In the News

Last week, Bitcoin fell below $26,000 for the first time in almost two years amid a broader selloff in cryptocurrencies that erased more than $200 billion from the entire market in a single day. The drawdown was one of the largest single-day corrections in recent history. In addition to the bitcoin selloff, Ether, the second-largest digital currency, tanked to as low as $1,704.05 per coin. It’s the first time the token has fallen beneath the $2,000 mark since June 2021.

Behavior in the crypto market currently mirrors that of the broader capital markets. Investors are fleeing from cryptocurrencies at a time when stock markets have plunged from the highs of the coronavirus pandemic. Some of the economic factors contributing to the selloff include:

- The consumer price index accelerated 8.3% in April, more than the 8.1% estimate and near the highest level in more than 40 years.

- Net retail inflows amounted to just $2.4B this month to May 10, compared to $11B in April and $17B in March, according to data from JPMorgan.

- Gross domestic product (GDP) in the U.S. declined at a 1.4% pace in the first quarter, below analyst expectations of a 1% gain.

While conditions in the crypto market are driven in large part by many of the same macroeconomic factors that impact the S&P 500 and the NASDAQ, there was one specific event that had an outsized impact on the meltdown.

Terra (“UST”) – a type of cryptocurrency known as an algorithmic stablecoin – saw its token value drop to 30 cents on May 11. Due to the currency’s function as a peg to the U.S. dollar, the drop in value was an alarming signal to most investors in the decentralized finance space. Stablecoins are like the bank accounts of the crypto world —digital currency investors often turn to them for safety in times of volatility in the markets. But UST has struggled to maintain a stable value as holders have fled the market.

Mechanistically, the basic idea of an algorithmic stablecoin is that you can always exchange one UST for $1 worth of Luna, Terra’s other cryptocurrency, which is meant to guarantee that UST always trades at $1.

The concern for investors — and one of the reasons why the market has seen so much volatility — is the fact that nothing props up the price of the Luna token, which is simply a financial instrument. Consequently, if people are concerned about UST and try to sell, they will get $1 worth of Luna, which they will also sell, which will drive down the price of Luna. This is ultimately what is known as the “death spiral.”

Given the context, it is clear that the collapse in the stablecoin market has had broader implications on the larger and more “notable” crypto assets. According to Bloomberg’s Matt Levine, there are concerns that there could be some type of contagion into other markets. Retail traders who have pulled out of crypto due to the crash are likely to exhibit the same tendencies in the equities markets. In essence, the crypto market selloff is having broader market implications.

(For more information on stablecoins, read Matt Levine’s article on Bloomberg Opinion )

The Sports Angle

Front Office Sports senior reporter A.J. Perez recently reported on the implications for the larger crypto exchanges and their sponsorship deals.

The prevailing sentiment from experts and executives is that although the market volatility is significant, the biggest exchanges — which make up most of the meaningful sports sponsorships — are so capitalized from the previous two-year bull market that there is little concern for payment issues.

Take FTX for example. The fourth largest crypto exchange by valuation, signed a 19-year $135 million deal in 2021 as the company looked to gain brand exposure in the broader markets. When asked about whether or not the company could afford that lucrative of a deal — CEO Sam Bankman-Fried was confident in the firm’s ability to pay.

“Without going into the details, it’s been a pretty good year for us. To the point where, frankly, we don’t need to rely on the other 18 years to have the funds for this. So, it’s been a phenomenal year for a number of businesses, and for the crypto industry in particular. And then I think us, even more so. And so, that’s given us a pretty big cushion.”

