Executive Summary

A new form of organizational structure has cropped up in the news recently.

You might have seen mention of an organization with the sole stated purpose of purchasing the United States Constitution. The organization – aptly named ConstitutionDAO – represents a new class of blockchain assets known as decentralized autonomous organizations (“DAOs”).

In the case of ConstitutionDAO, the premise was simple: Organize capital on the internet with the intention of purchasing the U.S. Constitution when it went up for auction at Sotheby’s on Nov. 18, 2021. Ultimately, the attempt at a coordinated capital raise to purchase one of the most prized collectibles in existence failed. However, the attempt brought mainstream attention to DAOs and subsequently opened the floodgates.

So, what is a DAO? These particular types of organizations represent blockchain native companies that are built with the intention of being decentralized and autonomous. These organizations are similar, in most cases, to regular LLCs. Where they differ are in two fundamental characteristics:

- Ownership: DAO ownership is ultimately distributed among the users, participants, and stakeholders of the organization as opposed to being concentrated in the hands of investors and founders. In essence, DAOs are owned by those who contribute value to the ecosystem.

- Organization: From an institutional level, the organization runs freely and unencumbered by any governance structures or top-down decision making. On an individual level, members of a DAO are able to contribute or participate in the manner and amount of their choosing. What this means is that individuals choose where and when they want to contribute and in the manner they see fit – and they are compensated accordingly.

From a decentralization standpoint, a DAO is “decentralized” in that it runs on a blockchain and gives decision-making power to stakeholders (members) instead of executives or board members. From an autonomy standpoint, these organizations utilize smart contracts, which are essentially computer programs that run on a publicly accessible blockchain and trigger an action if certain conditions are met (think of a software version of a legal contract) without the need for human intervention. DAOs are companies whose governance structures are formed by code.

Most simply put, DAOs are software-enabled organizations. They allow people to pool resources toward a common goal and share in value creation when those goals are achieved.

In The News

While ConstitutionDAO was all the rage for 2021, LinksDAO has been one of the most popular DAOs in the news in the new year. On Jan. 3, 2022 it was announced that the decentralized organization with a plan to purchase a country club has raised roughly $11 million through an NFT sale. The proceeds of the sale will be used to fund the project’s operations and ultimately bring the DAO one step closer to buying its own crowdfunded golf course.

The DAO in question represents a coordinated effort to raise funds in order to purchase a PGA-certified golf course. The group effort is currently being led by Mike Dudas, founder of The Block, founder and general partner at 6th Man Ventures, and advisor to Paxos.

Mechanistically, the roadmap for LinksDAO looks as follows:

- Late 2021: LinksDAO releases two tiers of membership NFTs which allow purchasers to gain community access, potential to receive governance tokens, and the “key” to unlock membership at LinkDAO’s first golf and leisure club.

- Early 2022: Release LinksDAO governance tokens – providing voting mechanism for members. The tokens will be released to NFT holders.

- Mid 2022: Planned purchase of PGA-certified golf course (target yet to be determined).

- Late 2022 – Early 2023: Open first LinksDAO Club location.

- Beyond 2023: LinksDAO community will expand to additional locations and begin to create a global membership and in-real-life (“IRL”) community.

At its current stage, the DAO has provided members with a tiered membership structure through its NFTs. Membership tiering and NFT distribution works as follows:

- Leisure membership: provides members with the right to purchase a membership at the first physical LinksDAO club, discounts on golf tee times, access to members-only Discord channels, and governance rights (aka voting shares)

- Global membership: provides users with access to the same perks as the leisure membership plus the ability to purchase one additional membership and four times the governance tokens as the leisure membership

While the stated goal may sound simple, the nuances of allowing individuals to actually have ownership in the golf course is a little bit more complicated. Unfortunately, DAOs may not hold traditional assets such as real estate for compliance reasons. The LinksDAO group is currently in talks with legal experts to create a separate operating entity called LinksDAO Inc. The legal entity will own the physical asset as well as serve as the day-to-day operating company for the prospective golf course.

Once legal concerns are settled, LinksDAO also plans to give its DAO members the first opportunity to purchase into the operating company. If realized, some NFT purchasers could receive actual equity ownership of a physical golf course and receive cash flows from the operation.

Why Do DAOs Matter?

