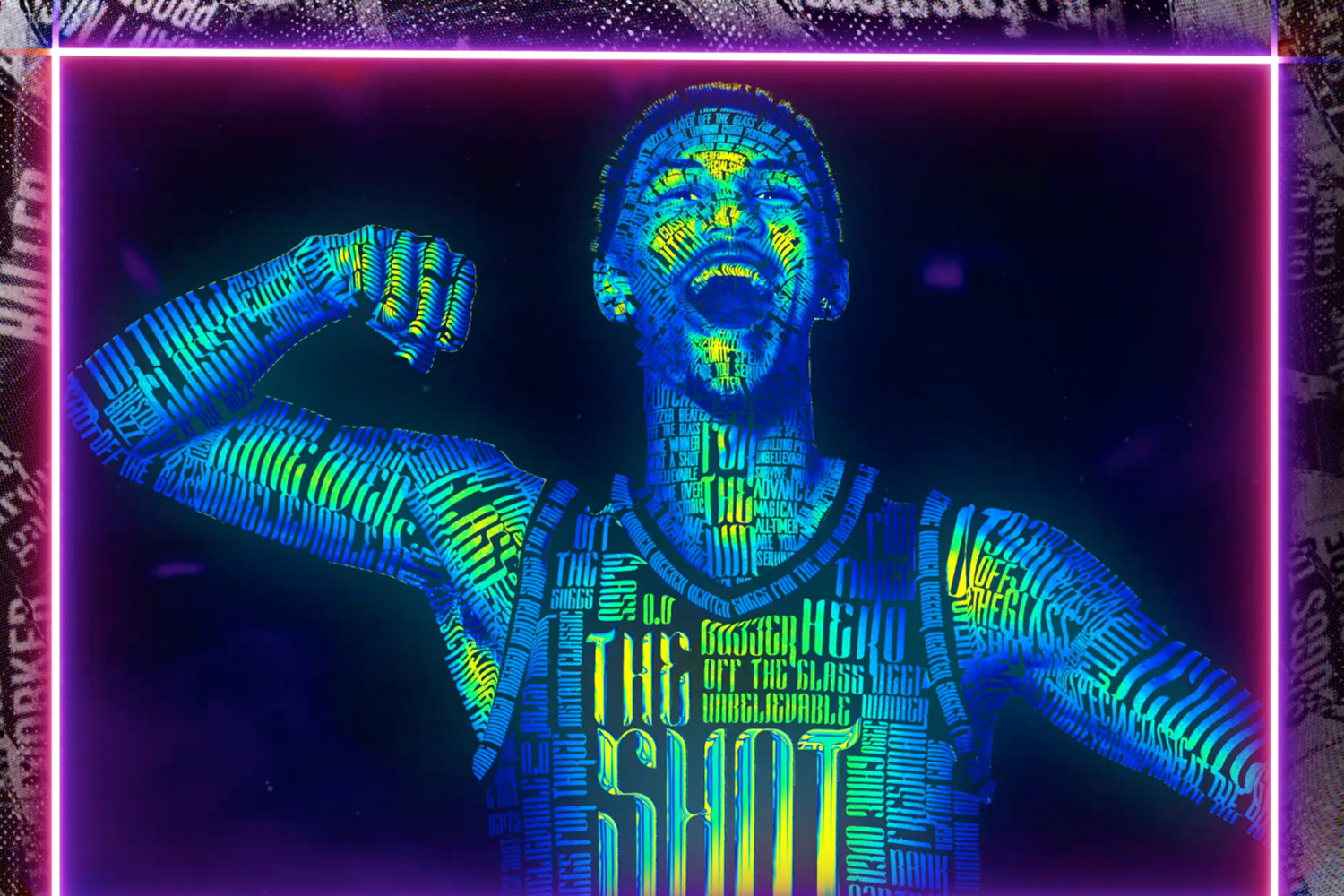

NFTs became one of the most popular vehicles in the first year of name, image, and likeness.

Athletes and companies flocked to the industry. Brands poured more cash into NFTs and trading cards than any other segment of NIL activity, comprising more than 17% of the NIL market, according to data from Opendorse.

What makes them so popular? They’re lucrative, convenient for athletes with busy schedules, and can help athletes launch their brands, company founders told Front Office Sports.

While compensation varies greatly, athletes can make a decent amount of cash without putting in much effort.

- Stuart Bush, CEO and co-founder of the Legacy League, said athletes can make anywhere from as little as $300 to $500 to as much as $10,000 to $20,000. On his platform, athletes receive 75% of sales.

- Keith Marshall, co-founder of and CEO of The Players’ Lounge, noted that when NFTs are sold on the blockchain, athletes can receive profits from secondary market sales, too.

Growing Controversy

The recent “crypto crash” has called into question their long-term value — and whether the NFT industry is a sound investment.

From focusing on in-person events to selling NFTs with credit cards, company founders believe they’ve found ways around the crash.

Kuntal Shah, founding partner of Katana Capital, is optimistic that the market will rebound. “There’s a lot of stuff in the news that says, ‘NFTs are dead,’” he said. “NFTs are really only 2 years old.”

Editor’s note: For more on this story, click here.