Just days after confirmation of a $760 million funding round, McLaren announced plans to raise another $620 million in a bond issue.

The transactions are subject to conditions, with the bond issue expected to be classified as one of the lowest-rated types of debt.

It’s not immediately clear how the new fundraising will affect equity distribution.

Bahrain’s sovereign wealth fund held 56% of McLaren’s ordinary shares and 68% of its preference shares as recently as April.

- As part of the new $760 million round, the Saudi Arabia Public Investment Fund and Ares Management invested $550 million in preference shares and equity warrants. Existing shareholders and a “limited number” of new private investors agreed to invest the rest of the amount.

- At the end of last year, MSP Sports Capital said it would acquire a 15% stake in McLaren’s racing division over two years for $247 million at a $746 million valuation.

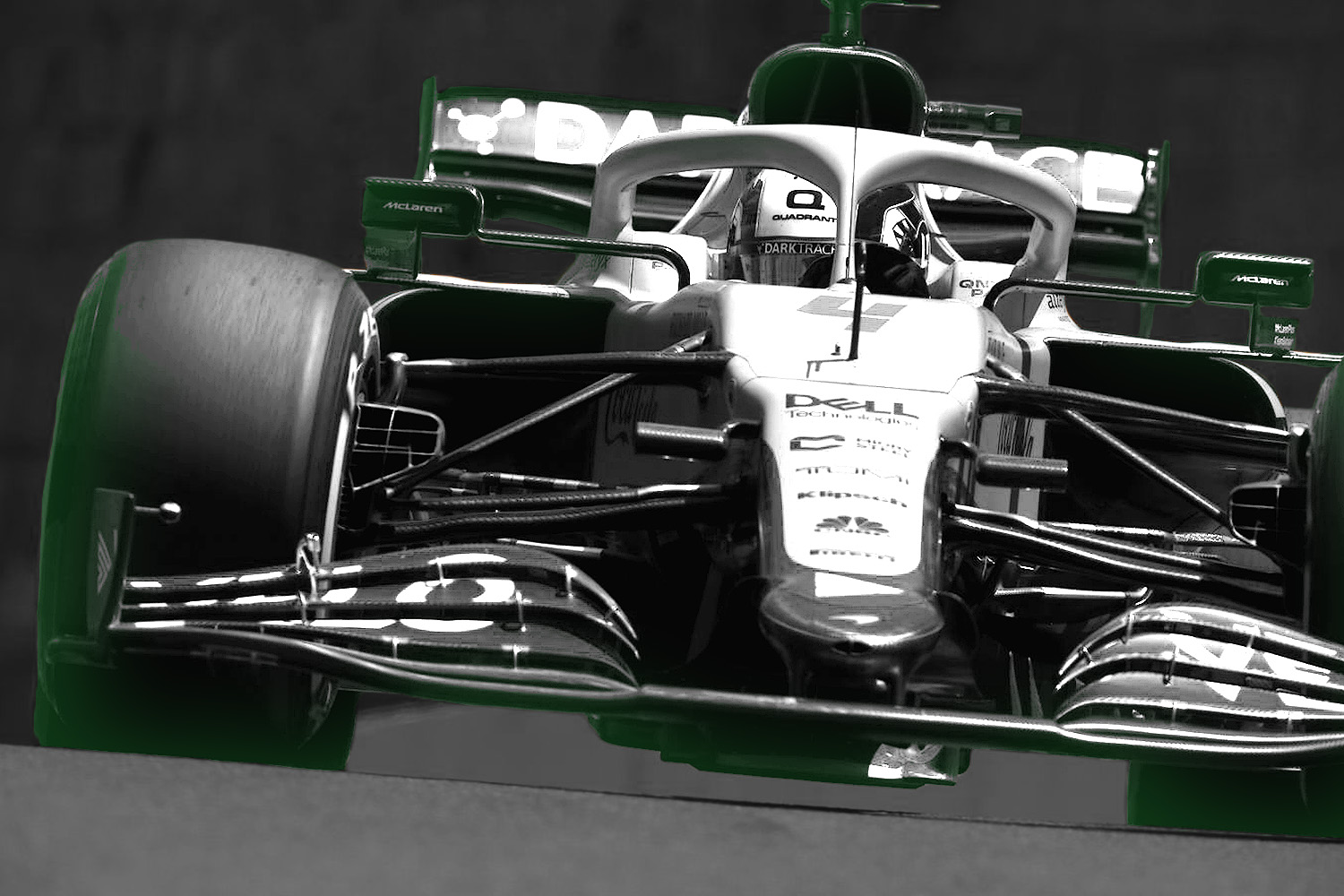

McLaren is aiming for all new cars to be hybrids by 2026. Its racing division will compete in Extreme E as the 10th team of the five-race series.

In Q1 2021, McLaren completed a $261 million strategic investment in McLaren Racing to fully fund its teams through 2023. The same quarter, it reported $260 million in revenue.

![[US, Mexico & Canada customers only] April 13, 2025; Sakhir, BAHRAIN; Oscar Piastri leads George Russell into the first corner at the start of the race during the F1 Bahrain Grand Prix at the Bahrain International Circuit.](https://frontofficesports.com/wp-content/uploads/2026/03/USATSI_25925940_168416386_lowres-scaled.jpg?quality=100&w=1024)