PHILADELPHIA — Julius Randle had a question for Joel Embiid. And he wasn’t interested in waiting for a stoppage in play.

“When are you going to get the deal done?” Randle asked Embiid while both were on the court.

The Sixers were hosting the Knicks in early January, and the 6-foot-8 forward had the inside scoop on Embiid’s sneaker free agency.

At the time, Randle, a three-time All-Star, was one of just two players signed to Skechers, which was three months into its first season in the basketball shoe space. Clippers guard Terance Mann had signed alongside Randle in October 2023 to help bring the brand to the NBA.

Randle and Embiid have known each other since high school and were drafted four picks apart in 2014. Embiid quickly indicated to Randle he hadn’t signed yet. “Hurry up,” Randle said.

Three months after their game, Embiid signed with Skechers, leaving Under Armour after five years. In June, Skechers added Los Angeles Sparks rookie Rickea Jackson with an assist from Mann, who is a family friend, making her the company’s first WNBA athlete.

More are on the way as Skechers enters its second NBA season and seeks legitimacy in hoops.

In a year when Nike and Under Armour are sliding and Adidas is emerging from its own prolonged swoon, Skechers is doing the opposite, broadening its reach while the industry’s giants are feeling it in their books. In July, Skechers posted a record $2.19 billion in second-quarter revenue. Nike recently announced revenues were down 10% year over year.

Skechers is far from the first shoe company to make inroads on the Nike-Adidas basketball monopoly. Puma reentered the space during the 2018 NBA draft, while others such as Anta and New Balance have carved out their own impressive rosters throughout the past 10 years. But despite the industry’s history, market analysts are bullish on the company’s ability to find success.

“I think they have a lot of early wins here, which tells me that the strategy is probably working out,” Matt Powell, a retail and apparel end markets senior advisor with BCE Consulting, tells Front Office Sports. “I think that the fact that the other brands are struggling has also opened up a lane for them.”

Skechers may be a somewhat surprising basketball newcomer, but it is a bona fide sneaker force. It was founded in 1992 and has grown into the country’s third-largest footwear brand in revenue thanks to its success in the running and family markets. While retail shops have broadly struggled in recent years, the company is having success there, too.

Skechers formally entered the performance space in 2011 by signing marathon runner Meb Keflezighi, but has expanded to other sports since then, adding stars such as Dodgers pitcher Clayton Kershaw and Bayern Munich’s Harry Kane.

“I don’t know that you could have done it earlier,” says Skechers COO David Weinberg. “I think why it’s a good time for us is we now have the strength and size from a balance sheet, size and scale perspective to compete and not have to worry about the next day’s sales.”

“This is the final frontier,” adds Greg Smith, Skechers VP of product development and merchandising. “It’s the one piece that has been missing from [the] Skechers portfolio.”

Convincing four players to become Skechers’s first basketball ambassadors didn’t come without hurdles.

“Growing up, it wasn’t the cool thing to wear,” Randle says. “I grew up idolizing Kobe, Jordan, so that was what all the kids wore. That was the popular thing to wear. If you wore Skechers, you were probably getting made fun of.”

Jackson says she thought of light-up kids shoes when first approached by the brand.

Mann had to do some lobbying to get his friends on board. “They all hated it,” he tells FOS.

Embiid couldn’t relate to his fellow endorsers. Growing up in Cameroon before coming to the United States for high school, he didn’t have preconceived notions about Skechers. Given his 7-foot frame, he didn’t care what teammates thought, either. “Everybody’s scared of me,” he joked. “So they didn’t say anything.”

Randle says the stigma didn’t factor into his decision, but he needed to process the idea after Skechers first contacted him.

In a lot of ways, Randle is a poster child for sneaker giants such as Nike. One of the nation’s top recruits coming out of high school, he played AAU for Nike’s EYBL, signed with Kentucky—a Nike-sponsored college—and inked a deal with the company when he turned pro. However, Randle points out most stars change shoe companies as frequently as they change teams these days, such as Stephen Curry going from Nike to Under Armour.

Randle was recovering from ankle surgery when Skechers first pitched him, and he used the free time to thoroughly research the company and see what they had to offer, even though there were no basketball products at the time. He liked enough of what he saw on the Skechers website to take a meeting.

