Total addressable market is an interesting concept. It’s what financiers and capital allocators use to describe the potential size of a market they’re entering, and a proxy for just how “big” their investments can become.

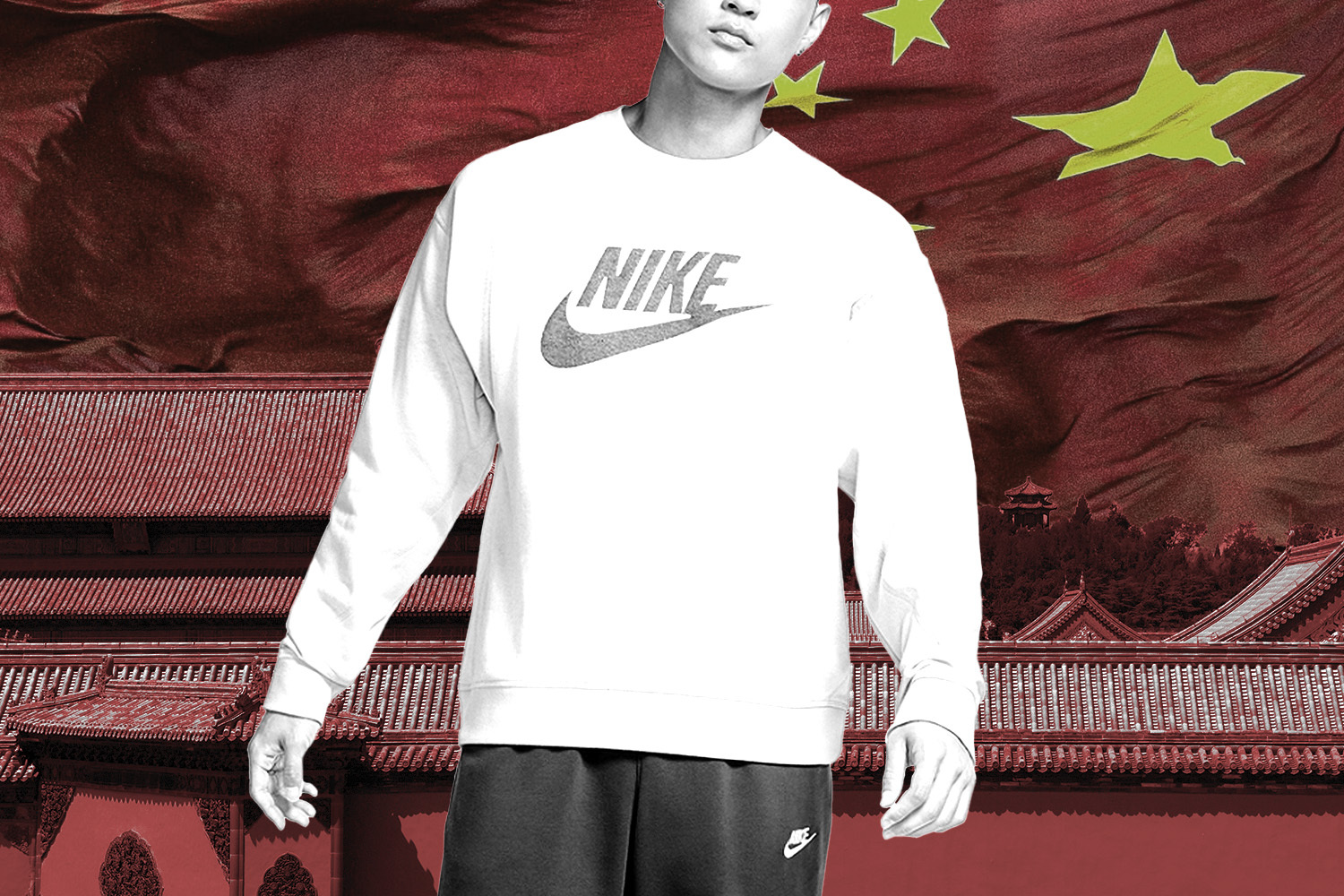

That’s why China has been such an incredibly compelling target market for brands over the past decade. With a population of just over 1.4 billion, there are few markets more “addressable” than the Chinese market. But size isn’t the only thing that matters.

