Grand Slam Track’s latest bankruptcy filings show the league is in dire financial straits.

The league is requesting court approval to receive more cash from Winners Alliance, its former-minority-investor-turned-lifeline. The move is a standard part of the bankruptcy process, one expert tells Front Office Sports, but the new documents contain previously unreported information about Grand Slam’s finances.

The track startup founded by Olympic champion Michael Johnson held three meets this spring featuring some of the sport’s biggest stars, promising to pay them big sums in appearance fees and a whopping $12.6 million in prize money. Then in July after canceling its fourth meet, Johnson revealed on Front Office Sports Today that, despite proclaiming earlier that his league had more than $30 million in its coffers, an investor had reneged on a deal and caused a “major, major cash flow issue.” The league nearly went under earlier this fall before existing investors provided up to eight figures of emergency financing. Grand Slam used that funding to pay athletes about half of what they were owed, but some vendors rejected a deal that would similarly get them up to half of what the league has ever owed them. On Dec. 11, Grand Slam filed for Chapter 11 bankruptcy, a restructuring process rather than a total shut down.

One filing reveals Grand Slam only has about $143,000 in cash on hand. All of that money is cash collateral owed to Winners Alliance as a secured creditor. Winners Alliance is the for-profit arm of the Professional Tennis Players Association. The group led Grand Slam’s initial funding round, helped orchestrate the emergency financing earlier this fall, and was already the league’s biggest creditor. It is chaired by billionaire Bill Ackman.

In total, Grand Slam has about $31.4 million in debts, according to the filing.

Grand Slam owes Winners Alliance about $11.4 million: the first roughly $5.3 million of those debts are secured, while the other more than $6.1 million is unsecured, the filing says. Then, the league owes about $7 million to athletes and roughly $13 million to vendors, according to the filing.

In bankruptcy proceedings, when the company doesn’t have enough money to get through the Chapter 11 process, it’s common for a secured creditor to provide a fresh loan. This new post-petition loan, known as debtor-in-possession (DIP) financing, often has special perks to protect the lending company, such as higher interest, and it gets repaid first before any secured or unsecured debts the company owed before the bankruptcy filing. Grand Slam reached out to 11 different entities to secure a DIP proposal, and Winners Alliance was the only one that agreed, the filing says.

“In many cases, it makes sense that the pre-petition secured creditor is at least the first option—if not the only option—to lend more money to the debtor based on its needs to get through the bankruptcy case,” Jimmy Zack, a bankruptcy attorney at Ballard Spahr, tells FOS.

In Grand Slam’s proposal, Winners Alliance would give the league $2.9 million to stay afloat. This would be broken into $1.1 million for an interim order, which could be green-lit on Tuesday morning in Delaware bankruptcy court, and an additional $1.8 million when the plan gets final approval from the court. Winners Alliance’s DIP loans would have an annual interest rate of 14.5%, the filing says.

Another aspect of this process is called a “roll up,” in which some of the lending company’s pre-petition secured debts can get moved onto the post-petition side of the equation, which triggers those special perks like higher interest. Grand Slam’s filing says it would roll-up $1.1 million of Winners Alliance’s pre-petition secured debts in the interim agreement, and an extra $3.25 million in the final.

That means, if or when Grand Slam is able to pay back its creditors, Winners Alliance’s higher-interest post-petition debts get paid back first, then whatever remains of its pre-petition secured debts. All the other unsecured creditors like athletes and vendors—and, once again, Winners Alliance—would have to go after these payments.

“The general theory would be that all creditors would be best served by the debtor emerging from bankruptcy reorganized and have the ability to stand on its two feet, so if it doesn’t have the cash right now to be able to get there, then it needs to borrow some cash post-petition,” Zack says. “Otherwise without that, there probably wouldn’t be a viable bankruptcy proceeding because there wouldn’t be any funding to get through the case, both from an operational perspective and the need to pay the legal counsel.”

The proposal will be discussed at a Tuesday meeting hearing in Delaware bankruptcy court.

“Absent immediate approval of interim DIP financing and authority to use Cash Collateral, the Debtor would be forced to curtail or cease operations within weeks of the Petition Date, resulting in immediate and irreparable harm to the estate,” one filing reads.

Earlier this month, before the league filed for bankruptcy, a spokesperson for Winners Alliance told FOS: “We believe in the vision of Grand Slam Track, and we’re hopeful that whatever comes next leads to a resolution and the strongest possible future for the league.”

On Monday, a spokesperson for Winners Alliance said in a statement to FOS: “Our goals have been the same throughout. This is how we effectuate that.”

A new spokesperson for Grand Slam did not respond to a request for comment. The firm that previously handled the league’s communications is now listed as a creditor that is owed hundreds of thousands of dollars.

Recent filings allege a pressure campaign by vendors that Grand Slam says forced it into filing for bankruptcy. Last week, Grand Slam filed another document that specified that the league filed for bankruptcy “in response to an imminent involuntary chapter 11 filing threatened by certain unsecured creditors.” Creditors filing an involuntary bankruptcy proceeding isn’t common because it can be costly and risky, but just the vendors’ threat was enough pressure to force Grand Slam’s hand. “In December 2025, a group of creditors delivered a written threat that they intended to commence an involuntary insolvency proceeding to liquidate the Company,” one of Sunday’s filings read.

