In the News

The payment wars have now touched the sports industry.

The market for software allowing e-commerce companies to facilitate “one-click checkouts” saw two of its largest players in the news for very different reasons.

Fast, the San Francisco based online payments company, announced Tuesday that it would be shuttering its operations due to lack of profitability. The kicker — the company had raised over $120 million to date from the likes of Stripe and Index Ventures.

The company’s roughly 200 engineers will now be looking for new homes. Consumer finance (specifically Buy Now Pay Later) company Affirm has already hired 130 engineers from Fast in the wake of the announcement. While Affirm has stated plans to build a one-click checkout product, the company will continue to develop its core BNPL product, which is utilized heavily in the fitness space by the likes of Peloton, Tonal, Canyon, and evo.

Then there’s Bolt. The “checkout experience” company — Fast’s main competitor since both rose to prominence in 2020 — recently announced two significant deals with BigCommerce and Fanatics. The Fanatics deal will make Bolt the sole one-click checkout provider to the world’s fastest-growing sports merchandising company, accessing a network of shoppers currently estimated just north of 100 million.

The Bolt network allows participants to securely shop with a single identity across a merchant’s site, removing log-in or password requirements and establishing an instant connection — and inspiring brand loyalty and repeat business.

In a world where the checkout page holds options from Apple to Paypal to Amazon and Facebook, consumers are demanding the highest-quality experience, and merchants need high conversion rates and low transaction costs. As the world increasingly shifts towards e-commerce, solutions to the checkout page will become more important than ever.

Market context

The battle for the checkout page is on. The number of solutions has increased significantly, with digital wallets competing with credit/debit cards, BNPL, crypto, and one-click checkout.

This is increasingly important for two reasons.

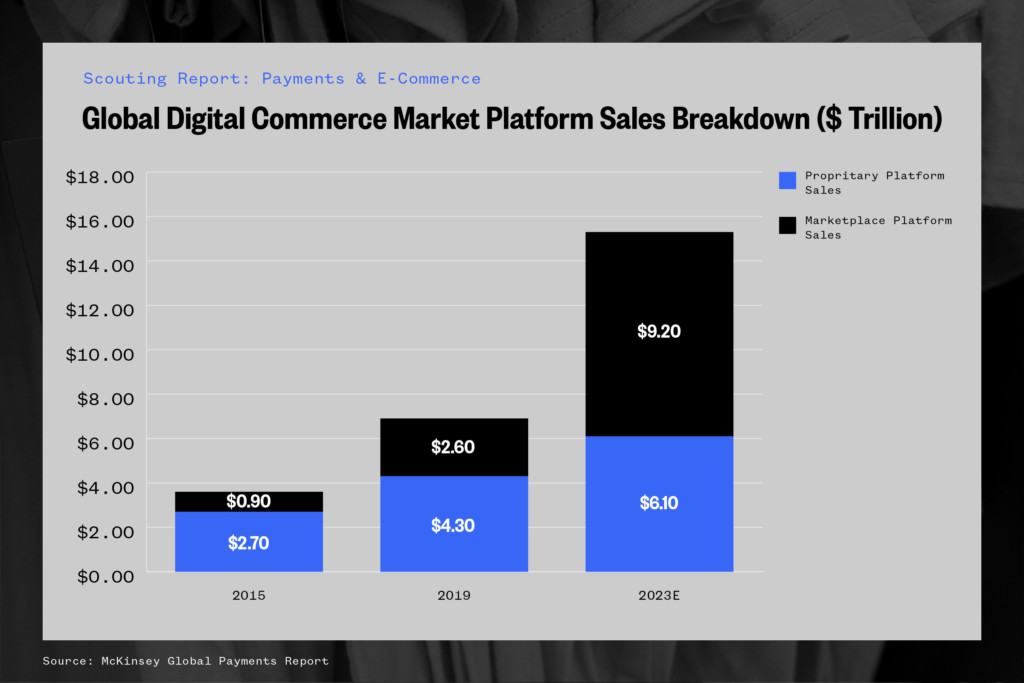

First, the shift to e-commerce. Over the past two years, consulting firm McKinsey has published comprehensive Global Payments Reports outlining key trends in the space. In 2020, the story centered on how COVID accelerated the increasing dominance of digital marketplaces such as Amazon, eBay, Etsy, and Shopify, which experienced 70%-150% growth in seller sign-ups. Marketplace sales accounted for 57% of all global retail sales, and the top 100 marketplaces saw nearly $2 trillion in sales, with 60 of the top 100 located in the U.S.

