A major online retailer is in talks to go public in a massive SPAC deal.

Signa Sports, a Berlin-based company that recently made inroads into the U.S., is in talks with Yucaipa Acquisition Corp., a SPAC led by Pittsburgh Penguins co-owner Ron Burkle, on a deal that would value Signa at $4 billion, according to Bloomberg.

Signa could acquire U.K.-based competitor Wiggle Ltd. as part of the deal.

The SPAC, an offshoot of Burkle’s private equity firm Yucaipa Companies, raised $345 million in an IPO in August.

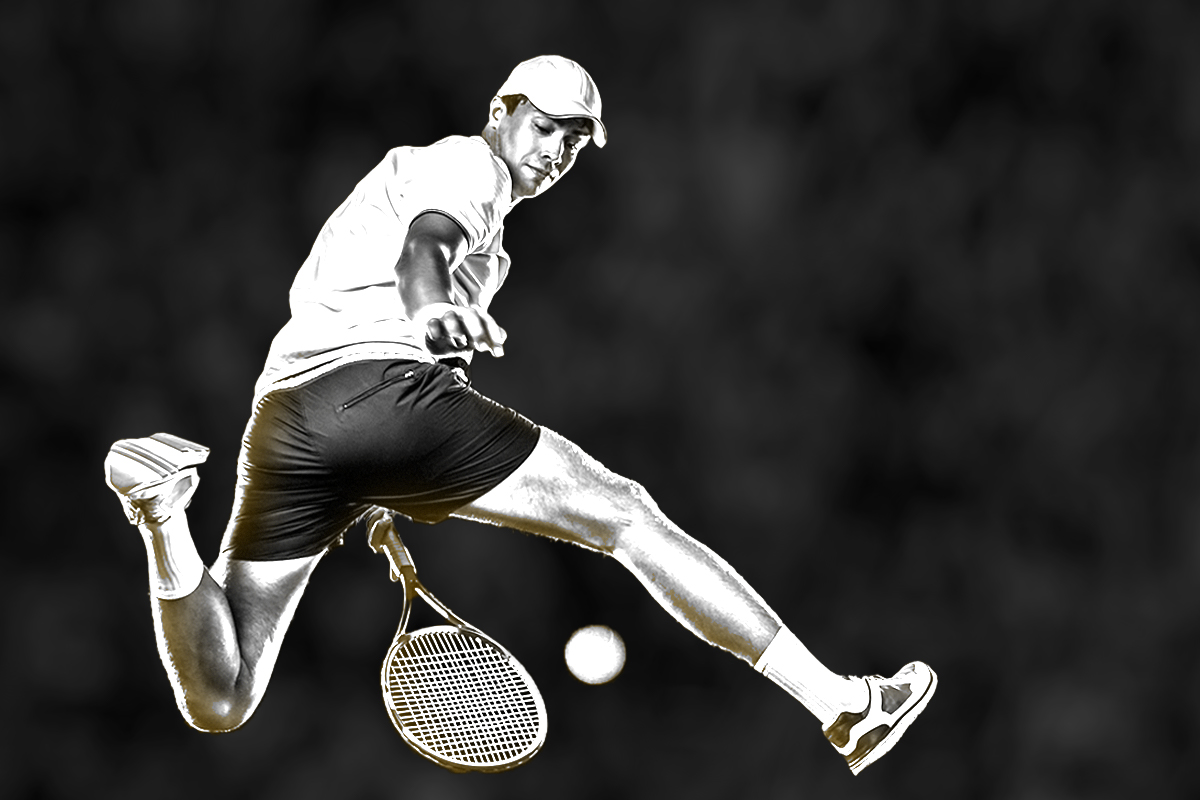

- Signa sells tennis, cycling, hiking, and other sporting goods across more than 80 online stores.

- The company entered the U.S. market with its February acquisition of Ohio-based tennis equipment online retailer Midwest Sports.

- Signa grew 30% on average annually over the last three years, and had over $1 billion in gross merchandise volume in its 2020 fiscal year.

Burkle made waves of a different sort in the sports world a week ago when he got cold feet on supporting Sacramento Republic FC’s promotion to Major League Soccer. The club was counting on Burkle’s assistance to help with the league’s $200 million entrance fee, and possibly a new stadium.

Signa is in talks with other SPACs, as well, and seems intent on going public whether or not the Yucaipa deal goes through.