the lag times of about two days since the arrival of Big Data + Panel.

Getting to a point where this data is part of official viewership figures will require additional testing by Nielsen, and then external accreditation. That’s something the NFL hopes will happen in time for the start of the 2026 regular season in September. Nielsen has similar aspirations on the timing to build out the co-viewing measurement.

Beyond the promise of greater accuracy, an expansion of co-viewing measurement is considered a simpler addition to the overall process compared to Big Data + Panel, and technically, is more akin to the prior expansion of out-of-home measurement.

“This is definitely more straightforward compared to going to Big Data,” Ballew said.

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)