Sam Bankman-Fried, CEO & Founder FTX

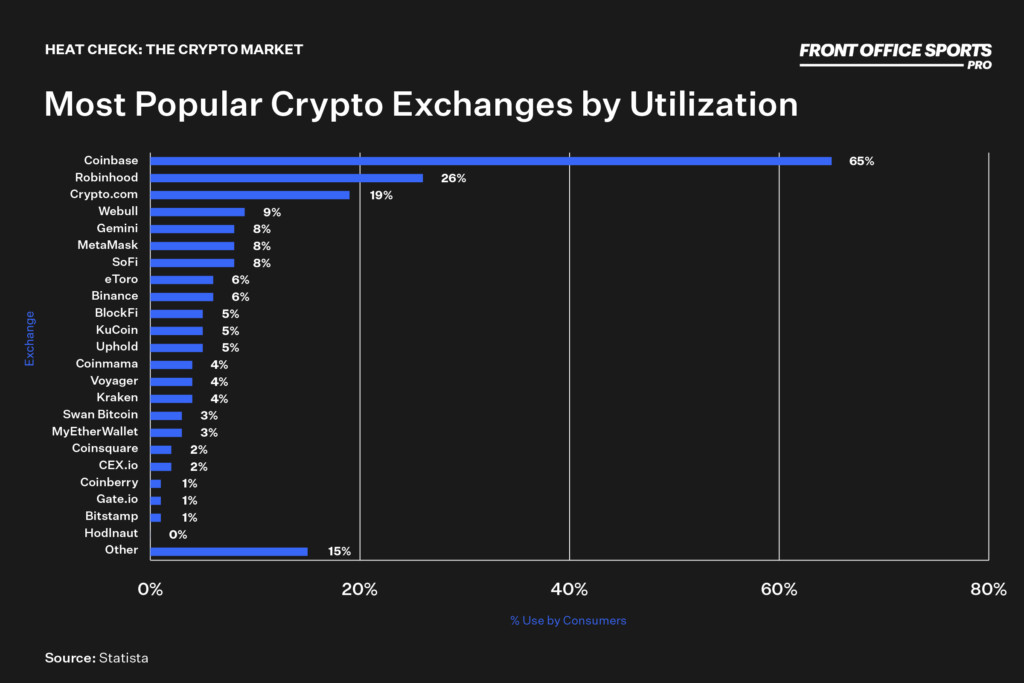

Currently, the largest deals tend to skew toward crypto exchanges, the companies within the crypto sphere that are the largest and most immune to swings in individual currency pricing.

- Crypto.com signed a 20-year deal reportedly worth $700M to take over the naming rights of Los Angeles’ Staples Center in November. The company also agreed to a 10-year, $175M deal with UFC and a five-year, $100M partnership with Formula 1 last year.

- FTX agreed to a 19-year, $135M pact in March 2021 for the naming rights to the Miami Heat’s arena.

- Last October, Coinbase inked a multiyear deal to become the exclusive cryptocurrency exchange of the NBA, WNBA, and NBA G League.

- The Dallas Cowboys became the first NFL team with a crypto partnership last month via a deal with Blockchain.com.

There are, however, examples of teams and leagues that have ventured outside of crypto exchanges. The Washington Nationals currently have a $38.5 million advertising deal in place with Terra and Luna.

According to a report from CoinDesk, the initial deal struck in February was a $40 million five-year pact with Terra to become the official crypto sponsor of the team. Under the terms, the Nationals will feature advertising for Terra throughout its stadium and have a premium seating club called Terra Club.

At the time of the deal, the Nationals said that the team could begin accepting cryptocurrency payments for the 2023 MLB season by using TerraUSD as a payment method.

“We are excited to partner with Terra to name our most exclusive club and explore bringing powerful new fan experiences to Nationals Park, including the use of UST cryptocurrency to make purchases.”

Mark D. Lerner, Washington Nationals Managing Principal Owner

The Nationals’ seemingly failed experiment (assuming the continued selloff of UST) is a phenomenon unique to the crypto market. Corporate sports sponsorships have a history of going south, as seen with Enron (a $100 million naming-rights deal that lasted two of its intended 30 years).

How Volatility Impacts Crypto Exchanges

The stablecoin market is currently proving to be volatile — particularly when it comes to sponsorships. Crypto exchanges, on the other hand, should still provide opportunity in the space due to several factors.

Capitalization: Many of the largest crypto companies in the world are highly capitalized. At the time of writing, seven of the top 10 largest crypto companies in the world are exchanges, with an average valuation of $31.4 billion.

- Coinbase ($85.8 billion)

- Revolut ($33.0 billion)

- Robinhood ($32.0 billion)

- FTX ($32.0 billion)

- Blockchain.com ($14.0 billion)

- Dunamu ($12.6 billion)

- Kraken ($11.0 billion)

The total level of capitalization helps provide a cash buffer for the companies which choose to enter into sponsorship contracts. As previously stated, even with the recent market selloff, FTX would be able to pay off the entirety of its deal with the Miami Heat for the arena naming rights — today.