Also last week, dozens of other “vendors, suppliers, and counterparties” were listed in a filing that identified many of the previously unnamed companies owed money by Grand Slam. The league’s 20 biggest creditors, a list that includes several Olympic athletes, have been posted as well, along with how much they are each owed.

One of Sunday’s filings includes more details. The document says Grand Slam hired the firm PJT Partners to go out into the market to get investors. PJT contacted more than 150 potential investors from January to March 2025 and held more than 30 pitch meetings, but “many potential investors declined to move forward, citing concerns over the early-stage nature of the league, the absence of operating results, and the uncertainties surrounding media and sponsorship revenue,” the filing says. Another reason was “the lack of a committed lead investor,” a different filing from Sunday says.

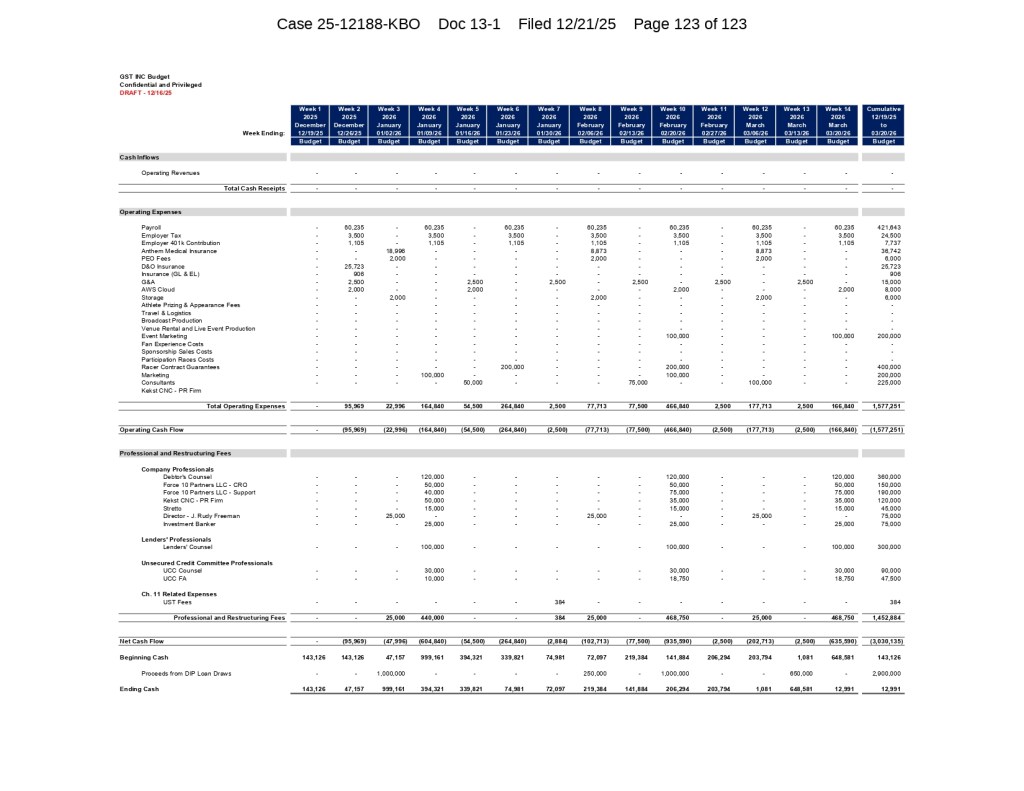

The league also proposed its 13-week budget, a standard time frame for companies going through Chapter 11; the proposal covers Dec. 19, 2025 through March 20, 2026. More than $600,000 of the proposed budget is set aside for marketing and PR, despite Grand Slam having no planned events in this time period, and a large chunk of money is set aside to recruit athletes back to the league.

The league proposed a budget that would have total operating expenses of more than $1.5 million by March 20. The biggest single anticipated expense would cover payroll with more than $420,000. The next largest expenses would be $400,000 for forward-looking “racer contract guarantees,” $400,000 divided evenly between “marketing” and “event marketing,” and $225,000 for “consultants.”

The budget lists an additional nearly $1.5 million for professional and restructuring fees during the Chapter 11 process. The biggest chunk of these expenses are legal fees, covering attorneys for the league, Winners Alliance, and “unsecured credit committee professionals.” (Creditors are allowed to band together, and did so in January.) Its new public relations firm Kekst CNC is slated for $120,000, the budget says.

When the proposed budget period ends in March, the league would have burned through most of its $143,000 in cash and the $2.9 million DIP loan from Winners Alliance, and have just under $13,000 left over, the filing says.

Editor’s Note: A previous version of this article incorrectly stated the proposed budget’s allocations for marketing, consultants, PR, and racer contract guarantees. These have since been corrected.

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)