Before the near-total implosion of the regional sports network model, Monumental Sports & Entertainment — the parent company of the Washington Capitals, Wizards, and Mystics — took control of its RSN partner.

“We viewed it as an opportunity to play offense,” Zach Leonsis, President of Media & New Enterprises at MSE, told Front Office Sports. “We were able to create a lot of efficiencies and consolidate our content programming efforts. But there’s no doubt that it was also a defensive measure, too.”

MSE’s acquisition of the 67% of Comcast-owned NBC Sports Washington it didn’t already own closed a year ago. As a result, the Capitals aren’t among a handful of stateside NHL teams — including those impacted by Diamond Sports Group’s bankruptcy — who don’t have to stress over local sports carriage as the regular season opens this week.

“I really felt like our network and many other RSNs became shells of themselves, just being placeholders for the live games,” Leonsis said. “Even though live games are always going to be [the most popular] in terms of what drives ratings versus your original programming during the day, we can still give people a reason to tune into our network and give them permission to be a fan.”

The Arizona Coyotes, meanwhile, finally got some clarity on its future with DSG’s Bally Sports Arizona, which was supposed to run through the 2024-25 season. A bankruptcy judge allowed DSG to reject that deal as the Coyotes took over the rights.

Coyotes President and CEO Xavier Gutierrez told FOS the team had planned on that outcome for several weeks, although the franchise couldn’t make any agreements until Thursday’s ruling came down.

“We did a lot of game theory, a lot of scenarios,” Gutierrez said. “It really wrapped up over the last 30 to 45 days. We were getting to a point where the season’s about to start. What’s exactly going to happen? Clearly, we had to figure it out right for ourselves. Finally, we got to a point where we got comfortable that we’re gonna be able to come to an agreement with Scripps, and we approached [DSG].”

The Coyotes announced a local broadcast deal with Scripps Sports to carry 81 of 82 games. The development of direct-to-consumer streaming services continues to progress.

On Tuesday, the Monumental Sports Network announced its direct-to-consumer streaming service that costs $199.99 annually or $19.99 monthly. The in-market product gives subscribers access to more than 200 live Capitals, Wizards, Mystics and NBA G League’s Capital City Go-Go games a year.

Minus the Coyotes, there are now 11 NHL teams with DSG deals: Los Angeles Kings, Anaheim Ducks, Nashville Predators, Tampa Bay Lightning, St. Louis Blues, Detroit Red Wings, Florida Panthers, Minnesota Wild, Columbus Blue Jackets, Dallas Stars, and Carolina Hurricanes.

There were signs that some of those contracts could be in trouble when DSG sought bankruptcy protection in March to restructure about $8 billion of debt. DSG won approval from a bankruptcy judge to drop Major League Baseball franchises San Diego Padres in May and the Arizona Diamondbacks in July.

MLB had been preparing for such an outcome for months, as the league hired several former RSN employees to help with its broadcast operations. The NHL, however, didn’t take as hands-on of an approach, partially because it couldn’t.

MLB took over production and helped coordinate distribution for the Padres and Diamondbacks, which didn’t happen with Coyotes. But Gutierrez said that the NHL convened all its franchises with DSG deals “several months ago and really started giving us a lot of guidance.”

MLB leveraged its MLB.TV platform to quickly solve in-market streaming for the Padres and Diamondbacks. But, under the NHL’s current media rights deals in the U.S., that wasn’t a viable option since the league no longer has a separate streaming service for out-of-market games.

Starting with the 2021-22 season, ESPN+ effectively replaced NHL.TV for out-of-market games under a 7-year, $400 million deal with Disney.

FOS contacted the remaining NHL teams affiliated with DSG, and all declined to comment. Most cited the ongoing bankruptcy proceedings because they could not weigh in on the record.

Gutierrez declined to specify the financial impact of the switch from getting millions from DSG annually to taking over the production and distribution of their games. However, one industry insider told FOS teams forced to go out alone are unlikely to reach the guaranteed broadcast money they had become accustomed to through RSN deals.

“You don’t get immediate carriage from the Comcast and the DirecTVs unless it’s either free or some minimal amount of money,” said the source, who was granted anonymity because the industry veteran is not authorized to speak publicly. “Some of these deals are revenue shares with a minimal rights fee.”

The Vegas Golden Knights enter the season with a new local broadcast deal with Scripps Sports, but it was announced in April as the franchise was weeks away from securing its first Stanley Cup title. Warner Brothers Discovery had decided to end its AT&T subsidiary that carried most of the team’s games.

Late last month, the streaming part of the rollout — KnightTime+, which costs $69.99 for the season — was announced. And, unlike the Coyotes, the Golden Knights’ games broadcast locally will be produced by Scripps Sports.

“Not many of these teams have a long history of producing their own games and selling their own time,” the source said. “So, this is going to be a new business for them, and in many cases, there won’t be an over-the-air partner for some of these teams.”

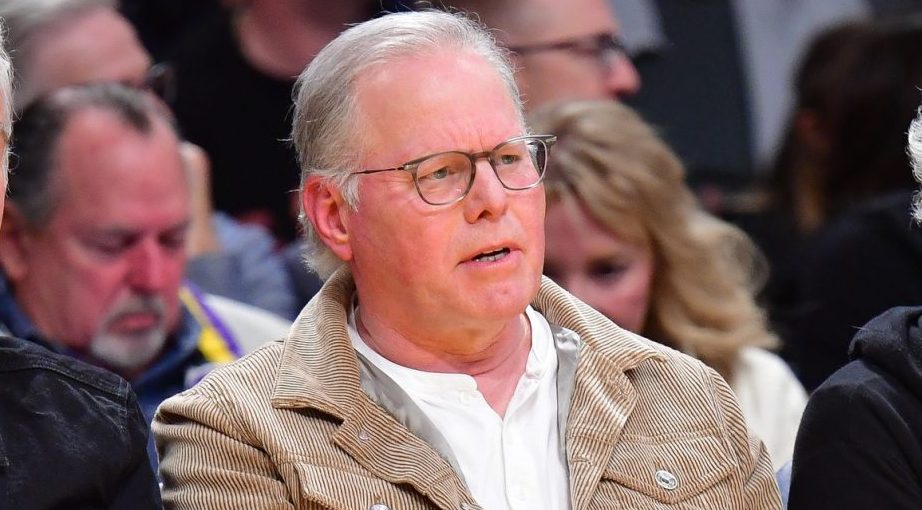

The Kings and DSG agreed to a restructured deal that includes digital streaming rights in September. DSG CEO David Preschlack said the company was “hopeful” that the agreement “can serve as a model for future discussions with team and league partners.”

Meanwhile, other NHL teams are bracing for potential in-season scrambles depending on how DSG’s bankruptcy case develops or other RSN industry shifts.

As abrupt as it was, Gutierrez already sees the advantages of life after an RSN.

“Our fans and the fans and fans we are trying to attract were having a much harder time accessing our games, accessing our content, accessing our brand and the great stories, and the great narratives,” Gutierrez said. “It was like a shrinking pipe which everything was getting funneled through. That is the exact opposite of what we wanted. We knew that if we could have greater reach, we could have more engagement, and we can monetize that. The brand will be more top of mind now.”