A Skechers shareholder is challenging the footwear giant’s blockbuster $9.4 billion sale to private-equity firm 3G Capital in California federal court over allegations the company skirted securities laws.

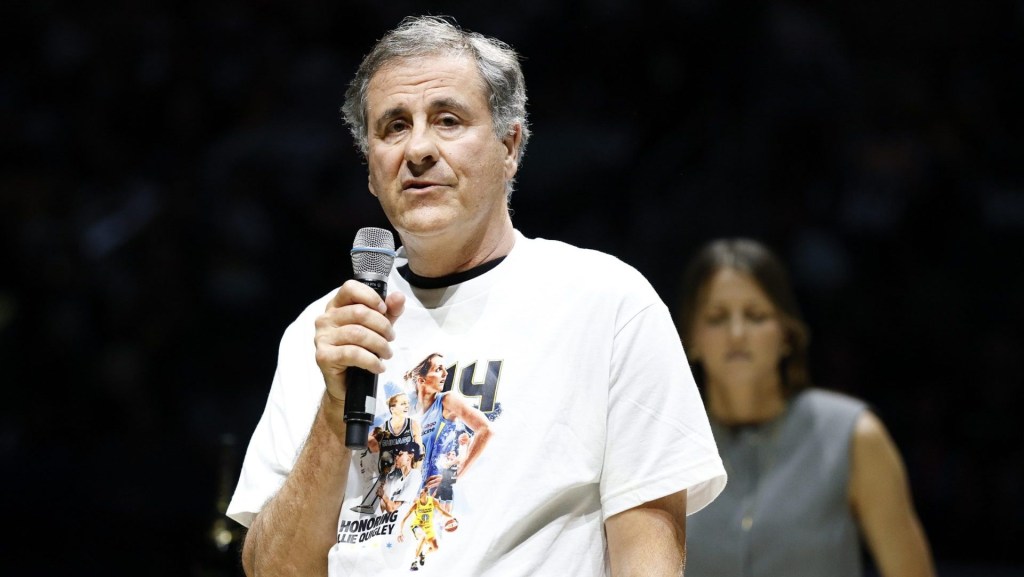

The suit from Key West Police Officers & Firefighters Retirement Plan names as defendants Skechers USA Inc. and the company’s two cofounders—chairman and CEO Robert Greenberg and his son, Michael Greenberg, who is president of Skechers. The duo cofounded Skechers in 1992. The private-equity firm that bought Skechers was not named as a defendant.

The suit claims the transaction was suspicious, saying it “raises red flags, with at least one analyst calling the deal ‘very surprising’ because the Company has ‘always been viewed as a family business that wasn’t for sale.’”

The suit says “it appears that the Greenbergs controlled the sales process to a single bidder and deprived the minority stockholders of any legitimate bidding process.”

The deal—which marked the largest footwear M&A deal ever—was indeed surprising. There were no rumors of talks with potential buyers, and the company gave little to no public indication it was on the market. Less than two weeks before it was announced, Skechers reported first-quarter sales of $2.41 billion, up 7% from last year—although it acknowledged a 16% sales drop in China—and became the latest company to pull its full-year guidance due to uncertainty over tariff policies.

Retail analyst Jane Hali told Front Office Sports at the time that “Skechers was in a pretty good position, with most of their business being international.”

Specifically, the lawsuit alleges the company and its cofounders violated federal securities laws by failing to make certain disclosures through a form called a Schedule 13E-3, which is supposed to be filed with the U.S. Securities and Exchange Commission in connection with a go-private transaction. Such forms are meant to provide shareholders with all material information they need to decide how to vote on a transaction. Schedule 13E-3 forms typically include a general overview of the terms of a deal, rationale behind the agreement, and more.

Under the terms of the deal as announced May 5, shareholders can elect to either receive $63 per share in cash or $57 per share in cash and one unlisted, non-transferable equity unit in a newly formed, privately held company that will be the parent of Skechers once the transaction has been completed.

The suit states that “immediate action must be taken to prevent Plaintiff from being forced to make the Consideration Election without full and accurate information concerning the Merger, the Company, and its financial condition and prospects.”

The Greenberg family collectively holds about 60% of the company’s outstanding stockholder voting power, the suit says, which gives them the ability to green-light the deal, even if it’s not in the best interests of the company’s remaining shareholders.

The lawsuit is seeking a declaration that the deal is indeed a “Rule 13e-3 transaction,” requiring that disclosure. It also asks the court to delay the deadline for shareholders to vote on the transaction until that filing is made and shared with stockholders.

A representative for Skechers declined to comment, and a representative for the plaintiffs did not immediately respond to a request for comment.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)