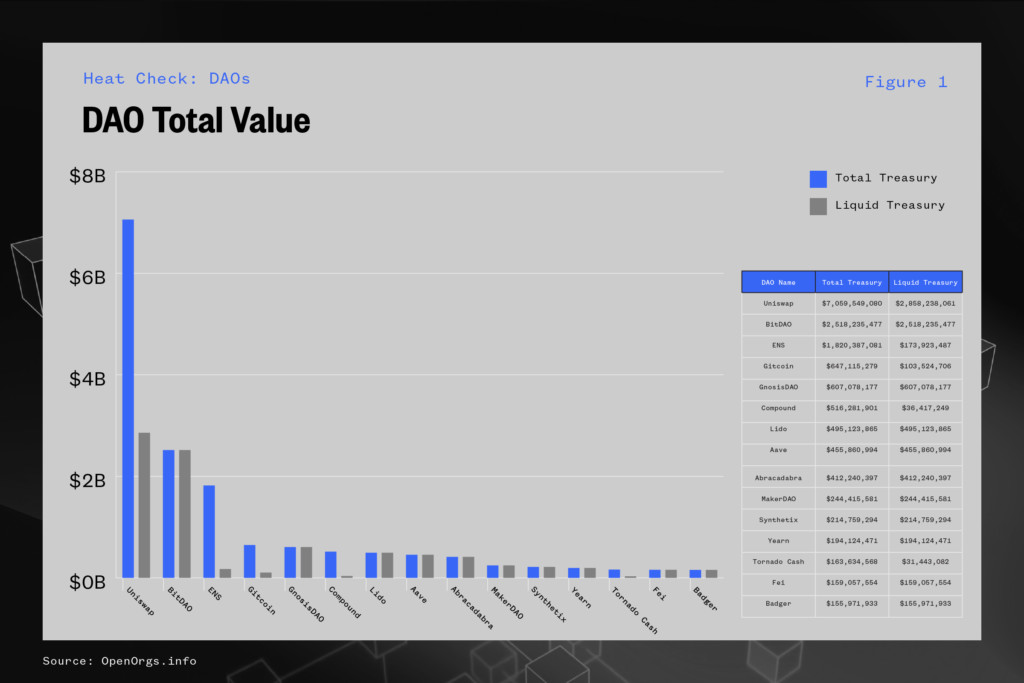

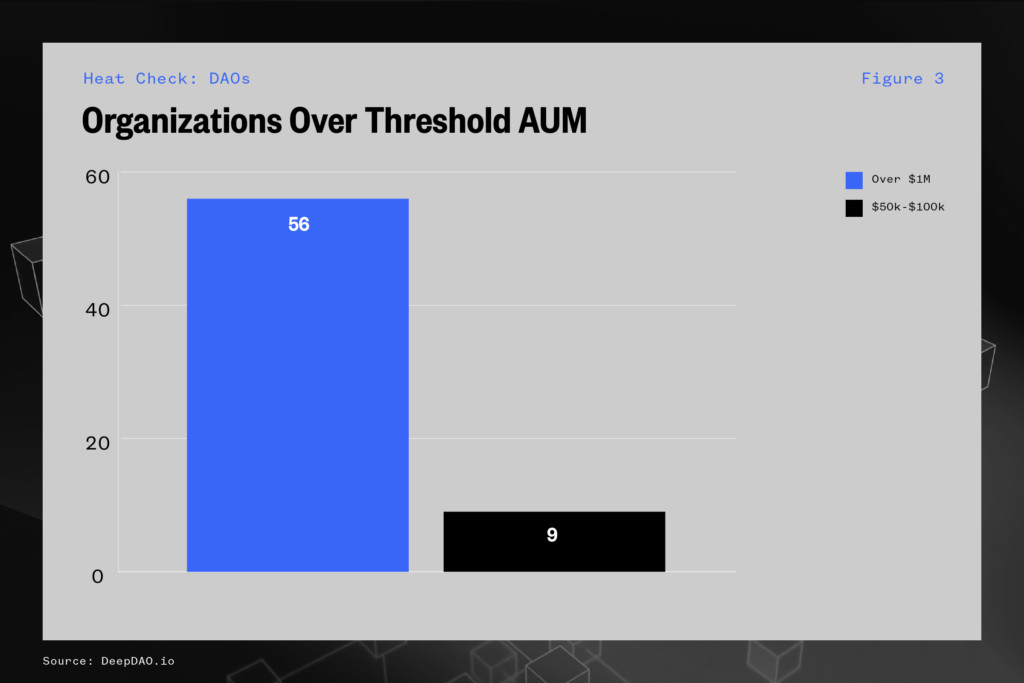

Like many other crypto applications, DAOs are attracting a significant amount of capital. The total amount of value locked in DAO treasuries as of the time of writing is $11.4 billion – including 65 organizations with greater than $1 million in assets under management according to DeepDAO and OpenOrgs.info.

