The Bulls play their first game of the NBA season Wednesday, but about a million Chicago households won’t be able to watch it unless they install antennas. That’s because of a standoff between Comcast and a new regional sports network with no end in sight.

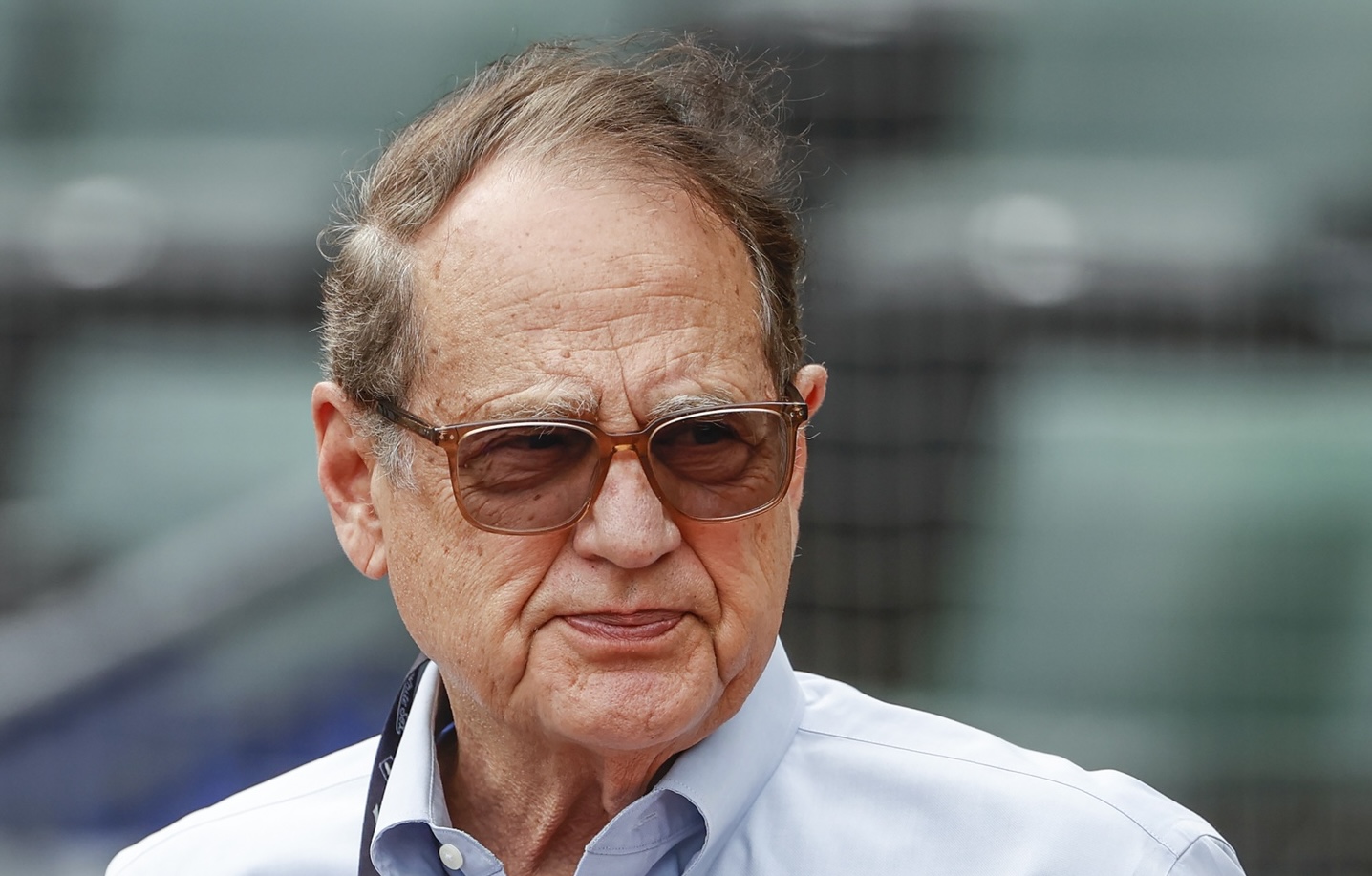

Chicago Sports Network (CHSN) began operations last month and will air White Sox, Bulls, and Blackhawks games. It’s a joint venture among Jerry Reinsdorf (who owns the White Sox and Bulls), the Wirtz family (who owns the Blackhawks), and Tennessee-based Standard Media.

