Manoj Bhargava is proud of the companies he’s killed.

The 5-Hour Energy tycoon’s office in suburban Detroit was at one time a tribute to competitors he put out of business with the help of a law firm based in the same building. His workspace was adorned with the tiny bottles of fallen competitors he sued out of existence. Over the last few months, it seemed like the Indian-born entrepreneur was trying to add Sports Illustrated to the graveyard. He failed but left wreckage behind him.

Bhargava, in his capacity as the person controlling a business called The Arena Group, oversaw the most-troubled three-month span of SI’s nearly 70-year history, a reign that kicked off in earnest in December with the firing of top Arena executives; an awkward introduction to the company’s employees (including SI staffers), where he told them to “stop doing dumb stuff”; layoffs; apparent meddling in editorial decisions; and threats to end SI’s print edition.

All of this capped a series of events dating back to 2019 and involving a bewildering array of blandly named (and renamed) corporations and their confusing business arrangements. The steady drip of news about SI has, as it turned first into a trickle and then into a flood, left all but the most dedicated followers of sports media news perplexed. Front Office Sports is here to help, by answering the questions we suspect a reasonable person might have here.

Why was Sports Illustrated in the news last week?

Until this past week, The Arena Group—formerly known as Maven—operated SI’s print and digital publishing rights, though it did not own SI, having paid a lot of money to a company called Authentic Brands Group for the right to do so. Partly because of the complete collapse of the ecosystem propping up advertising-supported journalism, partly because of broad mismanagement over the last several years, and partly because of the above-mentioned machinations, Arena—and therefore SI—was on the verge of cratering.

At the last second, because of a missed payment to Authentic, Arena lost the rights to operate SI at all, and Authentic selected a company called Minute Media, which owns a variety of sports-related digital media properties, to take over.

“Authentic Brands,” eh?

Authentic is a company that owns about 60 mostly (depending on your perspective) storied or Boomer-adjacent brands—from Elvis Presley’s intellectual property rights to Brooks Brothers to Reebok—and then licenses those brands’ rights to others. (Whether you feel this is savvy exploitation of intellectual property law or socially useless middlemanning probably aligns with how you feel about the term “Authentic Brands.”) The company saw SI as a natural, easy fit for its portfolio, with the idea being to get someone else to pay for the laborious work of putting out a sports publication and retain the right to make money by attaching the vaunted name to, for example, Super Bowl parties. That this wasn’t a journalism play was obvious from the second it bought the company and became even more so late in 2019, when Authentic entered into a 10-year, $150 million deal with Maven to operate and publish SI.

How did Authentic come into the picture here at all?

This goes back to Time Inc., the original owner of SI, which launched the iconic magazine in August 1954 as a sort of sports equivalent to Time or Life—magazines that were, as business propositions, something like the Netflix or Google of their day. Eventually, that day passed, and four years after Time Inc. was spun off from Time Warner, Meredith Corp. acquired Time Inc. for $2.8 billion in 2017, then began parting it out. Authentic picked up SI in May ’19 for $110 million. As things go, the setup is the rough equivalent of you paying $500 for a 1998 Toyota Tercel that has a slipping clutch, with your actual plan being to get someone else to pay you $1,000 for the right to repair that two-door jalopy and enjoy any profits they get from using it.

So Arena buys the right to drive SI. Then what?

Long story short (though you can read in more detail here, here, here, and here), Maven decided to turn SI into a content mill, met pushback from its unionized staff, and changed its own name to The Arena Group. Staffers were laid off, the print schedule was reduced from bimonthly to monthly, and the playbook by which owners of media properties seek to maximize profits by offering less of a lesser product was in all carried out. The cutbacks continued at SI, as they have at many other traditional outlets in the digital age, and things proceeded. It wasn’t until Bhargava entered the picture late last year, after purchasing a controlling interest—and tons of debt—in The Arena Group, that the Tercel’s gas tank got filled with 5-Hour Energy.

What caused this breakdown?

In late December, Arena missed a $3.75 million payment to Authentic—whose only real involvement here, remember, was supposed to be collecting payments from people who had agreed to be in charge of this whole mess. That put Arena in default on its deal, and Authentic terminated Arena’s contract Jan. 18. Arena remained SI’s publisher, though, for want of anyone else; Authentic simply owns things, rather than run them. Thus the outlet remained in limbo.