Chinese consumers love to spend, and the numbers prove it out. According to a report by Morgan Stanley, Chinese consumer spending is expected to double to $12.7 trillion per year by 2030 — equaling the consumer spend in the U.S.

The Swoosh has relied on China to derive much of its growth in recent years, and it’s paid off. Nike has seen year-over-year growth of ~302% in the region, undeniably great news for the company’s bottom line.

Changing Tides

The narrative, however, is changing. According to a Bloomberg report on Chinese consumers, since 2018 there has been a shift from American brands like Nike to a nationalistic focus on homegrown consumer goods.

Let’s not get it twisted — Nike still has a huge presence in the region and continues to see growth. CEO John Donahue even stated in a June 2021 analyst call that Nike is a “brand of China and for China.”

But despite its best efforts, the Swoosh can’t override a new reality where the likes of Anta and Li-Ning force foreign brands to rethink their strategies.

Let’s take a look at the data.

Sneaker Wars

On Tuesday, Bloomberg published another in-depth report of sales data from various shoe brands in China via e-commerce data tracking platform Taosj.com.

The data tells a fascinating story.

- In 2018, Nike stood atop the standings in terms of market share, owning roughly 30% of the sneaker sales on e-commerce platform Tmall.

- From 2018 through 2020, the top spot would oscillate between Nike or Adidas as the foreign brands saw their combined market share of sneaker sales reach nearly 50%.

During the same period, domestic brands such as Anta, Li-Ning, and Xtep lagged significantly behind. In 2020, even Converse outperformed them.

At the end of 2020, amid struggles with Covid-19 and supply chain issues, Nike’s China sales were the company’s fastest growing — up 24% YoY and topped $2 billion for the first time ever.

Then came the Xinjiang cotton controversy.

The Xianjing Moment

In March 2021, Nike and other foreign brands made public statements denouncing the use of cotton produced from western Xinjiang region of China due to human rights violations. The result? Backlash from the Chinese population.

This is when the data shifts. After the Xinjiang protests by brands, Bloomberg reported that Anta, Li-Ning, and Xtep quickly took the top three spots in terms of sales.

Ever since that moment, the “Fugian Tigers” (a nickname for Chinese sportswear companies) have anchored themselves to the top of the sales list — gaining incremental benefits from events like the Winter Olympics in Beijing.

By the end of January 2022, Anta and Li Ning accounted for 28% of sneaker sales, 12 percentage points higher than before the Xinjiang outcry. Over the 12 month period ending January 31, domestic Chinese brands saw sales grow by 17% while foreign brands saw sales decline by 24%.

Nike Earnings

Nike last reported earnings in December 2021. Domestically, the results were stellar with sales climbing 12% in the company’s largest market: North America. The laggard? You guessed it: China.

Nike’s China sales were down 20% during the YoY period and while many cited Covid-19 and factory closures as a driving force, the shift in Chinese consumer preferences could not be ignored.

Before the Xinjiang controversy, Chinese revenues contributed to 22% of Nike’s total revenues — a number that had grown from just 10% a decade prior. In the quarter following the controversy, the percentage of Chinese sales dropped to 16%, erasing half of the growth over the past decade.

New Markets

The Chinese market and opportunity is far too large for Nike to slow down its investment in the region, but banking on the growth of the past decade might no longer be a viable option. The company will likely have to look to new regional markets for growth.

Another potential avenue: the metaverse.

While many physical geographic markets are either mature or don’t have consumers with the commensurate disposable income for Nike products, the metaverse could present an interesting growth vector.

Nike has been no stranger to the space thus far.

- In May 2019, Nike’s Jordan Brand partnered with “Fortnite” to produce character skins.

- Nike filed a patent for “CryptoKicks” in December 2019, which would link physical shoes with an NFT to verify ownership.

- In December 2021, Nike acquired RTFKT, which produces NFTs that are sometimes paired with a physical collectible such as sneakers.

- In November 2021, it established virtual real estate within Roblox with Nikeland, an environment where users can play games and browse digital products.

In its most recent earnings report, Nike reported a 12% increase in digital sales while cutting ties with various brick-and-mortar retailers.

Even if the China growth chapter is coming to a close, Nike bulls can rest easy knowing that the sportswear giant almost certainly has an increasingly strong digital presence in its future.