Sports betting companies put down $1.2 billion on acquiring new U.S. customers this year.

With more states and leagues expanding sports betting capabilities, that figure is expected to reach $2.1 billion in 2022.

Thirty states have legalized sports betting in some capacity (10 only allow in-person betting). New York is expected to launch mobile sports betting in January.

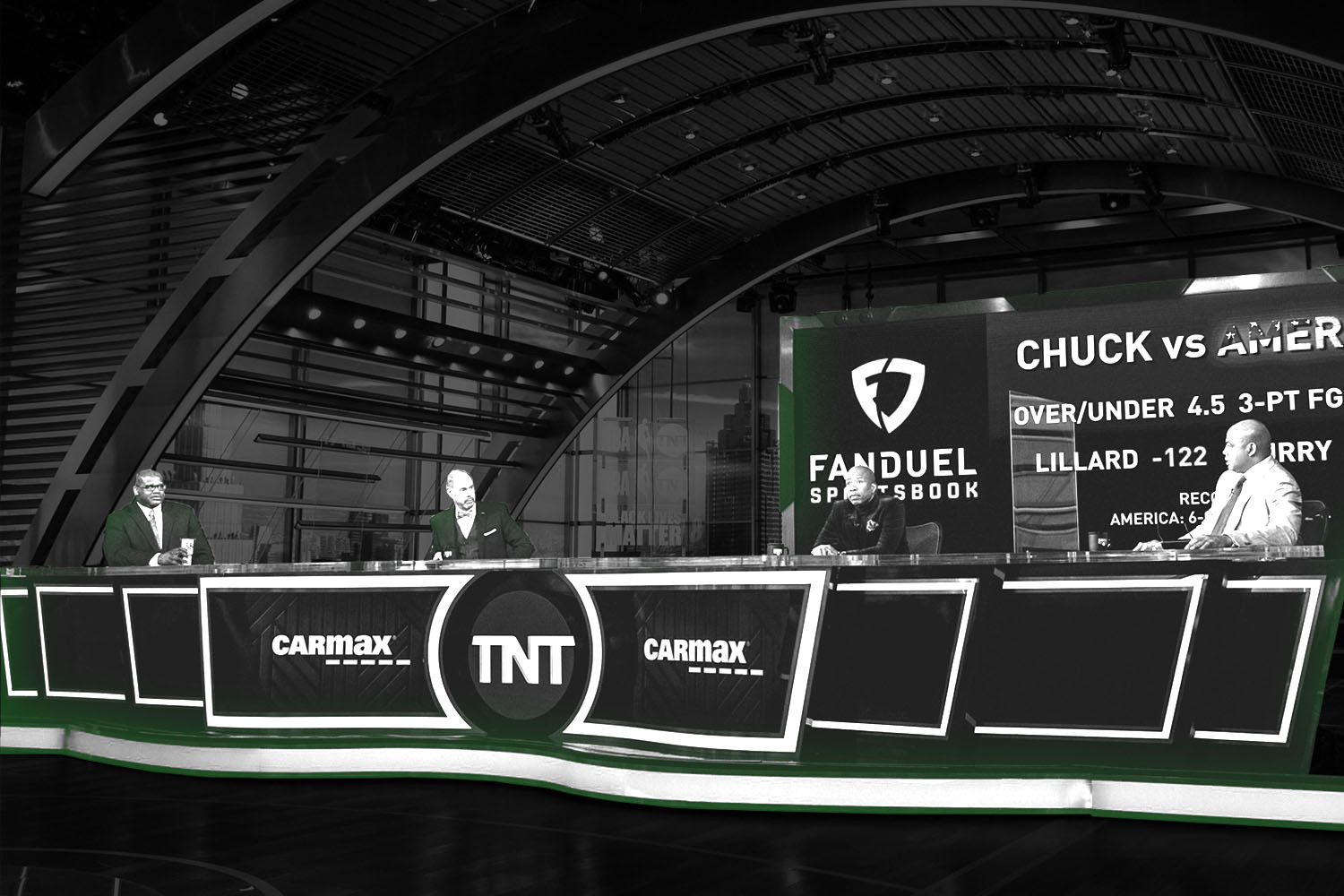

The NFL began allowing up to six sports betting commercials per game this season. Turner Sports, which broadcasts the NBA, NHL, NCAA, and MLB, expects to make more than $400 million off of sports betting commercials from DraftKings and FanDuel-owner Flutter Entertainment over the next three years.

- DraftKings more than doubled its sales and marketing spending in the first nine months of 2021 to $703 million, led by $303.7 million spent in the third quarter.

- FanDuel had spent over $1 billion on marketing as of June 30, and said it is the landing spot for 40% of new sports betting customers.

- Flutter noted in its earnings report that it sees an average one-year return of 1.2 times the cost of customer acquisition.

Media Deals Coming?

Companies could follow the lead of Penn National Gaming in buying into media companies to lower advertising costs. Penn bought 36% of Barstool Sports in January 2020 at a $450 million valuation.

DraftKings considered bidding for The Athletic, which is receiving renewed interest from the New York Times, Front Office Sports reported earlier this month.