How did Bhargava come into the picture?

Bhargava, 71, was once described as a “reclusive monk” by Forbes. When he did that rare interview in 2012, he claimed to be the richest Indian-born U.S. billionaire—a distinction he does not appear to have maintained. (The Princeton dropout hasn’t been on the Forbes’ billionaire list since ’13, and four U.S. billionaires not named Manoj Bhargava on the most recent list were born in India.) But 5-Hour Energy’s two-decade-long domination of the tired-trucker-and-stressed-out-college-student market meant that Bhargava built a fortune, so he apparently had the cash to purchase Arena—even as he’s been the subject of an IRS probe for years.

Arena executives initially welcomed Bhargava’s investment, which included the promise of a five-year, $60 million advertising commitment to tout his 5-Hour Energy and other companies. Insiders said Bhargava looked at Arena and SI as a vehicle (likely not a discontinued Toyota) to more cheaply serve ads to consumers.

What was the response after he took over?

Bhargava clashed with Arena execs and the SI union, especially after Arena announced layoffs in December, which led to the filing of multiple grievances.

“He told us he wanted to make news what it used to be,” a person with knowledge of Bhargava’s introduction to Arena’s management told FOS. “He thought there was bias in the news and he said he wanted to take it back to how things were reported in the 1970s.”

This wasn’t the first time that Bhargava, a major donor to GOP candidates and causes, employed this Elon Musk–esque approach. One of his ventures, for example, was Bridge Media Networks—a group with small TV signals around the U.S. that broadcasts Sports News Highlights and NewsNet. (NewsNet’s tagline is “News … as it used to be.”) Like the rest of Bhargava’s empire, the profitability and viewership reach of Bridge Media Networks—which Bhargava is looking to fold into Arena—is unclear.

So, under Bhargava, Arena just stopped paying to control SI but nonetheless controlled SI?

Yes—a weird situation, and one Authentic tried to solve by finding someone else to take that Tercel and enjoy the profits to be had by using it.

I bet there were lots of takers.

You’d be surprised! This was a really, really, nice Tercel when it was made, and with some care and attention it would make a lovely addition to anyone’s driveway, or be something you could sell to someone who finds a 93-horsepower car rad. Several media companies—including Penske Media, Vox Media, and others—reportedly kicked the (tiny) tires. But offering someone the chance to fix up a car they’re just leasing is not quite so appealing as just selling it to them; Authentic’s insistence on owning SI, which means that in the long term it will capture the value of anything anyone else does with it, cooled demand. A company called Minute Media was the clear front-runner before Monday’s announcement that it had secured SI’s publishing rights.

I’ve never heard of Minute Media.

