Executive Summary

Over the past 5 years, there has been substantial growth in the cosmetics industry as millennials’ purchasing behaviors have shifted towards niche brands that better cater to their ultimate preferences. Gone are the days of single brands dominating the market as the proliferation of social media “beauty content creators” and DTC e-commerce brands have fragmented the playing field. Interestingly enough, the shift to fragmentation has allowed for new trends within the cosmetics industry, namely “inclusive beauty” and more specifically, “male personal care,” are now table stakes for the industry.

According to data from CB Insights, the men’s personal care market is expected to reach $166 billion by 2022. Even with a market size this large, the male cosmetics demographic is still considered underserved in the current market. Up until 2020, Unilever (owner of brands including Dove, Suave, and St. Ives) still qualified certain beauty products as “normal” when marketed to women vs. men, a branding moniker that the company has since dropped. Inclusivity as a whole has been a trend within the market as companies shift product and packaging strategies to address their new and broader target markets.

Another key data point is the participation by and purchasing habits of millennials. As of 2017, millennial shoppers were buying 25% more cosmetics than 2 years prior, and significantly more than baby boomers, with self-described “makeup enthusiasts” using 6 or more products each day, according to NPD. Furthermore, the manner in which millennials are selecting their new brands and products has changed. According to data from CB Insights and L’Oreal, millennials are 3x more likely than previous generations to discover new brands and products using social media, with 37% of those individuals being more likely to trust a brand after seeing a sponsored post.

Changes in millennial preferences, a shift towards more gender-neutral beauty products, personalization, and de-stigmatization of men’s beauty products have led to an interesting opportunity within the consumer space.

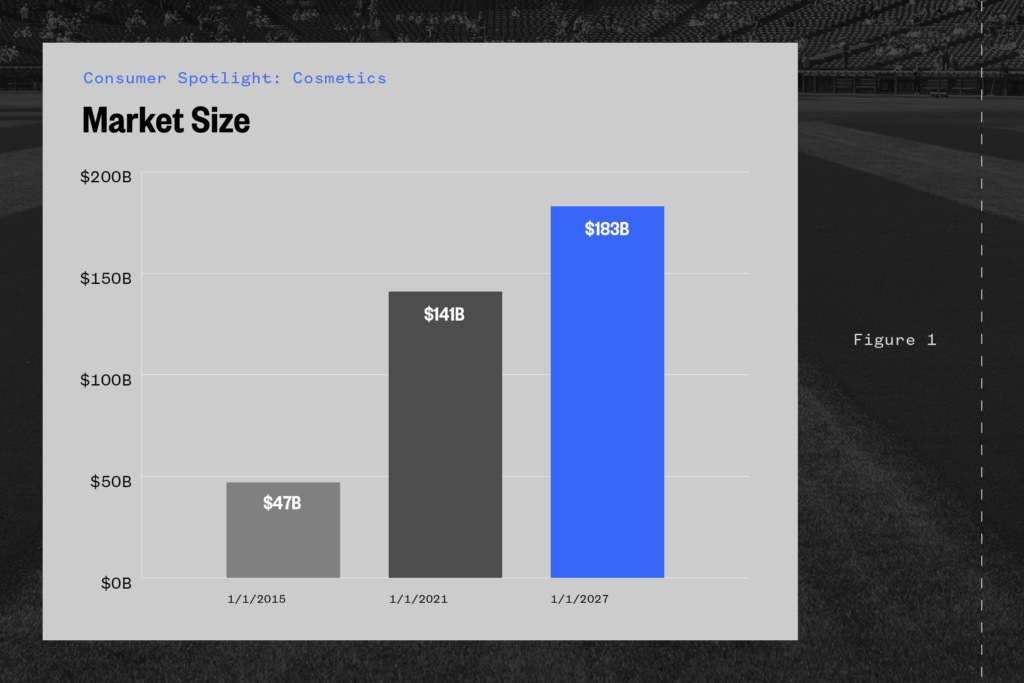

Sizing the Market

The total market size for the men’s grooming industry has grown substantially since 2015. According to research from GrandviewResearch, the market for men’s grooming products (inclusive of all products on a global scale) grew from 47 billion to an estimated $140.8 billion in 2020. Furthermore, it is expected to grow to $183.2 billion in 2027 at a ~4% annual growth rate. For context, the global market size for all menswear in 2020 is estimated at $545.8 billion. With a faster growth rate than the menswear industry and the current estimated market size representing around 26% of the total menswear market, the men’s grooming market has ample room to grow.

Aside from market size statistics, there has been reported growth in various sub-sectors of the market. According to Trendalytics (data science-based trend discovery tool), work from hoe (“WFH”) culture profoundly impacted men’s grooming as a whole. As we shifted from an in-person to a Zoom culture, there was a noticeable shift from makeup to natural skincare. Across the board, search volume for men’s makeup was down while other – more natural – forms of skincare were up significantly.

