The sports industry has survived catastrophic events such as the global financial crisis of 2008 and the dot-com bubble in 2001, but the current macroeconomic environment has presented new challenges for the industry — particularly live sports events.

It didn’t take long for fans to flood back to live sports after governments lifted COVID-related restrictions in late 2021 and the beginning of 2022.

The problem? Things felt a bit pricier than usual due to high levels of inflation.

For a product, service, or experience, its inflation reflects growing demand and one or many cost increases in its components.

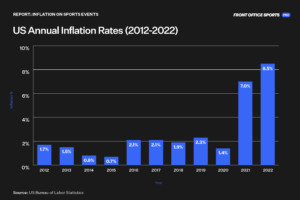

The US dollar annual inflation rate, which historically averaged about 2.5% for the last two decades, currently stands at 8.5% but reached a massive 9.1% rate in July — the highest it’s been since 1981.

These inflation levels can be primarily attributed to the measures taken in response to the pandemic, the war in Europe, and supply chain disruptions from shifts in consumer demand and lockdowns in China.

Changes in consumer pricing force companies to adjust and raise prices to maintain high margins and continued profitability — usually resulting in decreased demand and consumer discontent.

Furthermore, inflation creates a domino effect where changes in pricing for one product usually lead to subsequent price changes in related products, services, and experiences. Hence, the end consumer will usually be the one paying inflation costs.

As a result, millions of products, services, and experiences — including live sporting events — are impacted by the current price rises around the world.

Due to the business structure of live sports events, the most critical components that directly suffer from inflation are tickets and concessions. Changes in consumer sentiment and the reductions in consumer savings and disposable income indirectly impact the growth of sports events.

Concessions

Generally, concession prices are often higher in sporting and entertainment venues compared to regular restaurants and food courts.

Due to its volume and high margins, concessions could be considered one of the most lucrative sources of income for live sports events:

- Within the business model of in-person live sports entertainment, concessions make up over two-thirds of a facility’s revenues — leaving the rest to sales generated from tickets, parking, and merchandise.

- NFL teams typically generate about $1 million to $2 million in concessions sales on game days.

- Drinks have profit margins of over 90%, popcorn around 82-92%, and pizza from 69% to 75%.

High inflation not only harms the demand for concessions but can also cause general consumer discontent with potentially reputation-damaging effects.

- The PGA Championship in Southern Hills outraged some fans online for selling regular beer for $18, a bottle of water for $6, and 19-dollar cocktails.

- Earlier this year, the Super Bowl hosted at Los Angeles’ SoFi stadium charged $17 for a draft beer, $12 for a hot dog, and $7 for a fountain soda.

According to Team Marketing Report (TMR), the sports marketing firm that measures the Fan Cost Index (FCI) — the cost for a family attending a match, buying four average-priced tickets, one parking spot, two draft beers, four sodas, four hot dogs, and two souvenirs (hats) — found that the 2021 MLB season saw a 4.5% increase in FCI, compared to 2020, the largest in more than a decade.

However, the TMR report found that the acceleration in the 2022 MLB FCI was mainly due to increases in ticket prices for the 2022 season, as teams kept concessions relatively flat.

- Beer per ounce increased 2.2%

- Soft drink per ounce increased 0.1%

- Hot dogs decreased 3.1% to $5.13 from $5.29 in 2021

These flat movements (relative to the current 8.5% inflation rate) can be explained in two ways:

- Prices were already high in 2021 due to the pandemic and have stayed high since.

- Some teams aimed for a “fan-friendly” reputation and radically decreased their concession prices, bringing down the average.

Due to the value of that practice, teams from other leagues have taken steps toward it: The Houston Texans and the Atlanta Falcons have dropped their concessions prices drastically.

Tickets

It is customary for tickets for sports events to experience inflation close to the regular rate. According to the inflation calculator in2013dollars.com, the average annual inflation rate for attending sports events between 2000 and 2022 was 2.88%. In other words, sports events costing $100 in 2000 would cost $186.75 in 2022. In essence, the inflation rate for live sports during this time was more significant than the national inflation rate of 2.39%.

The amount of stadium innovation, constructions, renovations, and stadium improvement projects we’ve seen lately prove that with the pandemic exceptions in 2020 and 2021, the live sports ticket market has been going through a linear continued growth trend.

- Grand View Research estimated that the ticket market for global sports events in 2021 was valued at $6.45 billion and expected to grow to $18.7 billion by 2028 under an appealing compounded annual growth rate (CAGR) of 16.5%.

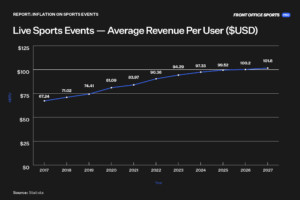

- The average revenue per user (ARPU) of sports events was $67.24 in 2017, and Statista estimates that number will grow to $101.6 by 2027 — representing a 51% increase in revenue per user in 10 years.

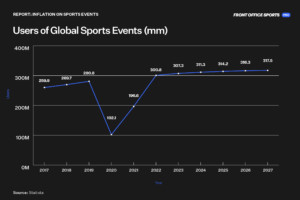

- Statista also found that the number of users attending sports events will grow from 300.8 million in 2022 to 317.5 million in 2027.

Data backs the demand growth for sports events tickets. Nevertheless, aggressive price hikes slow growth down, and ticket prices for sports events are also victims of inflation:

- According to secondary market platform SeatGeek, secondary tickets for the 2021 NFL season were selling for an average of $411 — a significant increase of over 34% compared to the 2020 season average of $305. The average in 2019 was $258 (18% less than in 2020).

- For the 2022 MLB season, the Team Marketing Report estimated that the average ticket price increased 3.6% from the 2021 season.

Ticket pricing is dynamic, and prices move in response to demand — organizers and secondary market ticket holders can track demand and apply price discrimination to sell as many tickets as possible.

Consumer Sentiment and Consumer Behavior

Some economic indicators, such as the recent unemployment rate of 3.5% — the lowest in 50 years — have held up well in the face of rising prices, but there are several worries that the U.S. economy may be heading for a recession.

The academic opinion on consumer behavior toward sports events is somewhat mixed. Dennis Coates, a sports economist professor, suggests that sports fans are “unresponsive to price changes.” Judd Cramer, a sports economist at Harvard University, says savings generated partially by COVID stimulus payments and support programs are “helping people afford to pay the high prices in sports.”

Consumer sentiment — the indicator that tracks consumer confidence and optimism about the economy — has been falling sharply lately, suggesting that consumers are more fearful now, even compared to how they felt at the peak of the pandemic lockdowns.

Looking Forward

Sports events have outpaced inflation levels in the past, but these numbers were always close to the actual rate.

In a hierarchy of basic human needs, live sports entertainment is relatively low. The mix of low consumer sentiment, a recession, and continuously high inflation all have the potential to stagnate the expected growth of live events.

If the current market conditions continue with significant price increases, demand will likely slow down for tickets and concessions.

For tickets, we could expect a transition to subscription-based business models in the coming years to replace general admission ticket sales — maybe even powered by blockchain technology. And for concessions, it seems like the extreme prices that have generated massive margins will not be sustainable. Unless event organizers want to harm their reputations, concessions will likely drop to more regular prices or stay flat in the coming months.