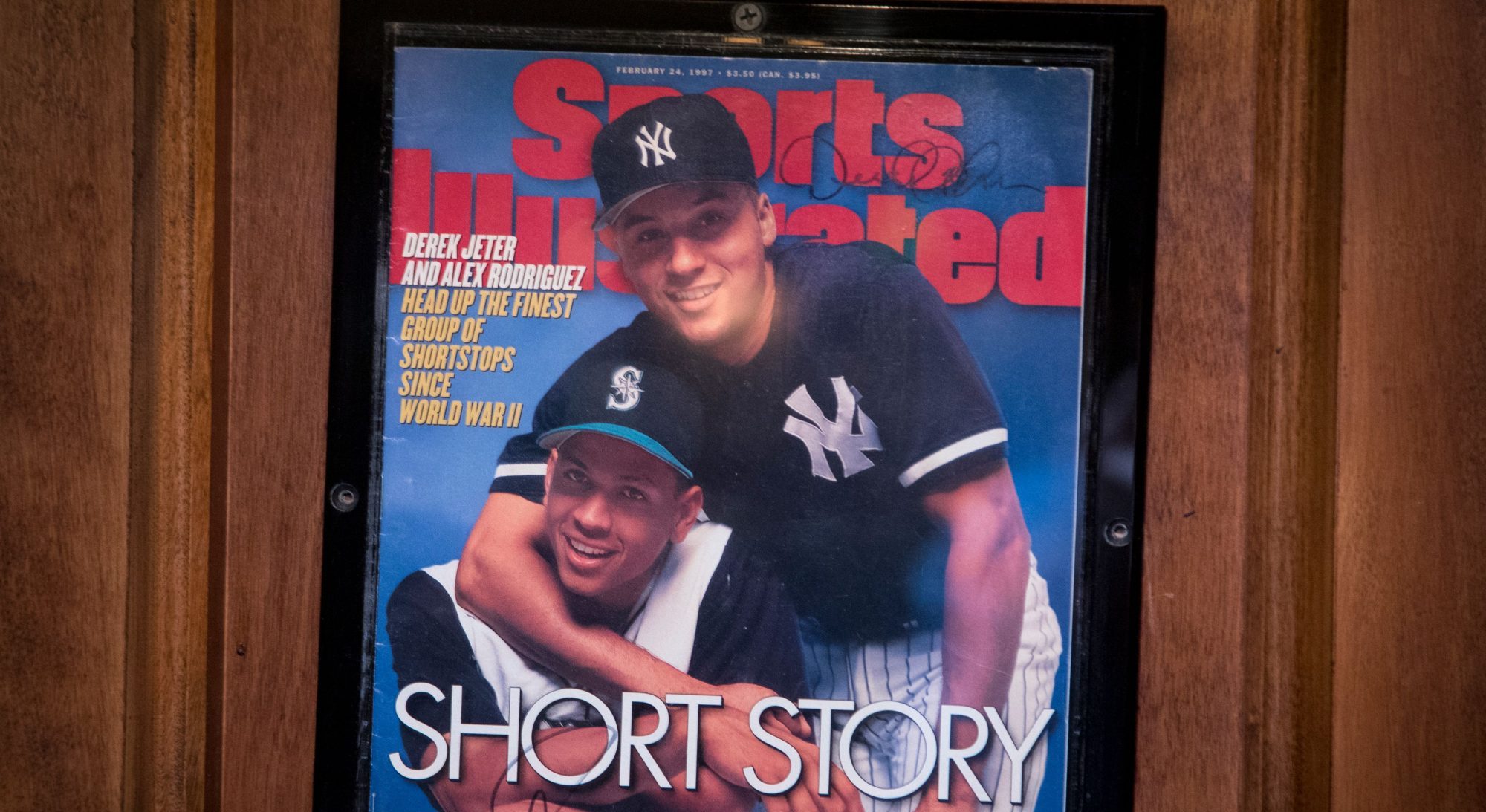

In 2011, Minute Media was founded by Asaf Peled, a former Cisco exec, in Israel. (Peled now calls London home.) The company grew out of the soccer site 90min and originally focused on short-form digital content using something called the Voltax platform, which it licenses to other media companies. Minute Media got into the long-form game with its ’19 purchase (for an undisclosed amount) of The Players’ Tribune, a sports site founded by Derek Jeter that presents stories ghostwritten for athletes as stories by athletes. (Many are quite good!) Minute Media also purchased The Big Lead in ’19 and acquired FanSided a year later.

Minute Media was valued at $1 billion and profitable, Axios reported in January.

How much is it paying?

Arena was effectively paying $15 million per year to publish SI. Neither Authentic nor Minute Media has disclosed how much the new 10-year deal that has two 10-year extension options is worth. Both Authentic and Minute Media are privately held companies, but two industry insiders estimate that Minute Media is paying at least $10.5 million per year.

Great for Authentic, I guess, but what’s the future of SI?

That’s complicated.

How about the print edition? That’s what I think of when I think of SI.

Bhargava tried to kill SI’s print version earlier this month, but insiders scoffed at that mandate. It had already become clear that Arena’s run as SI’s publisher was about to end, so any changes—like making May the last time SI would put out a physical issue—would be reversed by SI’s next operator.

And that’s indeed the case now that Minute Media has the reins. Now comes the hard part: printing and distributing the magazine without hemorrhaging money. This will be the first time Minute Media has done print.

“It’s hard to make sense of print unless you’re already in the print business,” says one longtime print media exec who spoke to FOS on the condition of anonymity. “You don’t have any efficiencies you have in digital media. You don’t have any scalability. So as a one-off print obligation, it can be hard to make it all work out if you’ve just been in the digital space.”

