From Cristiano Ronaldo’s contentious departure to reports of the Glazer family’s intentions to sell the club, the last few weeks have been a rollercoaster for Manchester United.

The Raine Group — the investment banking firm advising the Glazers in the sale process — aims to sell the club in the first quarter of 2023 at a price between $7.3 billion and $8.6 billion, according to The Athletic.

Given that Roman Abramovich sold Chelsea for $3.2 billion and RedBird Capital acquired AC Milan for $1.3 billion — and that Forbes values Man United at $4.6 billion, ranking third behind Real Madrid and Barcelona — the asking price for United sounds a bit overblown.

Could Man United really go for over $7 billion? And if so, why?

Skyrocketing Valuations

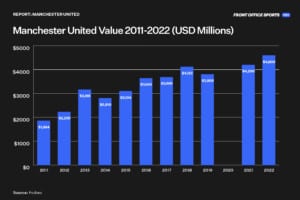

The Glazers acquired Man United in 2005 for about $1.4 billion, but the uptick and relative value of sports franchises has soared since.

- Dallas Mavericks owner Mark Cuban paid $280 million for the team in 2000; today, it is worth around $3.3 billion — an increase of 1,079%.

- The NFL’s 32 teams are now worth an average of $4.47 billion — a 28% increase year-over-year — with the Cowboys leading the list at $8 billion.

- Abramovich bought Chelsea for $233 million in 2003 and sold it for $3.2 billion — an increase of about 1,274%.

For context, the S&P 500 has returned ~302% since 2000.

The valuations of sports franchises worldwide have soared during the last two decades due to new commercial and financial opportunities and the entry of new and bigger partners.

“Higher valuations are a result of increased revenues flowing [from higher demand] for TV and broadcasting rights, the implementation of more restrictive financial discipline measures, and the arrival of more sophisticated managers aiming to streamline the management of these assets,” explained Luis Garcia Alvarez, who runs MAPFRE AM’s Behavioral Fund, which invests 25% of its total assets in European sports-related companies, including Borussia Dortmund, Ajax, and Olympique Lyonnais.

Big Tech’s interest in broadcasting rights expands the demand pool of buyers with deep pockets, raises bid prices, and boosts the related stakeholders’ values. And under growing global inflation, one would assume that a higher valuation is partly a product of the current macroeconomic environment.

The Macro Effect

Prices are usually a proxy for valuation, but they’re not the same. Despite the price someone is willing to pay, valuations are based on multiple factors like assets, net debt, and future cash flows.

One may think that a general increase in prices due to inflation would subsequently increase the value of Man U — but in reality, this is not the case.

“If costs and revenues are rising at the same rate, the net change movement is negligible,” explains Kieran Maguire, Associate Professor in Football Finance at the University of Liverpool and author of “The Price of Football.”

And higher prices don’t necessarily mean higher revenues, thanks to the former’s effects on decreasing demand. “Sport is a discretionary spend, there are fewer fans with spare cash to spend on sports tickets and merchandise,” Maguire adds.

Similarly, the reaction from central banks to counteract inflation is to raise interest rates, which negatively impacts the size of the debt and the present value of future cash flows, decreasing the value of such an organization.

Yet despite its lack of trophies and poor competitive performance in recent years, Manchester United hasn’t suffered from macroeconomic challenges as much as other European teams.

During the pandemic, the Premier League TV deal — which is worth ~$149 million per year, about twice that of the next-largest European domestic deal (La Liga, ~$68 million per year) — served as a massive business moat that protected Man United from a heavy financial burden.

“Bigger clubs did relatively better during the pandemic as they are typically more diversified and do not rely on ticketing revenue as much as smaller teams,” said Alvarez.

Thus, thanks to its relatively “pandemic-proof” profile, Man United continues to draw substantial interest from potential buyers, even amid general economic turmoil.

A Rare Gem

In traditional finance, safe haven assets like treasury bills, gold, real estate, and even art are expected to retain or gain value during economic downturns. Considering that a global economic recession is expected to arrive during Q1 of 2023, the timing for an increased demand for such investment vehicles — and Man United can be considered one — couldn’t be any better.

