After an obscure NFL career, Jack Brewer made his reputation as a savvy businessman.

On Friday, a New York federal judge ruled that Brewer committed insider trading after using information he acquired from one of his clients to net an extra $35,000 from a stock selloff.

The SEC first accused Brewer of insider trading in 2020, when it sought to ban him from trading penny stocks. It refiled its case in 2023 and was granted summary judgment on Friday.

In her ruling, judge Jennifer Rearden concluded Brewer committed insider trading when he sold stocks in COPsync, a struggling software company.

“There is no genuine dispute” that Brewer acted on material non-public information, she wrote in her ruling.

“We decline comment beyond public filings on the matter,” an SEC spokesman said in an email to Front Office Sports.

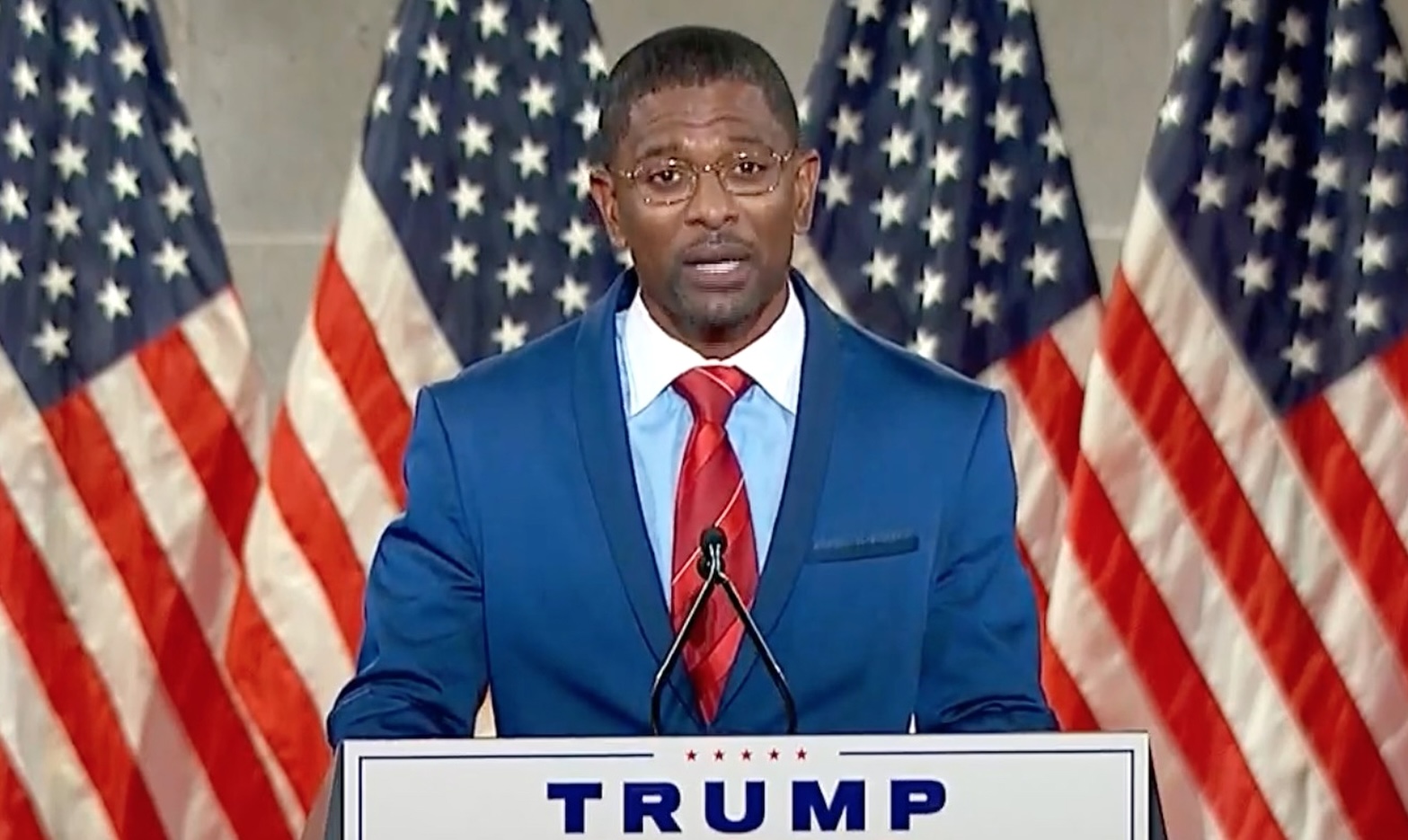

Brewer played in 40 games over five NFL seasons from 2002–06 and spent the first two seasons with the Minnesota Vikings. After his playing career ended, he started a private investment fund called The Brewer Group and contributed regularly to CNBC and Yahoo Finance. He has made a recent political turn and gave a speech supporting President Trump at the Conservative Political Action Conference in March.

In August 2015, Brewer & Associates Consulting LLC–another business of Brewer’s–signed an agreement with COPsync, which develops communication systems for law enforcement; he later became the face of the company.

In May 2017, COPsync would face delisting from the Nasdaq if it didn’t raise $4-$5 million in equity. To raise it, the COPsync announced a stock offering.

The SEC alleges that Brewer received this information before it went public and was told that the capital raise would fall short, which would cause the company to be delisted from the NASDAQ. Brewer—who knew the company was running out of money—instructed the company’s COO to sell his COPsync shares on Jan. 5, 2017, a day before the company announced the stock offering.

COPsync’s stock price plunged after the announcement, the SEC said. Brewer sold his shares at a higher rate than the closing price, which netted him an extra $35,178 than he would have received had he sold the stocks at its closing price.

Brewer’s attorneys did not immediately respond to a request for comment. Judge Rearden asked both sides to file a “joint letter proposing next steps” by June 9.