In less than a year, GOAT Group has more than doubled in value.

The resale market raised $195 million on a $3.7 billion valuation in a Series F round led by Park West Asset Management. That’s a 111% bump from the $1.75 billion valuation it received on its $100 million raise in September.

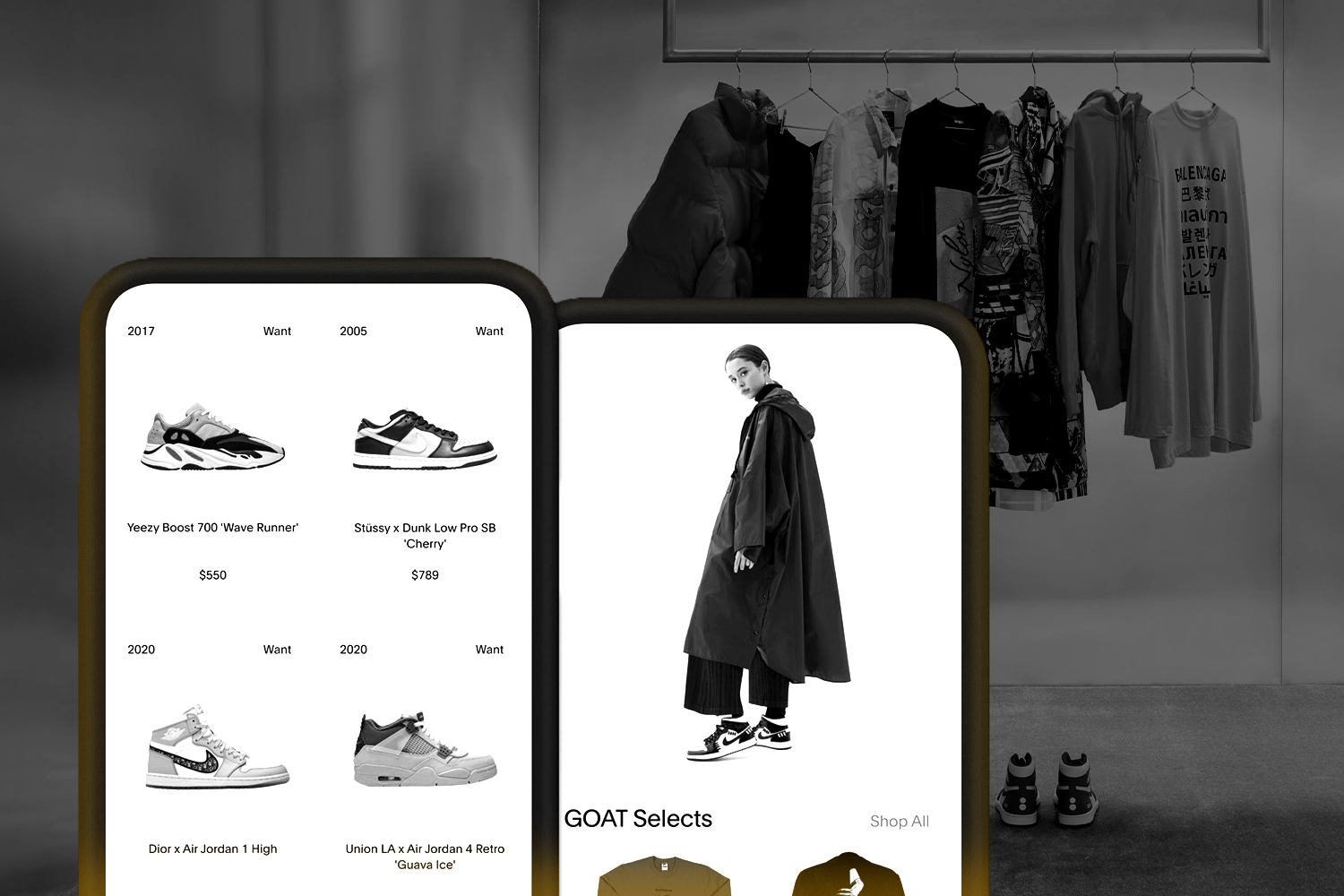

GOAT Group, which runs the GOAT online marketplace, has emerged as one of the winners of the sneaker craze. The market offers hard-to-find, second-hand sneakers and clothing, while also partnering with brands like Gucci as a retail platform.

- GOAT claims $2 billion in sales on its platform over the last 12 months.

- Sneaker sales on GOAT have doubled over the last year; apparel sales have grown 500%.

- The platform boasts 30 million customers, 80% of which are millennials or Gen-Zers.

Unlike StockX, which also sells gaming gear and collectables, GOAT focuses on sneakers and apparel. StockX received a $3.8 billion valuation in April and is expected to go public as soon as this year.

Market analyst Cohen Equity Research estimated that the global sneaker resale market could grow to $30 billion by 2030, up from $6 billion in 2019.

GOAT said it would use the funds to expand its operations, particularly in Asia. It is building fulfillment centers in China, Japan, Singapore, and Chicago to bring its global total to 17.