In the last circulation audit, SI had 1.2 million monthly subscribers for its print product—less than a third of the magazine’s reach three decades ago. Print hasn’t been a major driver of revenues for SI for some time, and insiders told FOS that it, in recent years, cleared $2 million to $4 million in net revenue.

Weren’t SI’s staffers all laid off?

The news that SI was free from the clutches of Arena was immediately welcomed by staff, many of whom are part of the SI bargaining unit, boasting about 80 members, which faced layoffs at the end of April if Authentic didn’t tap a new publisher.

“Minute Media coming in like the white knight for SI,” NFL reporter Matt Verderame wrote on X (formerly Twitter). “I can’t express how thrilled I am to see Minute Media getting the SI license.”

But outside of some managers, most SI employees aren’t yet Minute Media employees, although they aren’t welcome at Arena, either, as their emails (and all Google Workspace services) were shut down Thursday night, multiple sources told FOS. It’s expected the vast majority of SI employees and even some fired by Arena during Bhargava’s lordship will become Minute Media workers in the coming days.

What about the SI swimsuit edition?

When print circulation numbers were at their peak, the swimsuit edition was a major driver of revenues for SI’s original owner, Time Inc. The iconic one-off title launched in 1964 at one point accounted for about 15% of SI’s revenues. The SI swimsuit edition became a stand-alone product in 1997 and, as recently as 2005, netted $35 million in ad sales alone.

But in recent years, the SI swimsuit edition has teetered on unprofitability amid the digital shift in media. Days before Bhargava tried to kill the SI print edition, there was talk that he wanted to shutter the SI swimsuit edition altogether. Authentic reclaimed the SI swimsuit edition earlier this month, although Arena still laid off its entire staff, sources close to SI told FOS.

Minute Media is now in control of the edition, and SI swimsuit edition staff are expected to be brought on board to continue work on the 60th anniversary edition. Now ask me about SI FanNation’s future.

What is SI FanNation and what is its future?

What a great question! Minute Media now has the rights to SI FanNation, which Time Inc. acquired in 2007. Under Arena, FanNation grew to about 160 sites that cover individual college and pro teams, along with some sport-focused sites—it might not be what you think of when you think of SI, but it has been a major driver of revenue for Arena in recent years. Some team-dedicated sites have brought in as much as $1 million annually, according to multiple sources with knowledge of the finances.

Seriously?

Seriously—perhaps Maven was on to something with its content mill plans, it turns out. The top three FanNation bosses, including FanNation senior VP Mark Pattison, left Arena last week to assume the same positions at Minute Media. The process of onboarding the roughly 300 FanNation contractors is ongoing, and Arena is clearly making every attempt to keep FanNation at Arena. There’s also the fact that FanSided (an existing Minute Media network of a similar ilk) and FanNation serve the same audience, which could lead to staffing numbers being reduced when the integration process is complete.

What’s the future for Arena?

There’s been talk that Arena would rebrand its remaining sports assets (like The Spun, The Hockey News, and Athlon Sports) into a new, sports-focused vertical. Beyond sports, Arena also owns The Street, Men’s Journal, and the Parade Media Group.

Most of Arena’s assets rely on digital advertising, a market that has been rocky over the last year. Minus SI, Arena’s prospects don’t look all that great at this point.

Without SI, the employee count is roughly 300 employees, and Arena could conceivably make a modest profit (less than $10 million per year) if Bhargava takes the company private (and potentially further reduces employment costs), one person with knowledge of the company’s financial setup tells FOS. That means it will take years for Bhargava to recoup the roughly $110 million he’s already spent (stock and debt purchases) and as much as $37 million in loans to Arena that he’s backed.

“We are very bullish and excited about our future of The Arena Group without Sports Illustrated, parts of which broke even or lost money,” an Arena spokesperson told FOS.

Arena still owes Authentic a $45 million termination fee and could become liable for more in litigation. Authentic is considering a breach-of-contract lawsuit against Arena, one source with knowledge of those talks said. Arena could also face lawsuits filed by shareholders and former executives.

The roughly 10 lawyers who operate out of Bhargava’s company headquarters in Farmington Hills, Mich., will be doing some work related to what Bhargava did to that Tercel.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)