The 2021 report similarly highlighted the prevalence of e-commerce, particularly when it comes to small- and medium-sized businesses (“SMBs”). The likes of Amazon Marketplace, eBay, Etsy, Walmart Marketplace, and Wayfair continue to capture a significant share of the SMBs and microbusinesses shifting to e-commerce. According to the report, 50%-70% of digital commerce will be conducted on these platforms by 2025.

With some protracted data related to consumer behaviors, the shift to digital from cash seems to be more entrenched than ever. Cash payments declined by 16% globally in 2020, while real-time payments increased globally by 41% in 2020 alone — mostly in support of contactless wallets and e-commerce facilitation.

“The pandemic reinforced major shifts in payments behavior: declining cash usage, migration from in-store to online commerce, adoption of instant payments. These shifts create new opportunities for payments players; however, it is unclear which are permanent and which are likely to revert—at least partially—to prior trajectories as economies reopen. Nonetheless, the long-term dynamics seem clear”

McKinsey Global Payments Report

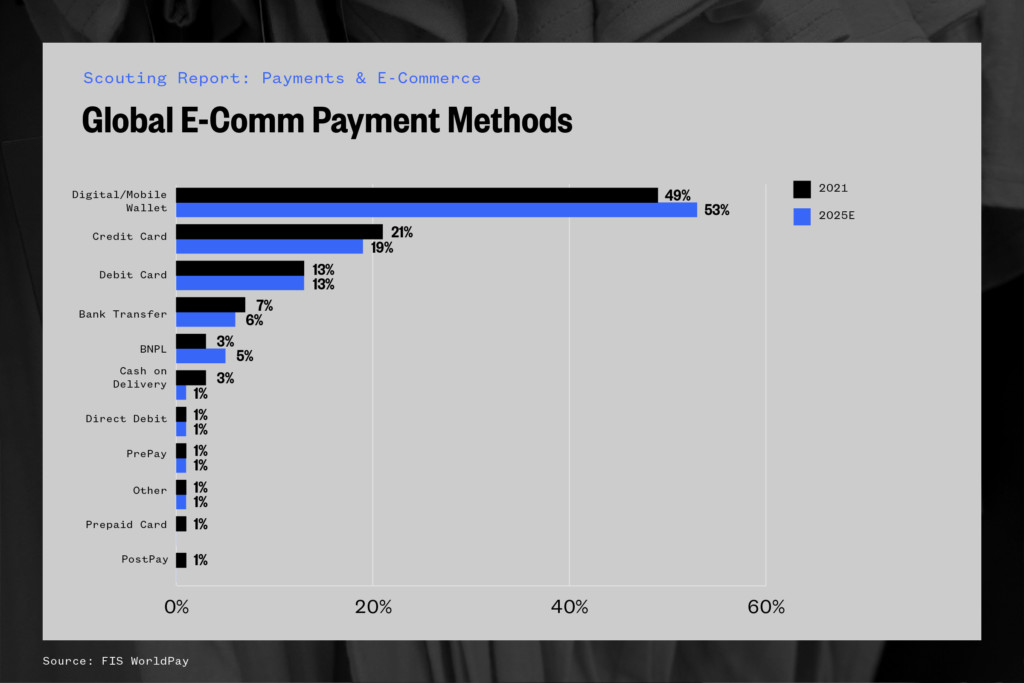

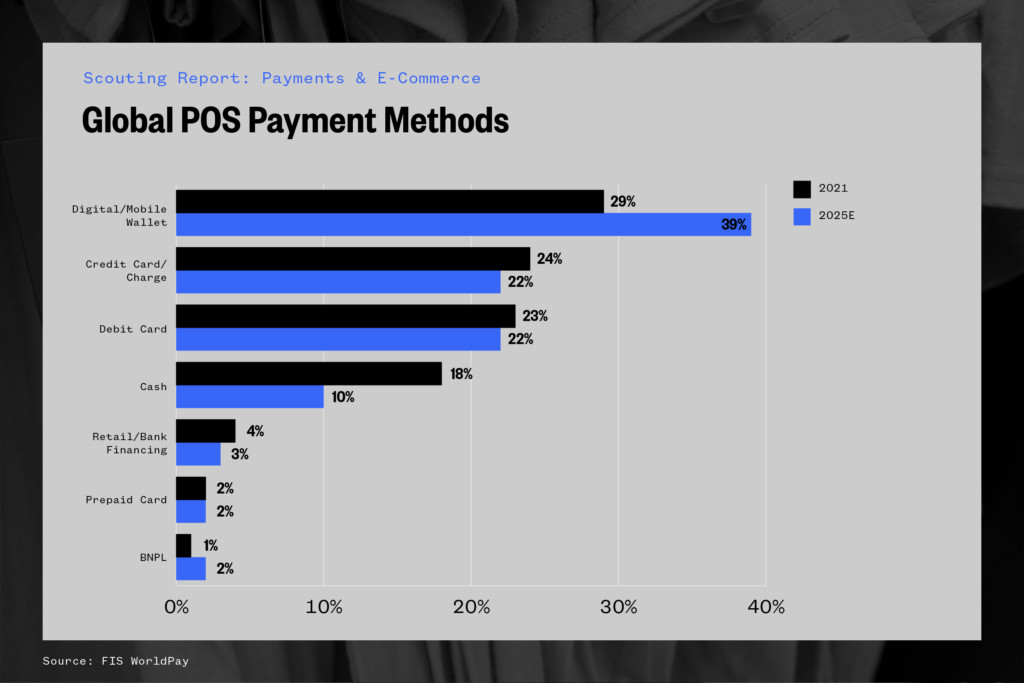

What does the shift to e-commerce mean? For starters, payment methods will drastically shift toward digital to an even greater extent than we observed in 2021. Data from FIS Worldpay shows the anticipated growth across global payment methods and point of sale.

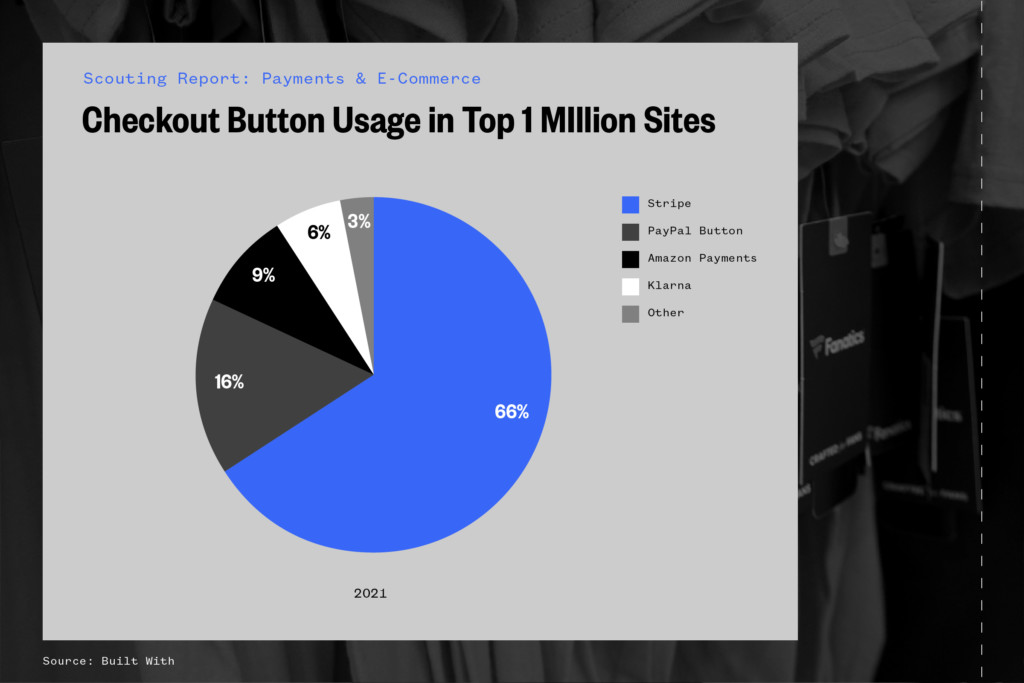

Stripe dominates the checkout market with 66% of the total market share, per BuiltWith. Checkout buttons drive much of e-commerce payment volume due to ease of use. According to PYMNTS, consumers fill out an average 23 information fields to complete a single online purchase which takes on average two minutes to complete. The data also showed that buy buttons have reduced online checkout times by ~ 40%. Additionally, on average nearly 70% of online shopping carts are abandoned, with 21% of those surveyed saying they left because the checkout process was too complicated.

