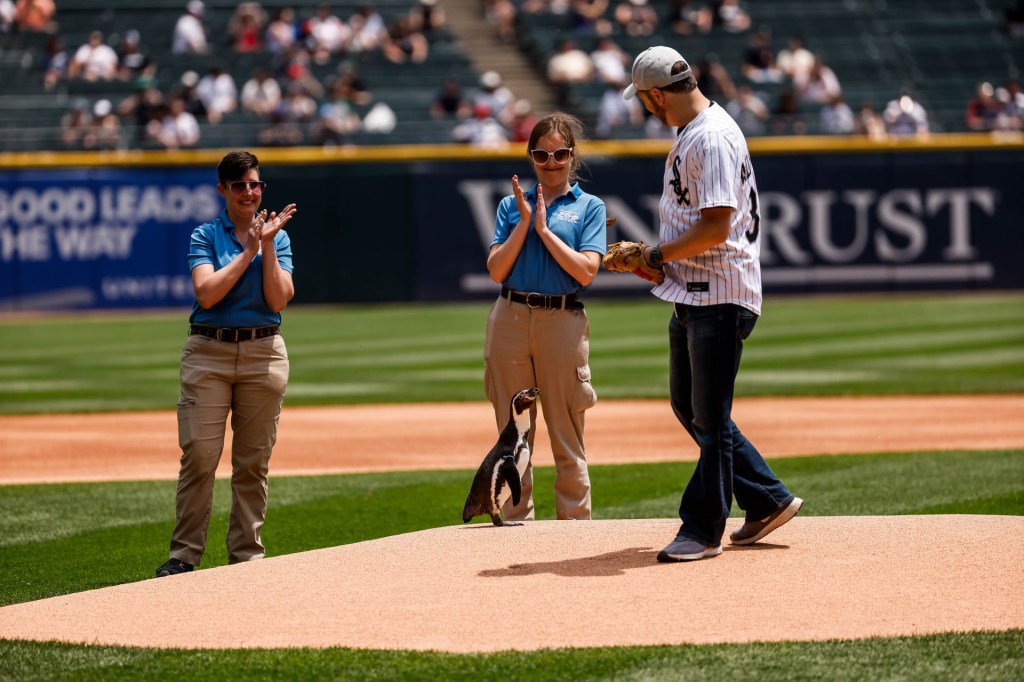

Fans’ in-stadium viewing experience is one already filled with advertising by brands looking to attract new consumers – with activations spanning static logos, animated graphics, and even pop-up events around games.

A select number of teams and leagues are also looking to sell additional inventory that would allow brands to reach fans via video format on jumbotrons, concourse screens, and other screens across the stadium.

Recent examples of this trend include Minor League Baseball, The American Hockey League, the New York Mets, and ISM Connect, which handles digital engagement for NASCAR. Each has signed multi-year deals with SV Sports – a newly launched sports vertical of Screenvision that made its name in the cinema industry, selling ads on behalf of movie theaters.

In the case of MiLB, the new deal starting in 2020 is sure to grow the amount of advertising dollars its clubs can attract, according to David Wright, the league’s chief revenue officer.

“Our teams have done a really good job at managing their inventory locally,” said Wright. “SV Sports now offers us the opportunity to reach 80 to 90 other markets, which is very appealing.”

Offering video advertisement opportunities should also improve fan engagement by telling stories that resonate with families attending minor league games, he added. In addition to sponsored content sold by SV Sports, on-screen materials produced by the league will span from work done in the community by clubs to more lighthearted blooper reels.

“It’s all about creating deeper engagement,” said Wright. “The beautiful thing about video content is that it strikes an emotional cord and peaks interest in a much deeper way than static advertising, which can lead a brand to become wallpaper overtime.”

On-screen video advertising will be available in about 80 to 100 MiLB ballparks across the country. The league is working exclusively with SV Sports to offload inventory, but it does house an internal ad sales team that offers broader packages to big brands.

MiLB declined to share revenue expectations from its new venture.

READ MORE: Nationals ‘Baby Shark’ Craze Paid Off On And Off The Baseball Field

NASCAR, meanwhile, operates its in-stadium video advertising through technology partner ISM Connect. The vendor has worked with the organization for three years, using its screens – which are moved from venue to venue each week – to communicate messages to fans around scheduling, recaps of the prior week’s event, and planned driver appearances before upcoming races.

As part of ISM Connect’s agreement with SV Sports, the latter will sell additional unsold inventory on behalf of the startup. ISM Connect’s 17 screens taken on the road throughout the season are utilized at all NASCAR tracks, except for the Indianapolis Motor Speedway – home of the Brickyard 400, according to Trent Staley, EVP of network partnerships and marketing.

“NASCAR is thoughtful about innovation,” said Staley, who worked at NASCAR as part of its partnership and marketing teams for over a decade before joining ISM Connect this spring. “They realized the opportunity to improve technology at race tracks in an economical way, and took it.”

Similar to MiLB, ISM Connect sports an internal sales team, but welcomes a partnership with SV Sports which has a larger sales force. ISM Connect’s television screens come equipped with cameras that capture demographic information about NASCAR fans, and engagement data the company leverages to sell inventory.

“We play video loops that are half advertising and half content produced by NASCAR,” said Staley. “We report data after every weekend to brands about how many fans pay attention, including a breakdown of age groups, gender, and other metrics.”

READ MORE: NASCAR, Coca-Cola Driving Deeper Bond Around Support For Military

In-stadium video advertising is not a new phenomenon, according to Michael Neuman, managing partner of Scout Sports Entertainment. These types of third-party ad sales companies have additionally existed for more than a decade, with a number of them folding or pivoting on their market strategy.

The underlying issue for these businesses has been that agencies or brands large enough to have personnel dedicated to working with individual teams directly did exactly that, he said.

Even today, despite SV Sports forming lucrative partnerships, the company faces much competition in the video advertising space from the likes of InStadium, Access Sports Media, and Tagboard.

“This [form of advertising] remains an important piece of the fan experience,” said Neuman. “What I love about this model is the fluidity of having brands move in and out, without the need to purchase [intellectual property] rights. This allows advertisers to be very strategic and surgical in what time of the year they want to advertise.”

Selling leftover inventory on the part of leagues and teams to build incremental revenue is a win-win scenario for all parties involved. But Neuman warned in-stadium offerings do require a digital component to help reach as many fans as possible.

“SV Sports thinks this is a great way to augment lower TV ratings. But in some sports, attendance has also been declining as people consume more content in more of a digital environment,” he said. “Without digitally engaging sports fans, you are not reaching the full complement available that advertisers will want to target.”

In response to those concerns, Screenvision CEO John Partilla said the company’s new vertical is not intended to replace the at-home experience, and cannot replace all the viewers lost to digital streaming. Still, a large audience of people want to experience games live, as has been the case traditionally with concerts and movies.

“We want to help advertisers and ad agencies replace diminished eyeballs from linear television,” Partilla said.

SV Sports projects a potential audience of 35 million people for brands to target across all of its league partnerships for the 2020 season.

“When we look at it from a brand perspective, we know they spend a lot of money to reach sports viewers and consumers,” said Eric Krasnoo, EVP of business development at SV Sports. “We are providing the opportunity for those same brands to reach avid fans onsite.”