CHSN is replacing NBC Sports Chicago, the Comcast-owned regional sports network that aired those teams’ games for the last 20 years before shutting down at the end of September.

It’s a curious time to launch a new RSN, as the trio of teams involved are somewhere between poor and historically awful, and the broader RSN business model is collapsing thanks to a wave of cord-cutters and former staples of the industry like Diamond Sports Group dropping teams and working through bankruptcy proceedings. Network president Jason Coyle admitted as much in an interview with Front Office Sports last month, saying, “I get asked ‘why now?’ a lot in various ways.”

Maybe predictably, CHSN is already running into its first roadblock. It still doesn’t have a deal with Comcast, as the two sides have not come to an agreement on carriage fees.

CHSN is available for free over the air with an antenna but has struck deals with most Chicago-area cable providers to get in homes that pay for cable. A direct-to-consumer app is also in the works. But Comcast is the Chicago area’s largest cable company, with about a million subscribers. Those million people would, as of Wednesday, need to get an antenna to watch Bulls and Blackhawks games.

Antennas retail for about $20, and some teams have taken the step of giving thousands of them away.

CHSN hasn’t opted for that route yet; instead, it’s going to war with Comcast through the press.

The network’s public campaign began with a post Oct. 17 calling on fans to reach out to Comcast and complain, and made a website outlining the steps under the domain name GetCHSN.com. Two days later, CHSN released a statement revealing it has been “trying to formally negotiate with Xfinity/Comcast for months.” Despite CHSN making “multiple offers” to the cable provider, including one that was a “substantial reduction in total fees” from the old deal with NBC Sports Chicago, Comcast still hadn’t come back with its own offer, the statement read.

Monday, Coyle went on sports-talk radio to press his case. He said he didn’t think anyone wanted the “great” relationship between Comcast and NBC Sports Chicago to end, but the business model “petered out,” and the new one reaches 600,000 households who had been “frozen out” because they use digital antennas. Coyle said CHSN had reached 12 deals from 13 conversations with paid TV providers. That 13th provider is FuboTV, a deal with whom is likely to be finalized soon, a source familiar with the situation tells Front Office Sports.

“We have made two offers to them, substantive, both at significant discounts,” Coyle told 670 The Score about the Comcast negotiations. “We have received no offers back. There are reports that we have, and that there’s something there for us to sign. We have not received anything back from them.”

Coyle emphasized that he’s not trying to get customers to cut the cord, and he wants to work out a deal for cable subscribers.

So what does Comcast have to say about all of this? Publicly, not much. A company spokesperson told FOS that the two sides have been in discussions with each other, but twice declined to comment on any specific details.

The Chicago Tribune reported last week that Comcast “doesn’t like” that CHSN is available for free to antenna users, who make up about 15% of Chicago TV households. The cable behemoth “objects to paying for content available for free over the air,” according to the Tribune.

Coyle said on the radio show that that was a “red herring argument” because pay-TV providers like Comcast already pass along free-to-air channels, including for Bears games.

Comcast subscribers in Chicago already pay $19.20 a month in carriage fees for existing regional sports networks, including Marquee Sports Network (which airs Cubs and Sky games) and Big Ten Network. But as RSNs have been collapsing across the country, Comcast has been moving sports from a less expensive tier to a pricier one. This year alone, Orioles, Nationals, Pirates, and Mariners fans have all faced a switch from the “Popular TV” to “Ultimate TV” level, which costs viewers $20 more every month. NBC Sports Chicago was on “Popular,” and Comcast wants to put CHSN on “Ultimate,” according to the Tribune.

Blackhawks chairman and CEO Danny Wirtz told the Tribune that the national media landscape leaves “a lot that’s out of our control” and “fans do sometimes pay the price.” But Coyle has consistently claimed in the media that he doesn’t want prices to go up for fans.

“There’s no particular reason that this has to extend beyond a phone call, a back-and-forth, and let’s get it on the air and let’s get going,” Coyle told 670 The Score.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)