Bally’s is pressing on with its aggressive move into digital betting, announcing plans to acquire U.K. gambling platform Gamesys for $2.7 billion. The companies have reached an agreement in principle, subject to shareholder and regulatory approval.

Bally’s has offered 1,850 pence — or $23.54 — in cash for each share, representing a nearly 13% premium from Gamesys’ closing price on March 23. The founders and executives of Gamesys, who own 30.7% of its shares, have voiced their support for the deal.

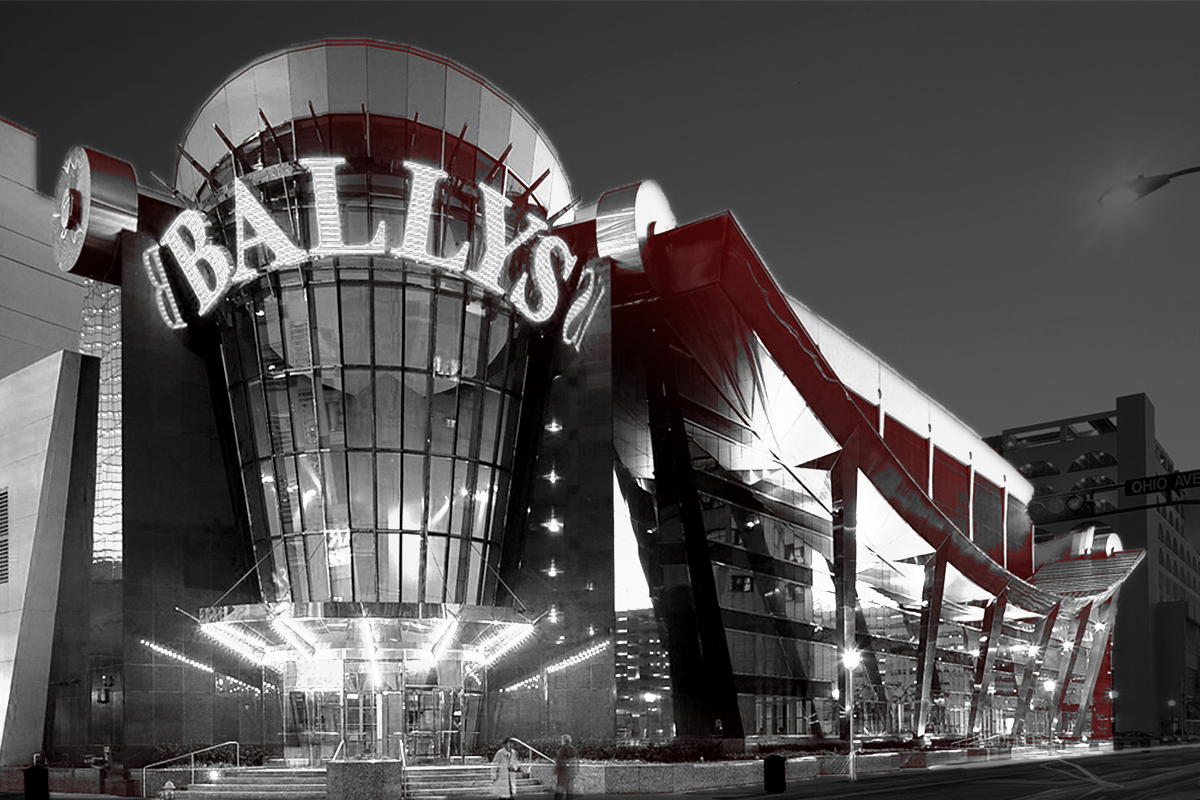

Bally’s, formerly Twin River Worldwide Holdings, merged with Dover Downs Gaming & Entertainment in 2019 to go public, then bought the Bally’s casino for $25 million and the Bally’s name for $20 million. Since then:

- Acquired sports betting platform provider Be.Works for $125 million.

- Acquired enterprise software solution platform SportCaller.

- Purchased fantasy sports gaming website Monkey Knife Fight.

- Entered an agreement with Sinclair Broadcasting to rebrand Fox regional sports channels with the Bally’s name.

- Announced official partnerships with MLB, NBA, and NHL.

Bally’s net income in Q4 2020, reported earlier this month, reached $20.2 million — a 51.4% increase year-over-year. Gamesys shares rose more than 14% after the news.