Software and venture firm Animoca Brands, an NBA Top Shot investor, plans to raise $100 million in a funding round that will include Singaporean state holding company Temasek, according to Bloomberg.

It’s the latest influx of fresh capital for Animoca Brands, which raised $359 million in January and $75 million in another round in July.

- Animoca Brands is valued at $6 billion.

- The firm owns more than 340 gaming, social media, and finance companies.

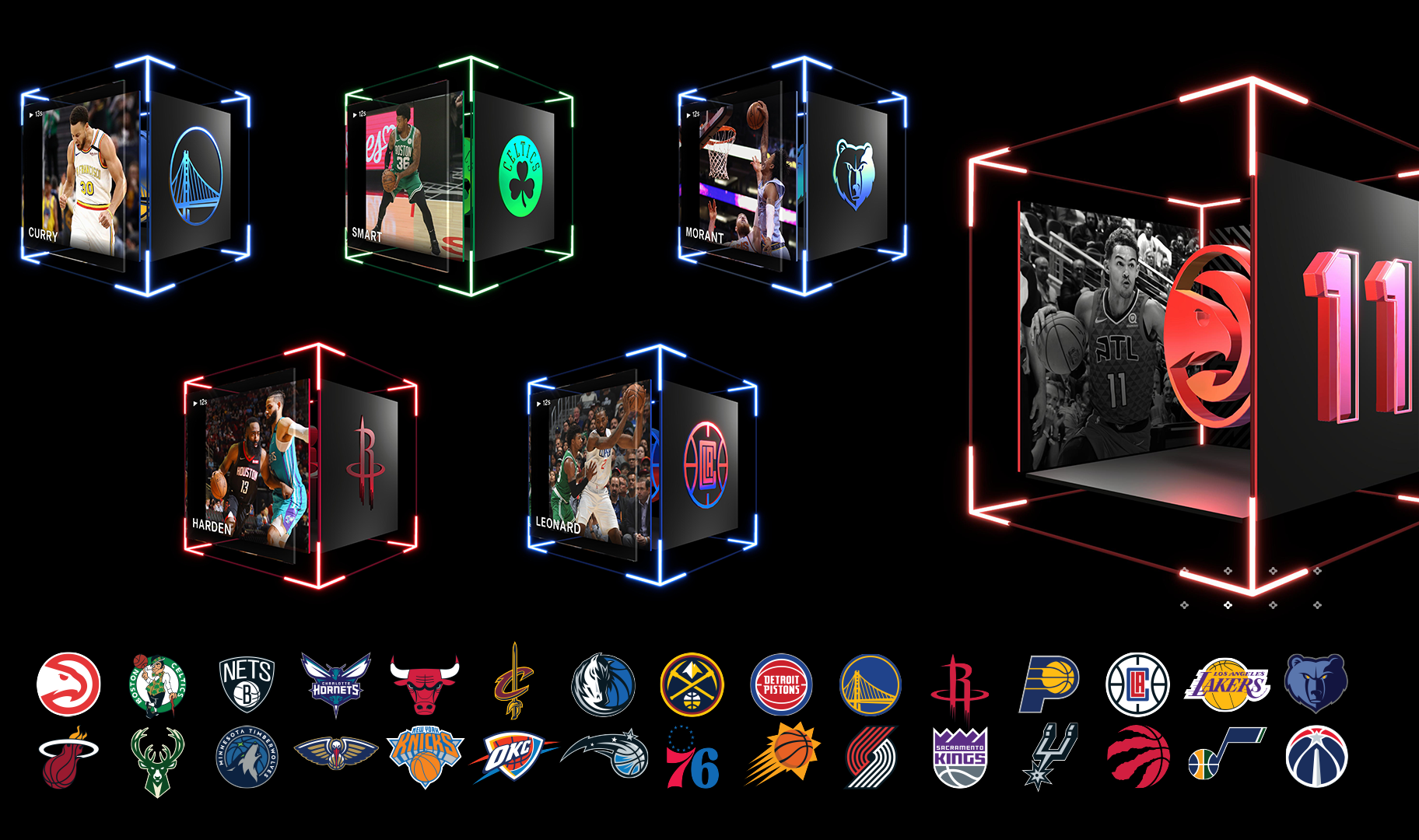

- It’s an investor in NBA Top Shot and Fan Controlled Football.

Earlier this month, the company’s Japanese business completed a $45 million raise that included MUFG Bank — the largest bank in Japan. That funding will be allocated toward Web3 growth.

A Great Start

Animoca Brands generated $573 million in revenue over the first four months of 2022.

The results were driven by its diverse portfolio of investments and the sale of NFTs. During the period, the Hong Kong-based firm had a cash balance of $98 million.

As of June 2022, Animoca Brands holds digital asset reserves of roughly $4.2 billion.