Digital Wallets, BNPL, and universal checkout (or one-click) are currently in line to dominate the checkout page.

Digital Wallets: Digital wallets include service providers such as Amazon, Apple, Google, Venmo, Zelle, and PayPal and allow for information from those vendors to be utilized to check out easily. These companies utilize transaction information from off-platform purchases (think Amazon checkout on a custom-built e-commerce website) to build out their existing customer profiles — something consumers have indicated they aren’t too thrilled about.

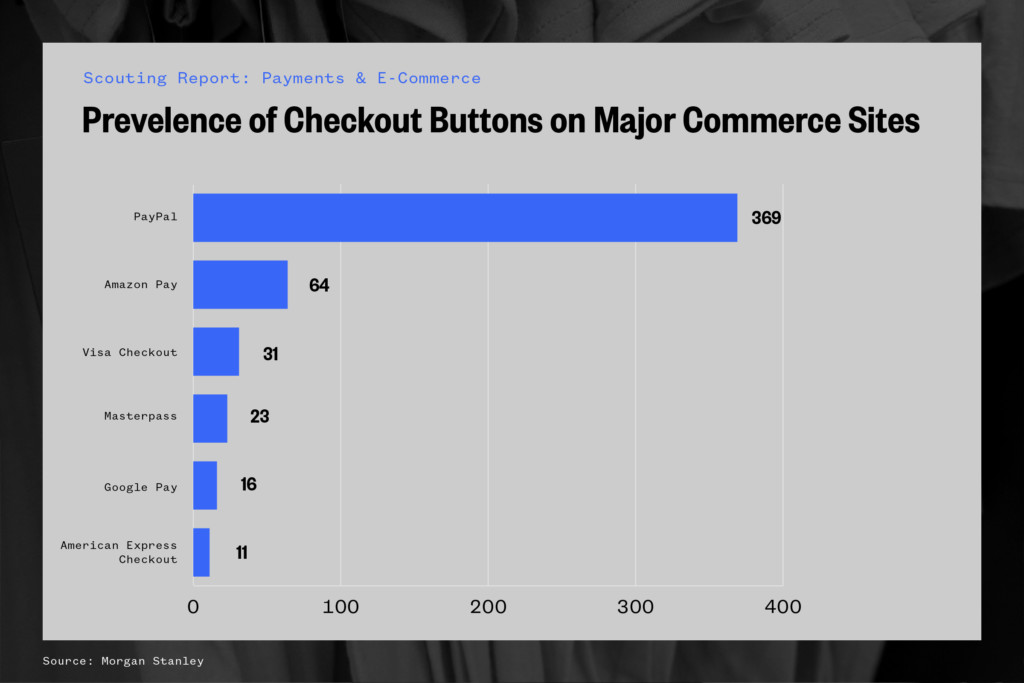

When it comes to autofill payment methods, companies such as Apple and Google have clear advantages on iOS and Android, respectively. Additionally, Morgan Stanley found in 2019 that PayPal’s checkout button was present on 369 of the top 477 internet retailers websites — Amazon Pay, the next-closest, had 64.

Additionally,

BNPL: The BNPL option benefits both merchants and consumers. It can help increase average order value for the former and spread purchase costs over a longer period of time for the latter — helping capture a younger demographic of purchasers with lower credit card penetration. BNPL is increasingly being used for larger-ticket items in the health and wellness industry from brands such as Peloton, Tonal, Mirror, Canyon, and Giant. At the beginning of 2021, while Affirm had more than 6,500 merchants, a third of its revenue came from Peloton.

While BNPL is certainly beneficial for both merchants and consumers, it has its drawbacks, namely credit risk. There are no hard credit checks, and consumers therefore have the ability to spend beyond their means without credit protection. Looking forward, if BNPL companies look to compete for the coveted checkout page, they will likely be required to report their purchases to credit bureaus — potentially crowding out younger users.