The Bad

- Men’s makeup: -4%

- Men’s concealer: -24%

- Men’s nail polish: -16%

The Good

- Beard growth kit: +233%

- Men’s moisturizer +324%

- Men’s anti-aging +42%

- Men’s Skincare +34%

Additionally, search volume on amazon for men’s related skincare products has seen a jump in the past three months. It appears companies have, for the most part, begun to identify ways to correctly market to the male demographic.

- Black moisturizer for men: +625%

- Men’s personal care sets: +228%

- Men’s face mask skincare: +112%

- Daily men’s face wash: +89%

Also worth noting, Jungle scouts identified “Dr. Squash Soap for Men” as one of the top overall searches in the Beauty and Personal Care vertical without filtering for men’s products:

Dr. Squash Soap for Men: +808%

News posts and mentions related to inclusive beauty and men’s skincare have been elevated since 2017 with peaks in June of 2020 and March of this year according to CB insights.

Specific subreddit’s related to or dedicated to men’s skincare and cosmetics have also recently shown growth. The subreddit r/malegrooming grew from ~60k members in 2019 to ~311K in 2021 YTD representing a growth of 518%.

The once ignored category is growing at an exponential rate and could heavily impact the consumer beauty space for years to come.

Background and Context

K-Pop

One of the main driving forces behind the shift to the adoption of more men’s cosmetic products are the Asian markets. In most Asian countries, the men’s skincare market is mature and has been a growing trend for several years by now. In terms of trendsetting, South Korea has held the torch accounting for one-fifth of the total spend on men’s skincare as recently as 2018.

Many attribute this particular trend – men’s makeup in South Korea – to the rise in popularity of K-pop stars. According to a CNN report conducted in late 2019, three-quarters of South Korean men undertake beauty or grooming treatments at least once per week. K-pop stars regular perform their concerts and music videos with full faces of makeup, and these stars have existing deals in place with cosmetics companies:

- Kang Daniel (Instagram: @daniel.k.here 4.3 million followers): Givenchy Beauty

- Lee Dong-Wook (Instagram: @leedongwook_official 11 million followers): Chanel Beauty

- Jackson Wang (Instagram: @jacksonwang852g7 25.3 million followers): Armani Beauty

- BTS (Instagram: @bts.bighitofficial 48 million followers): VT Cosmetics

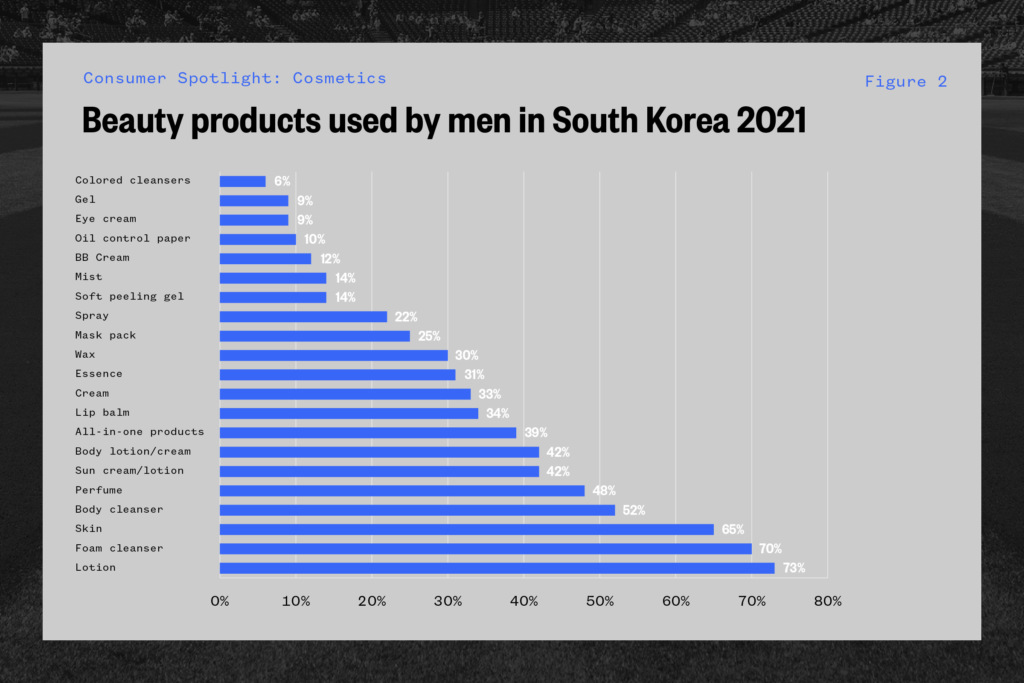

The products utilized have a wide range of applications across various spectrums. An Esquire article from July of 2021 outlines the various ways in which these K-pop stars have utilized (and monetized) their skincare routines and products. Below is an aggregated list from Statista of the types of beauty products used by male consumers in the country in 2021.

The days of the traditional bar of soap and a straight blade razor for the staple men’s grooming products appear to be behind us.

United States

The male grooming industry in the United States has also matured past traditional face washes and into newer products. Eye creams, facemasks, personalized sunscreen, and makeup are just a few of the new verticals that companies (both legacy and DTC) are adopting.

