Sponsorships are a key part of revenue for teams and events. (Photo via Roaring Fork)

The role that sponsorship plays today for brands still largely remains the same — brand equity, personality, and marketing to a niche audience. And marketing to a niche audience makes a ton of sense! As I outlined in this piece, a niche strategy can reap massive rewards. What’s changed is the ways in which brands have been accomplishing these goals.

Given that sponsorship valuation is still a murky field (how do you place a dollar value on one eyeball?), much of the decision is still reliant on gut instinct, or some degree of subjectivity. There is no such thing as price transparency in sponsorship. This leads to, among other things, an inefficient market.

Now — to be clear, we’re only talking about the upper echelon of properties. The vast majority of properties are still fighting to win sponsorships. Particularly for events, profit margins can be slim, meaning that an extra dollar can provide disproportional value.

Digital Activations

For larger events properties, and most properties as a whole, there exists a wealth of options that simply was not available a decade ago. For one, with the rise of digital, properties can now sell assets that are infinitely scalable.

Since marginal costs for digital activations are relatively low, compared to traditional activations such as halftime shows (time is linear, meaning that you’d need to carve out more time for more activations) or signage (there’s a limited amount of real estate), properties can offer the ability to scale as far as the number of engaged people, at a very low cost.

Thick vs. Thin Markets

Where in the past, we’ve seen sponsorship act in a more transactional manner — with it acting as funding or investment, we are now seeing sponsorship act more as a strategic merger.

There are a couple reasons for this. While many in the industry chalk it up to brands finally becoming aware of the benefits of sponsorship, much of this is natural as well. In free and competitive markets, prices will be set by consumers — where the equilibrium price will be determined by supply and demand.

Given niche focuses, sponsorship ends up looking a lot like a thin market: with few buyers and few sellers. A relatively small number of brands will be willing to sponsor a specific asset, and conversely, a small number of properties will suit the needs and objectives of a brand.

[mc4wp_form id=”8260″]

Thin markets are suboptimal because they will result in less liquidity and more volatile prices. In the sponsorship industry, we tend to focus on the latter.

That said, we have seen a recent thickening of the market — meaning, among other things, a rise in demands from the property side.

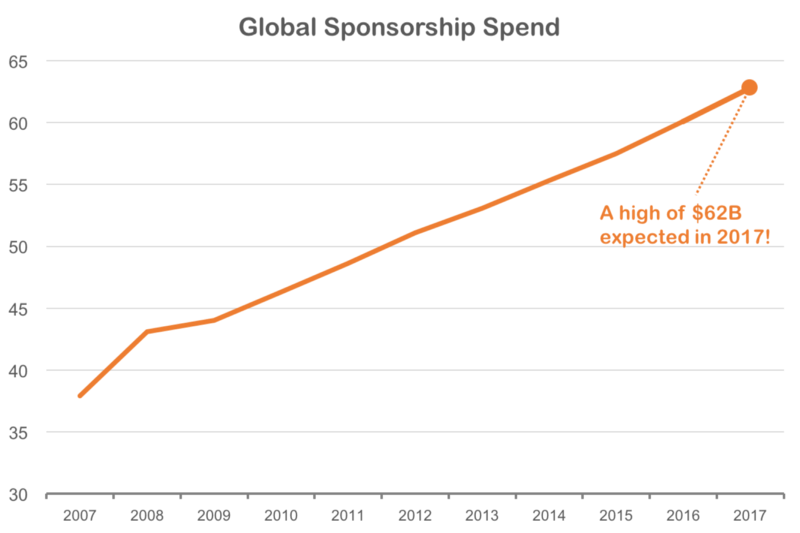

Globally, we have been seeing consistent upticks in sponsorship spend, with it reaching a projected $62.8B (as per IEG).