One Click Checkout (Universal): Universal checkout solutions are a cross-merchant, one-click solution to speed up the checkout process for consumers. As opposed to the one-click options offered by Apple, Google, and Amazon, companies such as the aforementioned Fast and Bolt allow users to create a secure, platform-agnostic profile across retailers. Bolt provides an example of how this technology can be used in a B2B context.

Bolt has built a “checkout experience platform” which sits on top of an e-commerce company’s existing platform. According to the company, their fast checkout can lead to a 60% increase in conversion for merchants. Targeting independent online retailers allows it to capture network effects of customers shopping. According to the company, 93% of their online retailers have had cross-network purchases with a conversion increase of 63%, and nearly 20% of all Bolt transactions are network-driven.

Funding

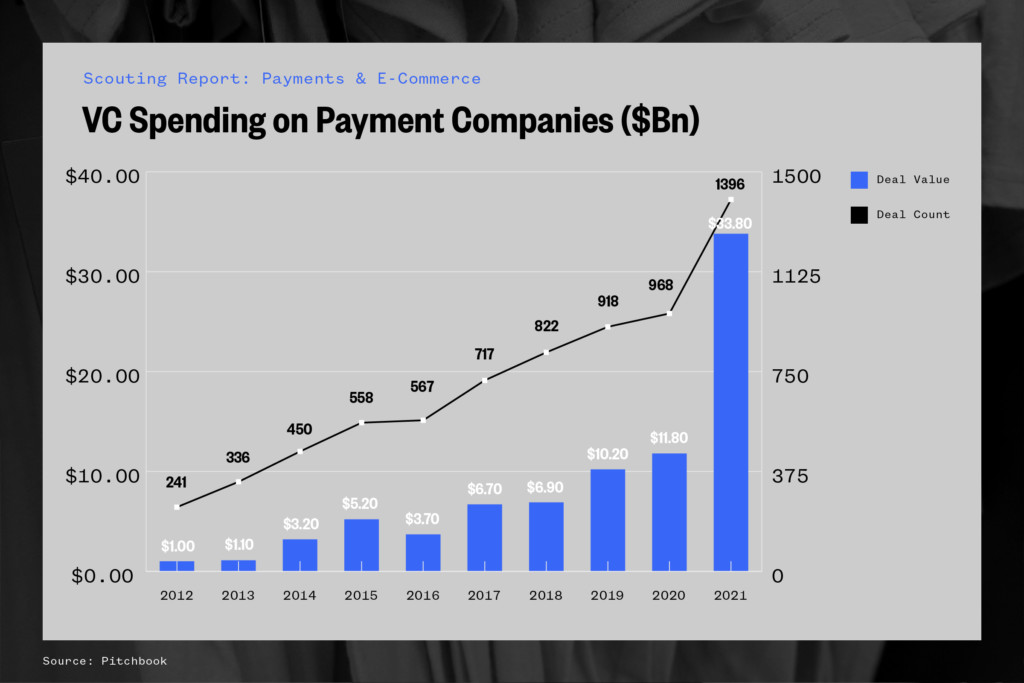

The payments market is large — and continues to grow. According to PitchBook data, the estimated global market size of the payments industry reached $2.1 trillion in 2021, based on revenues from payments services providers. PitchBook also estimated that revenue in the sector will surpass $3.1 trillion by 2026, an approximate 7.8% CAGR.

Private markets have also been active in the payments space. VC activity hit its highest total ever in 2021 by a large margin. The year brought in $33.8 billion in funding, almost tripling amounts from 2020 and 2019.

Interestingly, large payment incumbents such as Visa and Mastercard are some of the most active investors in the space.

Looking ahead, there are several areas where payment companies have the ability to impact e-commerce holistically — as Bolt has done with Fanatics. Two areas that stand out in this space are payment aggregation systems and cross-border payments.

Given the total number of payment solutions, aggregation systems will be next on the list to help merchants extract the most value from customers (as with Rapyd). Additionally, companies operating with international customers require significant cash management and sophisticated foreign-exchange risk management. Solutions to SMBs’ issue with managing multiple payment streams across international borders will be a large opportunity in the e-commerce space going forward (as with Veem).