“I wore Nikes my whole life, and I never really knew anything else,” Randle says. “It sounded off the wall a little bit that Skechers was getting into basketball. But for me, brand loyalty is not the same as it used to be when I was a kid. So, it’s not all about wearing Nikes and Jordans. I was obviously open to doing something different.”

Despite the lack of any basketball footprint, the brand had plenty to sell. Smith said Skechers sought players looking to help grow a brand and think differently. They didn’t just pick anyone. They would be the first basketball signees in company history.

Given the players’ injury histories, Skechers’s reputation with comfort resonated, too.

A small roster meant the company could treat its basketball quartet with more care than they’d received at other companies.

“In my time with other brands, to the day that the contract ended, shoes were never figured out,” Embiid said. “Never got to a point where I was comfortable playing in the shoes. It was never fixed. That’s one of the things I like about Skechers, because they’ve been talking to me every day. I’m a little different when it comes to the way I like to move and the way the shoe has to be built with the way I play.”

Regardless of any Skechers stereotypes, Randle’s deal has made him arguably the most visible athlete in New York, even after his trade to the Timberwolves. His billboard is still in just about every subway station—as are the company’s ads with Snoop Dogg, another spokesman. Randle and Mann are also featured in Skechers stores globally and were surprised to see their faces in the company’s Chengdu, China, location on a recent promotional tour in Asia.

Weinberg says Skechers is trying to utilize that global reach with its basketball players. “We promised Julius we’d make him even more known than he is. We did the same thing with Harry Kane. Harry complained that no one was using him with his career as it was. While he was very loyal, he didn’t get used much. That’s what happens when you have 300 athletes that you got to take care of.”

Embiid said multiple players at the Paris Olympics asked him for a pair of signed shoes after complimenting them. Mann’s teammates have asked to try on his shoes in the locker room after games and practices. WNBA players have quizzed Jackson about her deal.

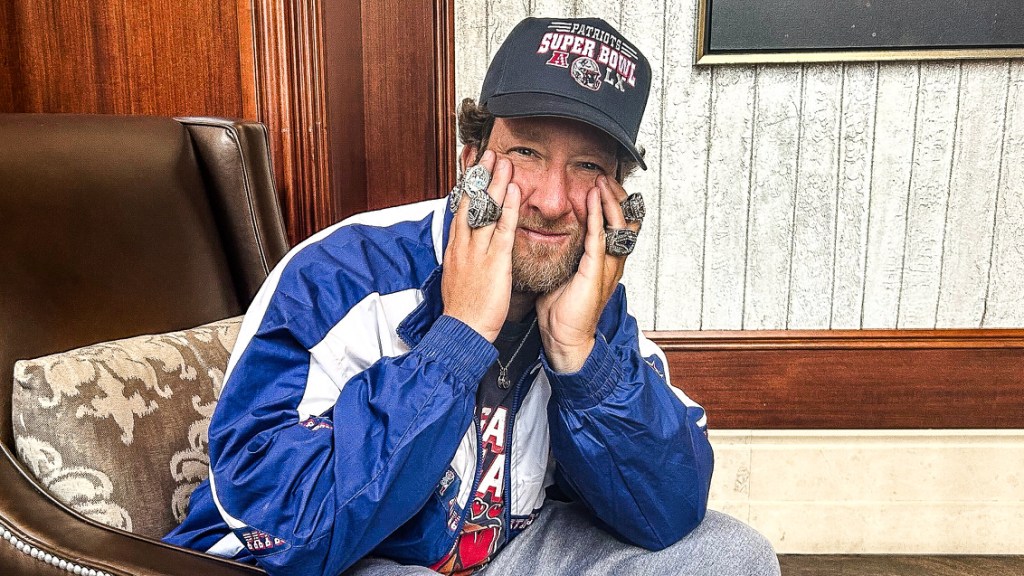

In late September, Embiid sat in a locker room at Bobby Morgan Arena on the campus of Saint Joseph’s University with a barber cape draped around him and a stylist grooming his hair and beard for a Skechers photo shoot.

As the biggest name currently associated with the company’s basketball division, Embiid is aware of the role he will play in the brand’s success, or lack thereof. He’s also very conscious of where Skechers currently sits in the industry’s pecking order.