The Value of “Other” Benefits

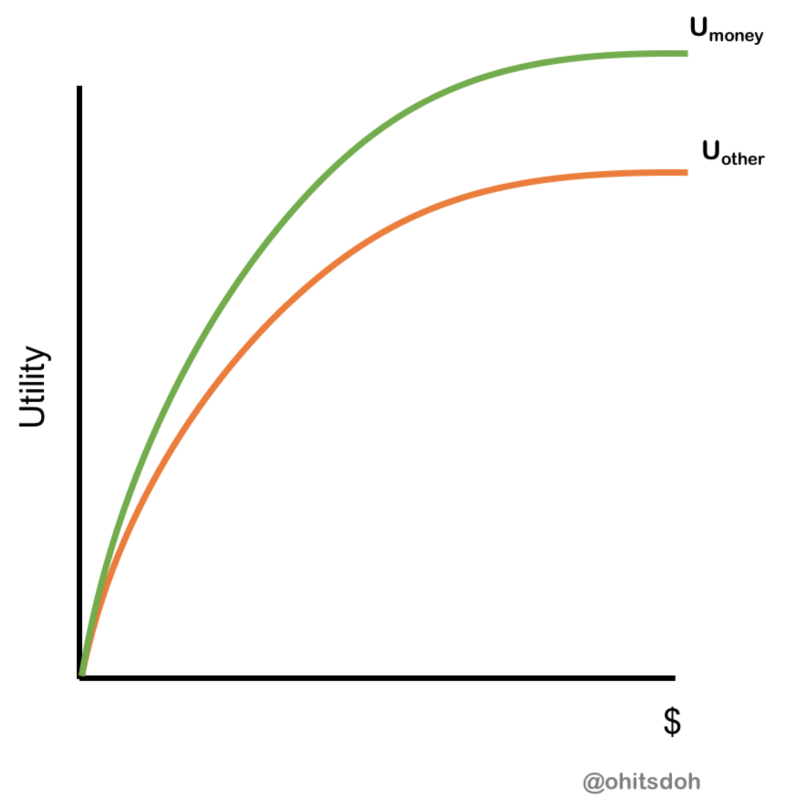

The benefits provided to properties are more than purely monetary. A great example of this is something that I’ve written about before — where colleges are willing to forego money to take a Nike endorsement. While this may seem irrational at first glance, consider the following Econ 101 example:

Where we assume diminishing marginal returns for both money and “other” forms of compensation. Umoney is the utility curve for money, and Uother is the utility curve for “other” forms of benefits (i.e.: brand prestige, activations, etc.).

We need to treat the collection of benefits that properties receive from sponsors as a bundle — where the individual pieces experience diminishing marginal returns. $200 sure looks like a lot more than $100, but $1,100 doesn’t seem like a huge downgrade from $1,200. When really, the difference in absolute dollar value is identical.

The conclusion from all this is simple — when properties are receiving more relative dollars from sponsors, the value of it diminishes. This means that brands, to win competitive sponsorships, may now need to provide greater “other” benefits such that the entire package is more appealing than competitive offers.

[mc4wp_form id=”8260″]

And we’ve seen this happen in practice this summer: when McDonald’s ended their 41-year sponsorship of the Olympics, the IOC promptly signed Intel to a 7-year deal in an effort to reach younger viewers. Intel provides clear benefits to the IOC — via brand equity and uniquely-Intel activations. The point of comparison here should not be between Intel and McDonald’s (who pulled out for financial reasons), but between Intel and other prospective TOP sponsors.

Another fact that I would be remiss to mention is that a strong activation will reap benefits for both sides — both property and brand. Greater engagement for an already niche audience should lead to greater expected revenues.

Unless there is a massive upheaval, it’s likely that we won’t see significant changes in this industry. While rate of growth in sponsorship spend has traditionally outpaced the rate of growth in events, that gap has been closing over the past several years. The number of events organizations in 2016 grew at a rate of 3%, while sponsorship has been growing at a consistent rate of 4%.

Given the nature of the sponsorship industry, it would be interesting to see a two-sided market emerge — similar to Uber. The sponsorship market would be well-suited for this, and it would significantly help improve market inefficiencies.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)