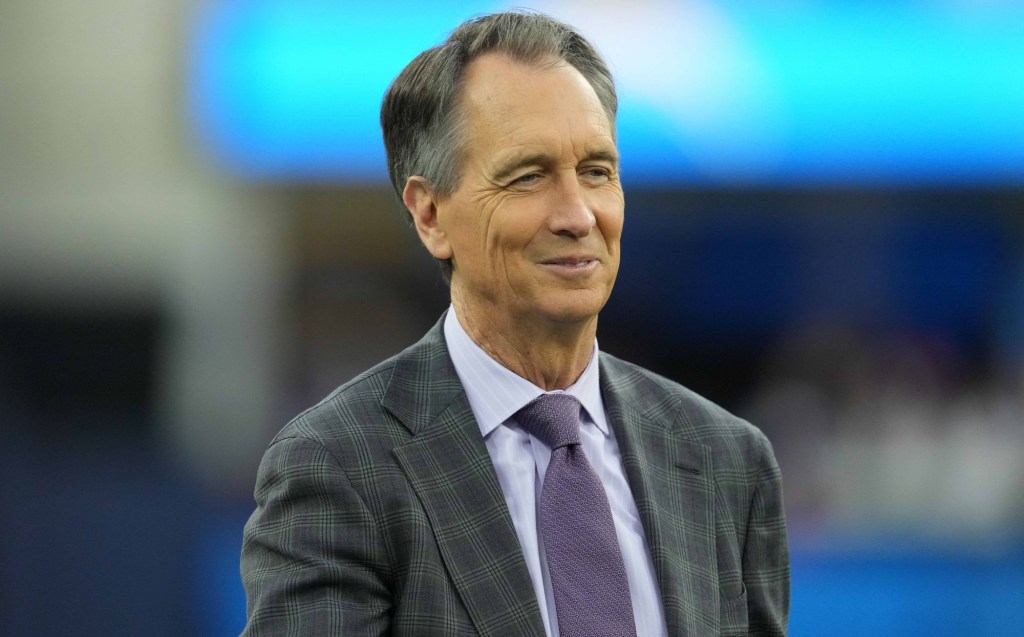

On the surface, Pro Football Focus has it good. The Cincinnati-based football analytics company, under celebrity owner Cris Collinsworth, counts every NFL team as a customer. It charges each of them $150,000 annually for its services, including its golden ticket: a proprietary, labor-intensive player-grading system.

More than 150 college and minor league teams are PFF clients, bringing in millions more in annual revenue.

Riding high from its ubiquitous grading system and respect for its products inside the football industry, PFF sold a $50 million stake to private equity titan Silver Lake in 2021. The deal valued Collinsworth’s company at $160 million, and the broadcaster tapped George Chahrouri to build out a consumer product to match its vaunted business-to-business, well, business.

Instead, Chahrouri’s two-year tenure was a complete disaster. The years since 2022 have seen an exodus of talent, and the private equity war chest is nearly spent with little but a new iPhone app to show for it. Chahrouri was quietly fired earlier this year, a move that seemingly came out of the blue but one that was a relief to many of those who worked under him.

“It was long overdue,” one former PFF staffer told Front Office Sports on condition of anonymity.

The loss of top-level talent under Chahrouri is only one threat to the football giant’s current chokehold on the player evaluation business. Outside PFF’s walls, automated player tracking and machine learning are creating cheaper alternatives, or even opening the door to teams developing better systems in-house. (Think of how rapid advances in video cameras and ball-tracking technology led to a new era of baseball analysis.)

“Some [NFL] teams are already looking for an alternative,” one source told FOS. “PFF doesn’t seem to realize that there are competitors out there. At first blush, PFF seems to be in a good position. As the incumbent company, they have good relationships with teams and are responsive to their needs. But PFF has lost so much talent that they may not be able to outcompete.”

‘It’s still unique’

The NFL’s Next Gen Stats, available to teams and the league’s broadcast partners, lack the granular grading data provided by PFF—for now. But every NFL player has two sensors embedded in their shoulder pads tracking their movements, and there are sensors in the balls as well. The league is implementing optical tracking for first downs this preseason with the strong possibility the system could be used in the regular season. Amazon’s “Prime Vision” on its Thursday night broadcasts have shown a tantalizing future for football analytics. Broadcasts last year correctly predicted when non-linemen would blitz and highlighted open receivers much faster than a typical broadcast, for example.

“The use cases are really expanding,” says Dominic Russo, a supervisor at Zebra Technologies, one of the companies that partners with the league on Next Gen Stats. “When [Next Gen Stats] started in 2018, it was mostly for the fans who watch the broadcasts. It’s really taken a leap from an analytics and scouting perspective.”

Each NFL team has access to the raw data from Next Gen Stats, which include precise player positioning, speed, and other information. Teams can get the NFL’s approval to share that data with third-party firms that can input that data into their AI models; how that compares to PFF’s very analog process is still an open question. AI models have to be trained on how to tell, for example, if a team is in a certain formation based on the player sensor data. Then comes a bigger hurdle to match what PFF does best: evaluating players individually, which still has a margin of error even for PFF.