This level of capital and the need for marketing distribution make crypto exchanges specifically strong candidates for partnerships, even in the face of market turbulence.

Volatility: The drawdown in prices has impacted crypto companies across the board. Exchanges, which take a percentage of every transaction on their respective platforms, are impacted by declining prices in that their fees are reduced to the lower value of the base currency. When prices decrease, however, the frequency of trading increases — meaning increased revenue opportunities for exchanges.

Coinbase, the world’s largest cryptocurrency exchange, recently reported earnings. The company saw reduced trading volume (prior to the recent selloff) and increased expenses related to marketing spend. While market turbulence and a general move away from capital markets from retail traders have eaten into Coinbase’s margins, the company ended March with over $6 billion in cash and cash equivalents, as well as an additional $1.3 billion in cryptocurrency on its balance sheet. The reserves give the firm ample liquidity to survive an extended period of low cryptocurrency trading volume.

Overall, trading volume will likely decrease market wide as expectation and speculative behaviors are being “reset” during this recessionary period. Additionally, Coinbase’s cost structure (more marketing and operating expenses) has negatively impacted earnings.

Volatility, however, will help bolster the trading volume on the platform and allow exchanges — like Coinbase — to continue to monetize.

Retail Traders: The behavior of retail investors also drives the profitability of the crypto markets. As it currently stands, retail investors have not totally fled the markets. According to brokerage TD Ameritrade, retail investors have continued to buy the dip in the recent market turmoil — even liking tech, despite the sector rout.

“Our indicators, TD Ameritrade [Investor Movement Index], just came out this morning indicating indeed that the retail traders are continuing to buy the dip”

AJ Kahling, TD Ameritrade

The magnitude of purchases has been impacted, however. According to the Financial Times, net retail inflows (the amount of money coming into the market from retail investors) amounted to just $2.4 billion this month to May 10, compared to $11 billion in April and $17 billion in March, according to data from JPMorgan.

While retail investors have decreased their spending, they have not completely disappeared. According to TD Ameritrade, investors are instead more selective, buying larger and more well-established companies — including highly profitable tech giants with proven revenue such as Amazon, Microsoft, and Google.

Even with incredibly difficult market conditions for retail investors, there is still money flowing into capital markets — from equities to crypto.

Additional Observation: Even with the recent selloff, the intention to continue purchasing cryptocurrencies in the future seems to be waning less than anticipated. According to research from Morning Consult, consumer trust in cryptocurrency is dropping, but purchasing habits remain unchanged. According to the survey, purchase intention for digital assets like Bitcoin and Ethereum has remained relatively unchanged since the beginning of the year, as has ownership of cryptocurrencies overall.

