Another potential mega-merger is poised to change the landscape of sports media, and likely in ways not yet fully understood.

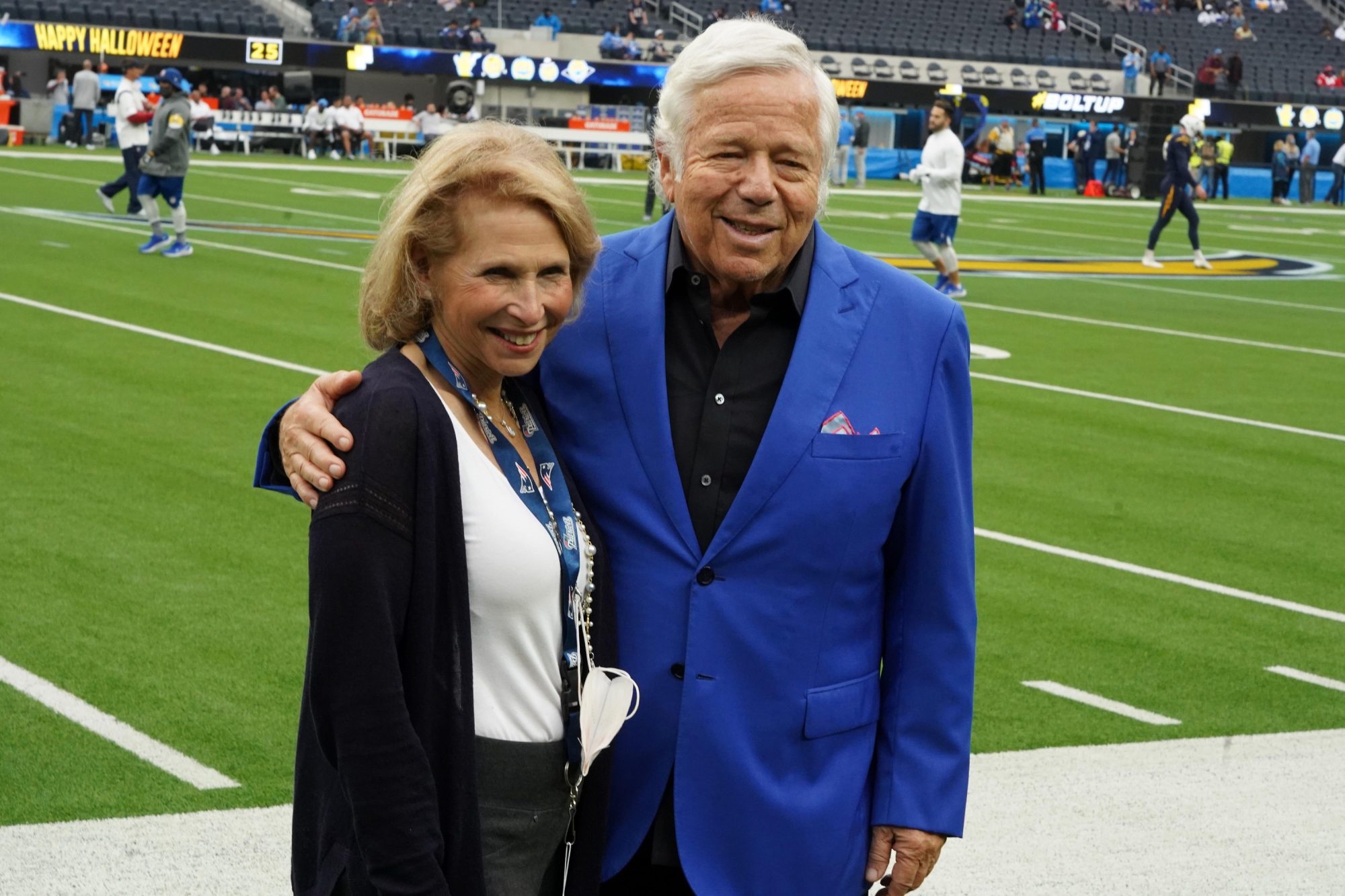

David Ellison, the CEO of Skydance Media and son of billionaire tech mogul Larry Ellison, is making a push to acquire National Amusements, the Shari Redstone (above, left) family company that controls CBS parent Paramount Global. In a complex two-stage transaction now under discussion, Redstone would receive more than $2 billion in cash, and then Paramount Global would acquire Skydance in an all-stock deal worth about $5 billion, with David Ellison likely leading the new entity.

Nothing is final yet, but the two sides have agreed to a month of exclusive talks, signaling that a definitive pact could be struck. The developing situation arrives about five weeks after Paramount Global ended early-stage merger talks with TNT Sports parent Warner Bros. Discovery.

Since the death of Redstone’s late father, Sumner, in 2020, Paramount Global stock is down by nearly two-thirds, putting her under increasing pressure to boost shareholder value, and S&P Global Ratings last month cut its rating of the company’s debt to junk status.

If Ellison is able to complete a deal, it would bring under one corporate umbrella a media company that has rights to the NFL, half of the men’s March Madness, several top college conferences, and golf’s Masters, among other assets, along with a fast-growing documentary unit behind such projects as the highly popular Kelce on Amazon Prime Video. The NFL is also an investor in Skydance Media.

Skydance is reportedly set to get financial help on the Paramount Global deal from Larry Ellison, RedBird Capital Partners, and KKR, and if completed could also see Jeff Shell, the former NBCUniversal CEO and current RedBird chairman of sports and media, assume a senior leadership role in the combined operation.

Immediate Pushback

There is other interest in Paramount Global, including from the private equity firm Apollo Global Management, but for now the board is favoring the Skydance possibility. Matrix Asset Advisors, a large owner of Paramount Global stock, wrote the company board Monday, however, arguing that the proposed Ellison deal benefits Redstone at the expense of other investors, and suggested that shareholder lawsuits could be forthcoming.

“This deal focuses on Shari Redstone’s shareholding for cash at a significant premium,” Matrix Asset Advisors wrote. “The vast majority of shareholders would not receive a similar premium and would be forced to finance a speculative investment in Skydance in a transaction significantly dilutive to shareholder value.”

Investors also do not appear enthused, dropping Paramount Global stock 7.6% Monday to $11.06 per share.

Editors’ note: RedBird IMI is an investor in Front Office Sports.