“It took PFF so long to build,” says author and journalist Matthew Coller, who penned the 2023 book on PFF, Football Is a Numbers Game. “It’s still unique. At the moment, there’s nothing that can match actual people watching actual games and pulling actual numbers. However, there are companies that are building AI models with the tracking data that is going to become more accurate and more useful as more people work on it.”

One of those companies that has pioneered machine learning in grading football is StatsBomb, a U.K.-based firm that expanded from its soccer roots in recent years. StatsBomb uses automated visual tracking along with humans for quality assurance to give teams an enormous amount of data within hours of a game’s conclusion.

“It’s a very, very rapid and powerful pattern-matching system, which certainly falls under the umbrella of machine learning and AI,” says Seth Partnow, StatsBombs’s director of North American sport. “This [automated StatsBomb] data already exists and people are using it in football.”

StatsBomb head of American football analysis Matt Edwards says the company collects and contextualizes data unlike any other company, including quickly classifying the route a receiver is running, defensive setups, and offensive blocking schemes.

A battle for control

These would be challenging, even existential circumstances for a company under any conditions. But instead of being able to fully focus on adapting to the player-tracking era, PFF has been beset by its own personnel tumult in recent years.

Turnover is common in the sports analytics industry, where careers can be low-paying, intense, and brief. But even by that standard, PFF has been hemorrhaging top-level talent in recent years.

The analytics talent that has departed over the last two years includes:

- Eric Eager, PFF’s VP of research and development. Eager went to the sports analytics firm SumerSports in September 2022 before taking a job in the Carolina Panthers’ front office earlier this month. He worked at PFF for seven years.

- Geoff Lane, PFF’s head of engineering. Lane, who modernized PFF’s technical architecture over his seven-plus years at PFF, left in February.

- Rick Drummond, PFF’s GM of football. Over his 14 years at PFF, the former chiropractor was key to making analytics relatable to teams and worked closely with them to address their needs. He left PFF in February.

- Brad Spielberger, a research and development analyst. Spielberger was PFF’s cap expert and left in March after nearly four years.

Multiple former PFF employees told FOS that the exodus largely stemmed from Chahrouri’s mismanagement. PFF also did its only round of layoffs in late 2022, cutting 16 full-time employees, mostly from the consumer side.

PFF spokesperson Tonya Carruthers confirmed to FOS that Chahrouri was no longer with the company, although she declined to state a reason for his departure. Chahrouri didn’t return messages seeking comment left by FOS.

Chahrouri was a math teacher at a private high school in Compton, Calif., before he joined PFF as an analyst in 2017. His talent for analytics chops secured the admiration of Collinsworth and PFF founder Neil Hornsby, who tapped Chahrouri and Austin Gayle to take over the content side of the business in ’21.

With new money and new management, Hornsby and Chahrouri began battling over the future of the company in late 2021 and early ’22. Hornsby, who started what would become PFF from his one-bedroom apartment outside of London two decades ago, sought to demote Chahrouri. Collinsworth, however, backed Chahrouri, leading a frustrated Hornsby to take a sabbatical.

During Hornsby’s time away from PFF, Gayle took a job at The Ringer in June 2022 and Chahrouri’s stature within PFF was boosted even more. Hornsby quit later that year.

“George was incredible at convincing people like Cris Collinsworth that he could help make them a billion-dollar company,” one former employee says. “He was next-level terrible at managing people below him.”

‘A lose-lose situation’

Collinsworth also elevated and his son, Austin Collinsworth, to COO before Hornsby’s departure. Like Chahrouri, Austin Collinsworth’s management experience was limited. PFF has always been a go-go workplace—especially during the football season—where there was more “work” in their work-life balance, sources told FOS. That was the case when Hornsby was in charge, but the influx of money changed how PFF was viewed internally as less of a mom-and-pop shop and more of a company that sought to compete with media giants like ESPN.

And Chahrouri’s management style—which multiple former employees described as far harsher than Hornsby’s—was met with skepticism, a combination of Chahrouri’s shorter résumé and his decisions at the helm that failed to propel the site forward. Chahrouri regularly dressed down employees in meetings and over Slack leading to a toxic environment, multiple former employees told FOS. A social media manager who worked under Chahrouri alleged mistreatment in a lawsuit that led PFF to settle with that former employee for $20,000, according to Coller’s book.

“When I got asked what was the last straw [for Chahrouri], I had to laugh. He’s been this way the whole [expletive] time,” the former employee said.

Nearly three years after the Silver Like investment, that money has almost entirely been spent, according to multiple sources with knowledge of the matter. There’s been chatter that PFF may be on the hunt for a new partner, this time within the analytics world. SumerSports—an analytics firm owned by billionaire hedge-fund manager Paul Tudor Jones that touts “AI-powered insights to maximize your team’s winning potential” on its website—could be one of those potential partners. (A SumerSports spokesperson declined to comment when reached by FOS.)

In the meantime, PFF remains an analytics power with a strong business supplying pro and college football teams with data—and the relationships the company has built with teams over the years gives it some cushion when higher-tech alternatives become more of a challenge. But there are questions as to how much longer PFF can retain that dominance.

“The door is wide open for somebody else, and PFF may be in a lose-lose situation,” another former employee says.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)