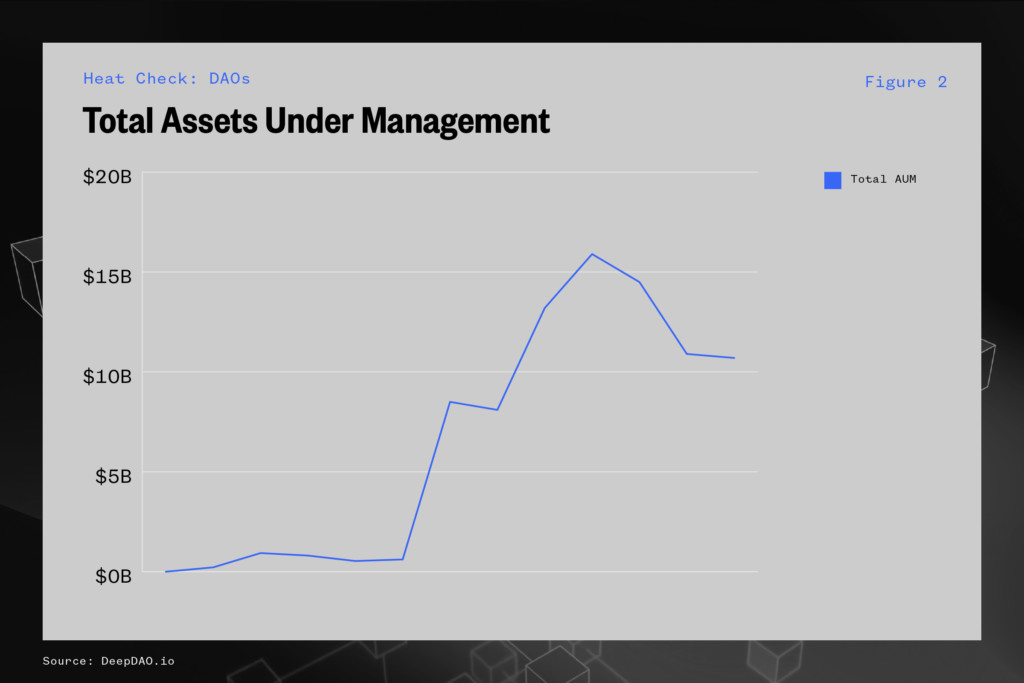

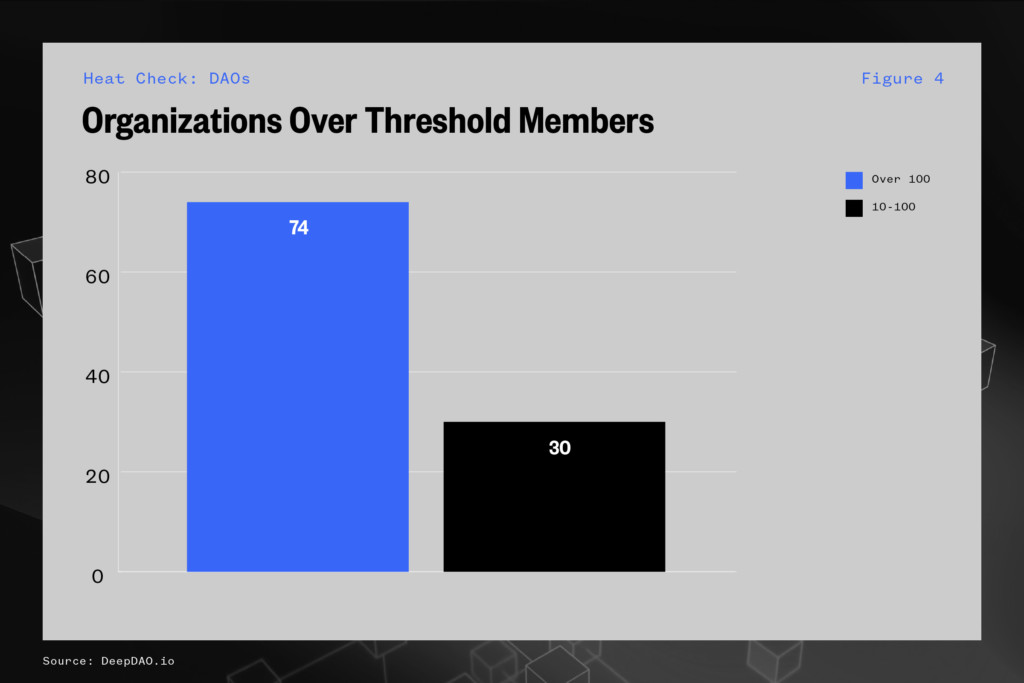

Additionally, over the past year we have seen an explosion in the total assets under management as well as the number of organizations over the $1 million AUM threshold.

