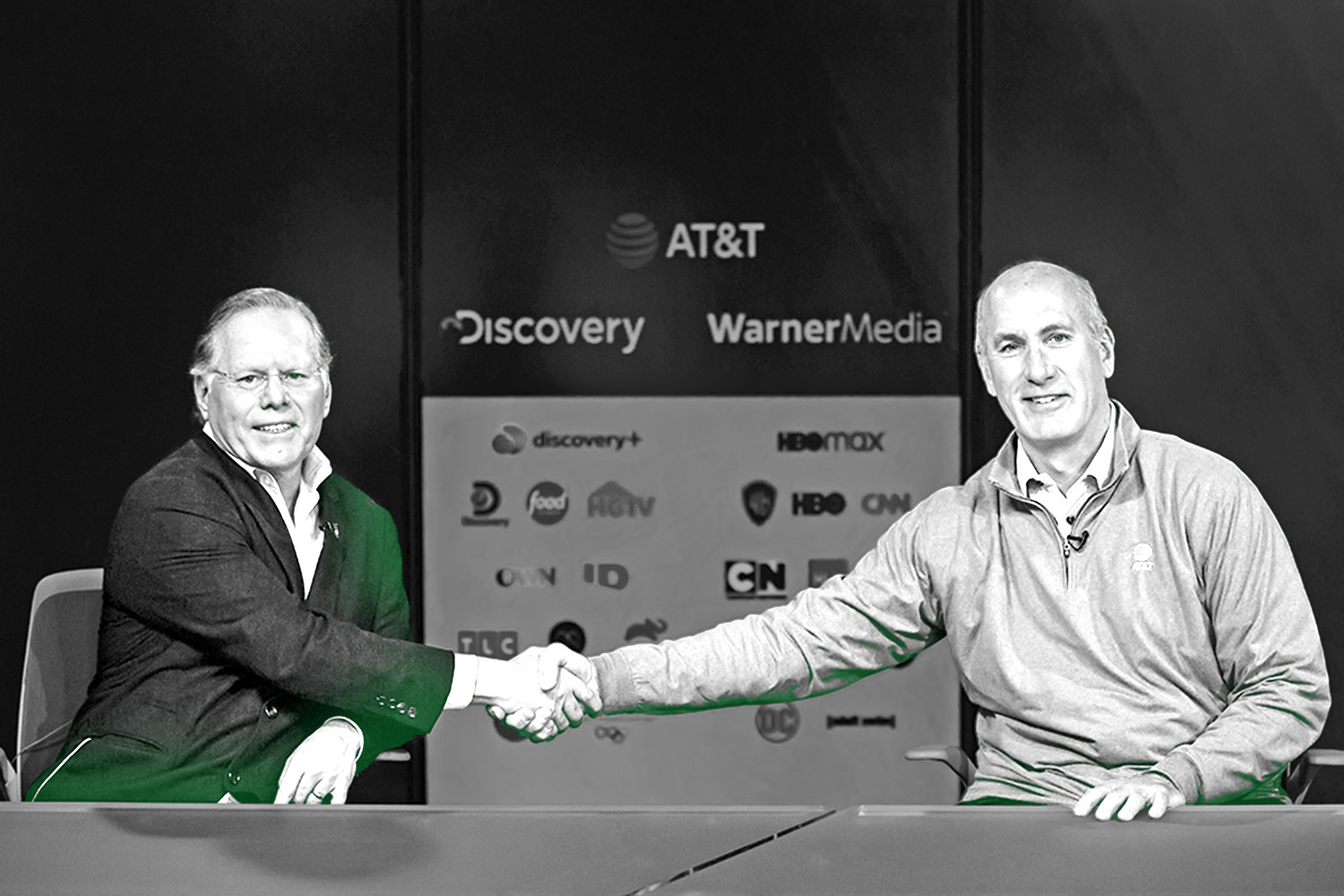

The historic Discovery-WarnerMedia mega-merger will be able to proceed as structured after it received approval from the IRS.

The $43 billion deal will bring together WarnerMedia’s Turner Sports, TNT, TBS, CNN, Warner Bros., HBO, and Discovery’s Eurosport, Food Network, HGTV, and others.

Discovery also has the rights to the Olympics across Europe through 2024 in a six-year, $1.5 billion deal, and is reportedly in talks to form a joint venture with BT Sport, which holds U.K. Premier League rights.

On Wednesday, WarnerMedia-owner AT&T revealed that the deal received a favorable rating from the IRS as a “Reverse Morris Trust,” a transaction type designed to be tax-free for shareholders.

- Under a Reverse Morris Trust, AT&T will first spin off WarnerMedia before merging it with Discovery.

- To remain tax-exempt, AT&T shareholders must retain a majority stake in the company. As currently structured, they will receive 71% of the new company’s shares and be able to name seven of 13 board members.

- Discovery CEO David Zaslav and CFO Gunnar Wiedenfels will run the new company.

Not a Done Deal

While the merger received the blessing of the European Commission earlier this week, Democratic lawmakers wrote to the Department of Justice this month asking for close scrutiny of the deal.

If completed, the combined entity will be worth around $130 billion and hold broadcast rights to the NBA, NHL, and Olympics.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)