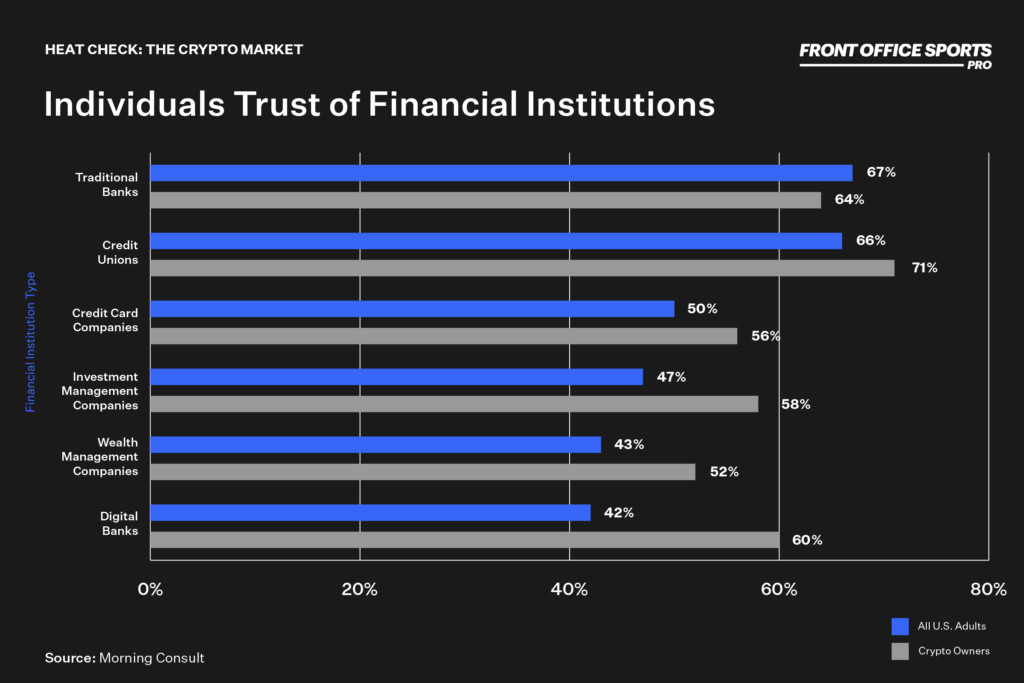

What is equally interesting, however, is that while consumers seem to still be willing to purchase crypto assets, they still trust financial institutions. Cryptocurrency owners actually show strong trust in traditional providers.

“Trusted and trustless financial services are not mutually exclusive in the eyes of cryptocurrency owners. Roughly two-thirds of U.S. adults (67%) say they trust banks, and the share among cryptocurrency owners is not much different at 64%.”

Morning Consult

What does this mean? While traditional sentiment is that crypto natives are distrustful of financial institutions, the Morning Consult study indicates that purchasers of cryptocurrencies might actually be willing to trust more traditional financial institutions.

Existing crypto holders might actually look for more traditional models than anything else. The business model for a trustless exchange is built upon access, control, and transparency. Going forward, institutions will not only need to be custodians of individual assets but also need to provide customers with access to a broad array of cryptocurrencies and decentralized finance products.

Keep Your Eyes Out

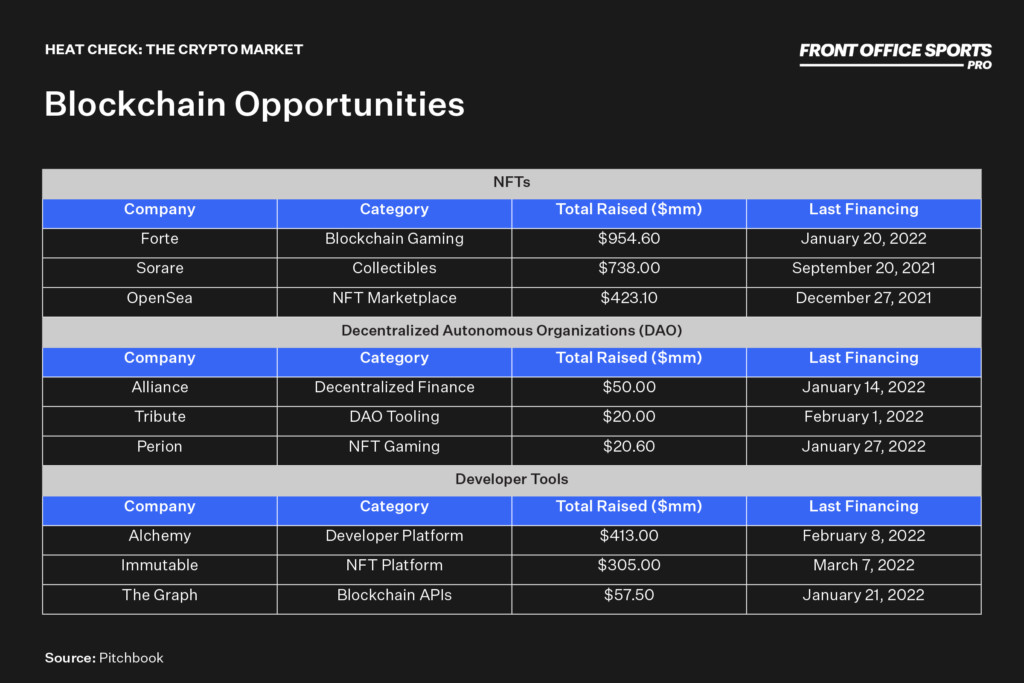

Financial data provider Pitchbook recently came out with its Blockchain industry overview for the first quarter. In the report, Pitchbook identifies NFTs, DAOs, and Crypto Infrastructure companies as the “Key Themes” going forward. We have summarized those opportunities below.

For more information, please feel free to reach out to me directly at liam@fos.company.

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)