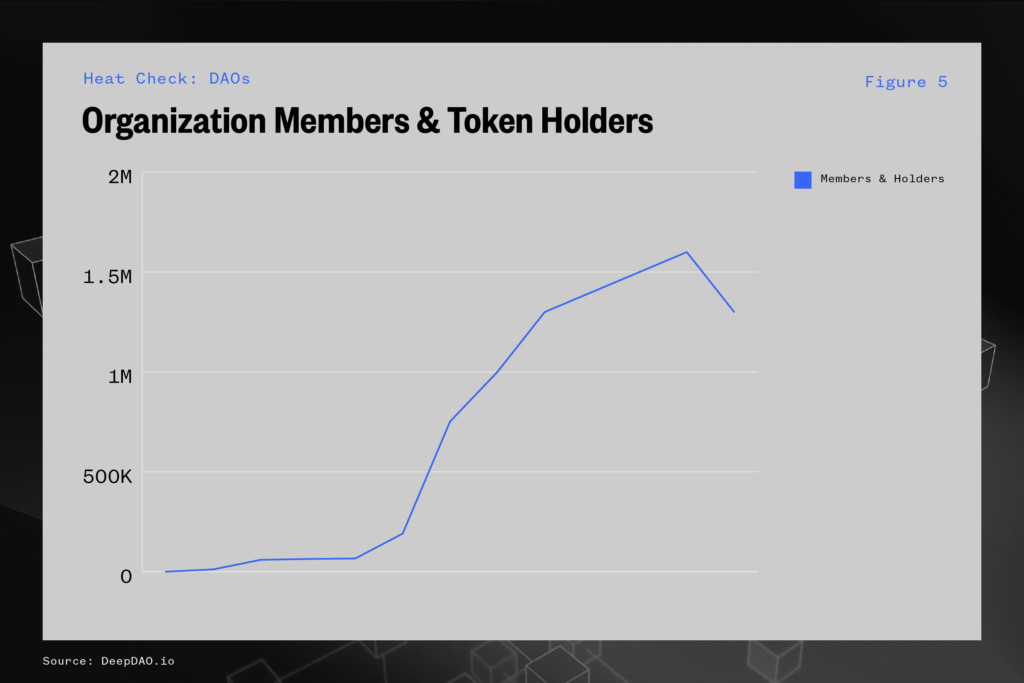

What is also important to note is the number of governance tokens in circulation, which represents the number of participants within a given DAO. When comparing the total AUM to DAO participation, the trends demonstrate high correlation as participation has direct monetary incentive.

The adoption has clearly accelerated in the last 12 months, and the size of the DAOs is continuing to skew in the direction of large organizations with significant assets under management.

Types of DAOs

There are various types of DAOs that have been started over the past 12 months. Below we outline a few of the top categories to provide context on the market and the utilization of the strategy.

Media DAOs

These organizations produce public content and informational products through collaborative workflows. Participants in the information network are then rewarded for the content they contribute and are able to vote on the process for disseminating their information. Examples include:

Social DAOs

These organizations are formed with the sole purpose of bringing like-minded individuals together with the intent to mobilize behind a common interest. This is akin to many forms of social clubs but with the DAO “twist” of including governance structures and ownership mechanisms. Examples include:

Collector DAOs

Much like other investing cohorts, collector DAOs are organizations that mobilize and orient themselves around specific asset classes, for example collectibles. An analog example would be car collecting groups. In the DAO space, these groups ultimately curate the asset classes that interest them while providing a level of institutional support. Examples include:

Protocol DAOs

Protocol DAOs are currently the most common use case. These DAOs are utilized to collaboratively build various types of protocols. In crypto, protocols are simply a system of rules or procedures that allow data to be shared. Protocol DAOs are therefore simply organizations that collaboratively build information systems. Thus far, most protocols have centered around the idea of trading and lending assets. Below are some examples:

Creator DAOs

These particular DAOs are akin to influencer fan clubs. Just like some fan clubs give an influencer’s most passionate supporters opportunities to consume their products and content, DAOs have the capacity to do the same for their chosen creators. Examples include:

Another Sports DAO

While the examples of sports DAOs are few and far between, there is another example of a sports-specific DAO which has gained popularity. KrauseHouse is a DAO based on the idea of collective ownership of a sports franchise. The company raised $4.6 million at the time of initial fundraising, a far cry from the funds necessary to purchase a major sports league franchise.

The KruseHouse DAO is not the first blockchain application to attempt to bring democratization to sports ownership. Fan tokens, such as those developed by Socios.com, have been a successful example of utilizing blockchain technology to provide fans with increased opportunities for engagement.

From a functionality standpoint, KrauseHouse is similar to most other DAOs in that $KRAUSE tokens provide members with the ability to vote on how funds raised by the organization are deployed.

While they are still a long way from their stated goal, the idea of purchasing sports-related assets via DAO organizations is one that could potentially become popular in the near future.