DTC brands began to receive acclaim and attention from investors after Dollar Shave Club was acquired by Unilever in 2016 for $1 billion. Since then, there has been a large amount of investment and M&A activity within the space.

- 2018: P&G purchases Walker & Company Brands (parent company of beauty and grooming brands focused on people of color

- 2019: SC Johnson purchased men’s skincare brands Oars + Alps for ~$20 million

- 2020: Edgewell buys Cremo for $235 million

- 2020: Manscaped (currently generating a reported $100 million in sales) is exploring a sale/fundraising that would value the company at $700 million, according to individuals familiar with the matter

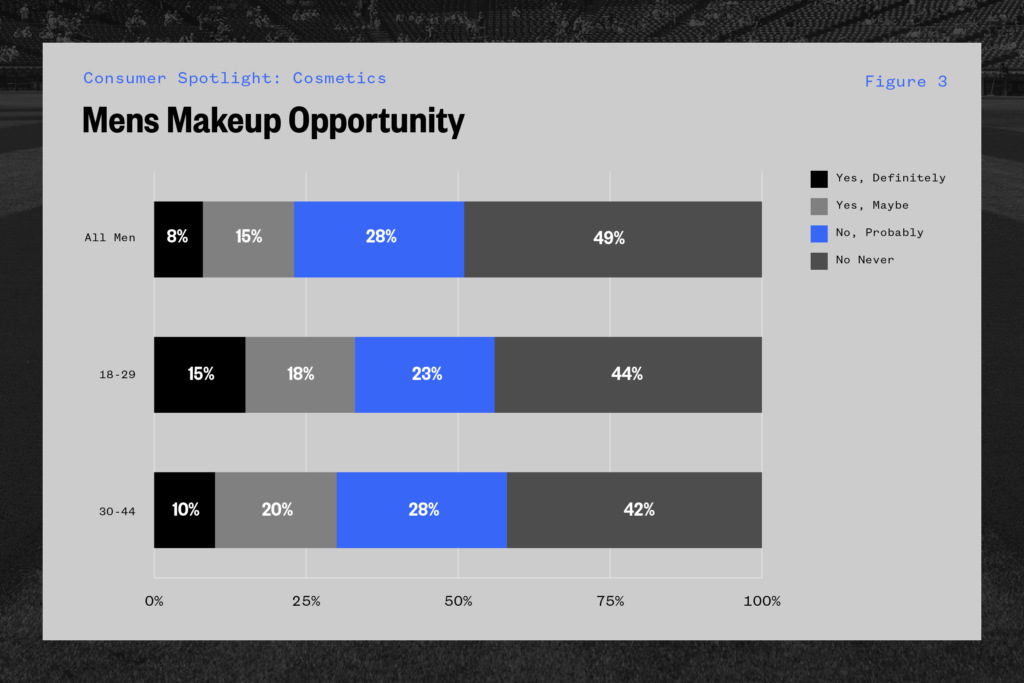

One of the key commonalities between these brands has been their ability to niche down their marketing campaigns. This targeted marketing is important as the number of male individuals interested in the product continues to increase. According to a study conducted by Morning Consult, about 25% of all men and 33% of men aged 18-29 would consider or are willing to use men’s makeup and cosmetics.

In response to the survey, CVS made a large bet on the space this time in 2020 as it introduced a cosmetics line from Stryx – a brand launched to 2,000 U.S. stores and is targeted towards men. The move by CVS provides further credence to the thesis that men’s makeup is primed for mainstream adoption. A quote from Ben Parr (co-founder of marketing firm Octane AI) encapsulates this sentiment:

“It’s simple for cosmetics – men are a growth industry.”

One reason for this growth is that the legacy men’s grooming styles such as shaving cream and after shave balm are seeing some consolidation. While the market grew 13% over the past 5 years, revenue is projected to decline at a 1% rate in the coming years, another signal for a shift in consumer preferences.

A push to gender-neutral is also a consideration for the trend. According to a study conducted by advertising insights agency Bigeye, 50% of Gen Z agree that traditional gender roles and binary gender labels are outdated, with 56% of Millennials believing the same. Legacy skincare brands from Aesop to Ursa Major have ditched gendered marketing and instead have utilized packaging to sell unisex products that focus on specific skin concerns or conditions instead. In February of this year, Phlur (unisex fragrances) was recently acquired by The Center – a beauty products incubator run by Ben Bennett – for an undisclosed amount (at the time of acquisition, the company had raised over $20 million). Furthermore, the likes of Marc Jacobs, Tom Ford, and Gucci have all launched gender-neutral beauty-based products. This remains early innings for the trend.

Conclusion

The trend for men’s makeup – or maybe better put men’s cosmetics – is one that plays on consumer behavior. With a generation of consumers (gen Z and millennials primarily) that increasingly care about what they look like, how they feel, and their overall social perception – the thesis that products being specifically tailored to men is logical. The current subset of data, including search volume, current company funding, and consolidation of DTC brands being acquired by legacy players, is a sign of a more secular shift.