“I always liked the idea of underdogs,” Embiid said. “Obviously you got the guys who have been in the industry for a long time, and you also got Skechers trying to get started. New ideas, new ways of thinking that really impressed me when thinking about it and talking to them.”

Nobody is expecting Skechers to become the new Swoosh. Nike and Adidas dominate the sneaker and apparel business with roughly a 16% and 9% global market share, respectively, according to Euromonitor. Skechers has a 2.4% market share.

“I think success for Skechers could be different than success for another brand,” says Beth Goldstein, sneaker industry analyst at Circana. “They don’t have to be the biggest in every category. But there is definitely a customer there who is looking to participate in the category but would be attracted to the more moderate price points.”

Both Nike and Adidas have also created grassroots pipelines for future endorsers, but it doesn’t appear the company will go down that road. AAU helps get products on young consumers’ feet, but the company already has a niche carved out in the family space that Nike and Adidas don’t.

Embiid, similar to Randle, played AAU for Adidas before signing with Kansas, a trademark Adidas school. Embiid seemed to echo the thoughts of Adam Petrick, Puma’s former global director of brand marketing, when he said the company “has to be willing to spend,” which will help attract players.

The company is known for its affordability and is in stores such as Shoe Carnival, Kohl’s, and DSW more than its competitors. Skechers’s problem hasn’t been kids not wearing their shoes, but rather losing them to other brands when they get older.

“We want to leverage all that brand recognition we already have with the young consumer all the way through their sports careers,” Smith says.

If Skechers could marry its family sector with the performance shoes, it could be a game-changer. Nike and Adidas have struggled partially due to consumers looking for more price-friendly shoes instead of the $100-plus offerings both brands are known for. (Skechers’s basketball sneakers are all $100 or less.) In 2006, Stephon Marbury successfully launched Starbury, which retailed for $15 but were made like Jordans. The problem was the retailer he partnered with, Steve & Barry’s University Sportswear, filed for bankruptcy a few years later. Skechers is too financially strong to do that.

“Skechers already has a huge allegiance on the part of the consumer,” Powell says. “What if there was a lower-priced Harry Kane soccer boot for $49.99 at Famous Footwear? How many of those could they sell to little kids starting out playing soccer? That could change the whole business right there.”

In the era of direct-to-consumer vs. retail, Skechers has had strong success with its own stores. Earlier this year, the company said retail sales were up nearly 10% year over year to roughly $1.4 billion. Now the challenge is getting customers to recognize Skechers’s retail stores as a destination for basketball shoes, the way Foot Locker is. Weinberg acknowledged the stigma and didn’t oppose going into those stores, but countered Foot Locker’s reach is limited to domestic, whereas Skechers has stores globally.

“Those consumers will tell us where they want to shop,” Weinberg says.

Air Jordan’s ability to go from a basketball shoe to a lifestyle line is why the company is a billion-dollar money-maker for Nike and not just another category. Skechers is taking the reverse route.

Carving out a sector of the market takes time. Perhaps its biggest asset is what Weinberg says: Skechers has the infrastructure to build it without constantly worrying about the numbers.

“Puma tried to do basketball a couple times while I was there,” Petrick says. “And they never had the patience until this last time to stick it out. We also never had the executive oversight and handling to allow us to take the time to get it right. If they can stick with it, if the execs over at Skechers say we’re not doing this for the short term, this is a long-term play, they will win.”

The players said the onus is on them to make the brand more mainstream. Mann said five years is a good window to see where the brand will be by then. Jackson, who was named to the WNBA’s All-Rookie Team, said her play can propel the process.

“The better I play, the better I perform, the more I get myself out there, the quicker it will come,” Jackson says. “I feel like five years is a good cushion, but I’m trying to do that before five years. And I feel like we’re going to do that.”

Randle, who has seen all aspects of the sneaker world dating back to his youth, agrees. The player who knew nothing but Nike throughout his career and signed with a brand you’d get “made fun of” for said his decision to do so shows how a consumer’s mind can change over time, and that’s why Skechers can be successful.

“The player wears the shoe, and that’s what’s going to change the perception,” Randle says. “It’s all about who you put in the shoe.”

In September, Randle was in Manhattan’s Lower East Side when a fan approached him. To his surprise, they wanted to talk about his shoes.

“Man you’re killing it,” the fan told Randle. “You’re doing the Skechers thing. That’s so outlandish, but it’s so dope.”