“Big international soccer clubs with top brand resonance, wide reach, and predictable revenue streams are very scarce,” says Rayde Luis Baez, founder of The Connect and SPORTHINK, an advisory board member for the World Football Summit, and a strategic consultant to top sports brands like the New York Yankees and Euroleague Basketball.

“Additionally, besides its long-term appreciation opportunity in an industry that continues to grow its media and commercial impact, these brands provide a widened sphere of influence in multiple geographic territories.”

An added draw: Ownership of a sports organization is a prime source of status signaling.

“Manchester United is a trophy asset — similar to a Picasso painting. It gives the owner kudos that cannot be generated from owning the usual baubles of billionaires, such as yachts, private jets, or apartments in Monaco,” said Maguire.

But even an appealing asset doesn’t translate to a willingness to overpay.

Manchester United trades in public markets and must disclose its financial information, allowing us to evaluate the premium — the proximity between the market price and the company’s valuation.

A Question of Balance

The club’s latest quarterly report, released on Dec. 8, disclosed relevant information for potential buyers.

Man U announced that the company would stop distributing semiannual dividends — something it has delivered consistently since 2015.

The timing of the dividend suspension ahead of the sale of the club is no coincidence. Instead of distributing any capital gains, the Glazers can keep that cash inside the company to strengthen the balance sheet and increase the valuation.

However, Man United’s cost control and debt management have led to an underwhelming financial performance, with high financial leverage relative to their cash flow generation.

- Maguire says the club spent “£218 million on players in Q1 2023, but transfer fees owing to other clubs increased from £182 million to £307 million, indicating the club had been using installments to acquire talent.”

- “The net football debt stands at a record £909 million — it was as low as £346 million in 2017,” Maguire adds.

- The club’s wage bill has increased by 65% since 2017, but the success hasn’t translated to the pitch — for instance, Man United’s failure to qualify for UEFA Champions League dragged broadcast revenue down by 19.2%.

In times of uncertainty and volatility, news and rumors mainly adjust investors’ expectations — but during earnings season, when results and guidance provide more tools to set expectations, stocks tend to be less volatile.

So what does the market expect of Man United, given the sales hype?

Price vs. Value

As a result of the latest news, Manchester United’s stock has surged over 60%, bringing its market capitalization to $3.54 billion, as the public tries to digest and speculate on the organization’s value moving forward.

In essence, acquiring Man United at the current market price in the public market would be far cheaper than the asking price.

The excess premium to fully acquire the club comes from buying out the class of shares with voting power owned by the Glazers and a few other majority shareholders.

Forbes arrived at its $4.6 billion valuation by factoring in economic performance from matchday, broadcasting, commercial sources, market position, and earnings.

“The only justification for the price sought by the Raine Group is that MUFC is a scarcity asset, and therefore a scarcity premium is attached to it,” explains Maguire.

“Based on business fundamentals, Manchester United is probably worth about ~$4.87 billion, which is benchmarking against Chelsea. Everyone was surprised that Chelsea, as a distressed company that has lost ~$1.09 billion for 19 years, went for such a high price, so this has set the hares running in relation to Manchester United, that it must be on a higher multiple than Chelsea.”

Unlimited Potential

Like any other sports franchise, Manchester United’s on-pitch performance can greatly impact its balance sheet and thus, its valuation.

Qualifying for the Champions League, finishing top of the table, or even winning the Premier League has direct revenue implications.

“Champions League money is worth about four times the money of the Europa League, and there are significant penalties from major stakeholders such as Adidas if they fail to qualify for CL for two consecutive years,” says Maguire.

Besides that, as an organization, Man United has room for improvement in leveraging its brand and technology to create synergistic value-creation opportunities.

“There are opportunities in infrastructure, revenue optimization, fan engagement, commercial strategies, scouting, sports science, and performance or corporate governance, just to name a few,” said Alvarez.

For any value investor, Manchester United will seem highly expensive under its current fundamentals, but the club has global appeal and sky-high potential through different opportunities. It wouldn’t be surprising if someone was willing to pay that much for the club.